IF IHC Book Discussion on ‘Negotiating India’s Landmark Agreements’

India Foundation, in collaboration with India Habitat Center held a book discussion on ‘Negotiating India’s Landmark Agreements’, written by Shri Avtar Singh Bhasin on 21st August 2025 at India Habitat Center. The panelists for the discussion were Dr Rajiv Ranjan, Associate Professor, Dept of East Asian Studies, Delhi University; Amb Veena Sikri, Former High Commissioner of India to Bangladesh and Amb Ashok K Kantha, Former Secretary (East). The session was moderated by Capt. Alok Bansal, Executive Vice President, India Foundation.

The author introduced the book to the audiences and mentioned that that book explores five pivotal agreements- India-China Agreement on Tibet (1954), the Indo-Soviet Treaty of Peace, Friendship and Cooperation (1971), the Simla Agreement (1972), the India-Sri Lanka Accord (1987), and the India-United States Civil Nuclear Energy Agreement (2008) which have propound impact on India’s foreign policy. He emphasised that book also explores the impact of each of these treaties and reflects on the evolution of Indian diplomacy through these five agreements. He talked about the nature of these agreements, and how did India emerge after these agreements and the neighbourhood India inherited, along with India-US relations and India-USSR relations.

According to Dr Ranjan, the book has encouraged archival research amongst young scholars and also pointed out about how the book has reflected the evolution of the Indian Foreign Service to a professional force. He focuses on the new perspectives given by Mr Bhasin through the book. Amb Sikri called the book a service to the history of Indian diplomacy. She talked about how this work connects the dot and shows how India was attached to the policy of non-alignment on the Indo-Soviet Treaty of Peace, Friendship and Cooperation. She also described her experience when the Simla Agreement took place and talked about the details mentioned in the book about Simla Agreement and how that gives the impression that India as a winner was more desperate for talks than Pakistan and that the talks should have given a better deal to India as Pakistan got a better deal. Amb Kantha talked about the China Agreement on Tibet (1954), the Simla Agreement (1972), the India-Sri Lanka Accord (1987) and the lessons that have been derived from these agreements.

Borderlines of Security: A Strategic Assessment of West Bengal’s Cross Border Threats

MoU Signing between India Foundation & ICIMOD, and Roundtable on Himalayan Climate Risks

On 13 August 2025, the India Foundation hosted a roundtable on “Enhancing Transboundary Cooperation to Address Cascading Climate Risks in the Himalayan Region,” bringing together policymakers, experts, and practitioners to deliberate on strengthening regional collaboration amid mounting climate challenges. Distinguished speakers included Dr. Pema Gyamtsho, Director General of ICIMOD, and Lt. Gen. Syed Ata Hasnain, Member of the National Disaster Management Authority (NDMA), Government of India. The event was also attended by Maj. Gen. Vetsop Namgyel, HE Ambassador of Bhutan to India, and Dr. Shankar Prasad Sharma, HE Ambassador of Nepal to India, along with representatives from leading climate organisations.

Summary of Remarks made by Dr. Pema Gyamtsho:

- Highlighted the critical importance of the Hindu Kush–Himalayan (HKH) region – often called the world’s Third Pole – which sustains nearly two billion people across eight countries.

- Noted that the region faces an accelerating climate crisis, with warming occurring at twice the global average, glaciers receding, and growing risks of glacial lake outburst floods, droughts, landslides, and cascading disasters such as the 2023 Sikkim and 2021 Melamchi floods.

- Added that these physical risks are compounded by socio-economic vulnerabilities, including high poverty, conflict, and gender inequalities in mountain communities.

- Outlining ICIMOD’s role as a neutral convenor linking science, policy, and practice, he shared key initiatives such as the HKH Assessment and HI-WISE Report, cryosphere monitoring networks, flood and landslide forecasting tools, and the implementation of community-based flood early warning systems in more than 20 sites.

- He also described nature-based solutions, springshed management programmes, and the establishment of the HKH Disaster Risk Reduction Hub in 2024 as steps toward resilience.

- Looking ahead, he emphasised ICIMOD’s Strategy 2023–2030, which calls for a regional institutional mechanism, enhanced coordination, and inclusive approaches.

- Stressing India’s pivotal role, he underlined that as the region’s largest democracy and fourth-largest economy, India’s leadership is critical in advancing transboundary cooperation.

Summary of Remarks made by Lt. Gen. Syed Ata Hasnain:

- Drew attention to the operational dimension of disaster management, focusing on inter-force collaboration between the Indian Army, Air Force, and the National Disaster Response Force.

- Praised advances in early evacuation and rehabilitation, enabled by technological tools such as satellite imaging, which have enhanced situational awareness in disaster-prone regions.

- Spotlighted the NDMA’s flagship innovation, the Sachet App, which integrates geo-intelligence and hybrid messaging channels to strengthen citizen preparedness, early warning, and rescue operations.

- Citing the Sikkim flash floods and other recent disasters, he described the NDMA’s whole-of-system response, which combined immediate humanitarian relief with longer-term recovery.

Points picked up during the interactive discussion:

- India’s past leadership in disaster relief, including its role in Nepal’s 2015 earthquake and Myanmar’s 2025 earthquake under Operation Brahma.

- The need for collective regional mechanisms to tackle shared climate risks more effectively.

The roundtable concluded with the signing of a Memorandum of Understanding between the India Foundation and ICIMOD to deepen cooperation on the climate and sustainability agenda in the Indian Himalayan Region (IHR) and the wider HKH region.

India Foundation looks forward to playing an important role via this partnership to build a resilient, inclusive, and sustainable IHR and HKH.

Asia’s Role in Global Supply Chain

Myanmar: A Struggle for Stability

IF –IHC Panel Discussion

India Foundation, in collaboration with India Habitat Centre organized a Panel discussion on ‘BRICS and the Emerging World Order’ on 5th August, 2025 at Gulmohar Hall, India Habitat Centre. The Panelist for the discussion were Shri Dammu Ravi, Secretary (ER), Ministry of External Affairs; H.E. Prof Anil Sooklal, High Commissioner of Republic of South Africa to India, H. E. Vladimir Ladanov, Chargé d’Affaires, Embassy of the Russian Federation in India & Shri Pankaj Saran, Member National Security Advisory Board & Former Deputy National Security Advisor. The session was moderated by Capt Alok Bansal, Director, India Foundation.

The event was widely attended from diplomats, policy makers, bureaucrats, scholars among others attended. One of the key discussions were how BRICS has grown from five founding members to ten, with 25–30 countries formally seeking membership. This surge reflects the aspirations of the Global South for inclusive governance and the bloc’s appeal to nations across continents, from major economies like China and India to strategically placed smaller states such as the UAE and Cuba. Participants stressed that BRICS’ expansion is driven by its ability to voice Global South concerns—ranging from global governance reform, poverty alleviation, and food security to AI governance, financial stability, and tropical disease management—and to develop solutions from within the South itself.

A strong economic focus emerged as the unifying force within BRICS. Delegates emphasized trade settlement in national currencies, strengthening the New Development Bank as a lender without IMF- or World Bank-style conditionalities, and developing financial infrastructure such as BRICS Clear, a cross-border payments system, and a BRICS Investment Platform. The discussion recognized that consensus-building remains both a hallmark and a challenge, particularly with sensitive issues like UN Security Council reform and the definition of terrorism, among others.

Geopolitical context was central to the debate, with panellists identifying two major external events shaping BRICS: the 2008 global financial crisis, which spurred the G20 and bolstered BRICS’ role, and the 2022 Ukraine conflict, which revived Global South solidarity amid renewed East–West polarization. While acknowledging differences, speakers affirmed that BRICS is neither anti-West nor isolationist but committed to a multipolar and inclusive international order.

The forum concluded that BRICS is consolidating its role as a durable platform for the Global South and an alternative to the world. Its future will depend on sustaining economic cooperation, managing diversity among members, and delivering consensus-based solutions. With India set to assume the BRICS chairmanship next year, expectations are high for it to advance initiatives in finance, governance, and development, building on the legacies of Brazil and South Africa to strengthen the bloc’s position in a multipolar world.

IF-IHC Book Discussion on ‘In Between the Blurry Lines: 14 Defining Moments That Shaped Arunachal Pradesh’ by Shri Sonam Chombay

India Foundation, in collaboration with the India Habitat Centre, organised a discussion on the book, ‘In Between the Blurry Lines: 14 Defining Moments That Shaped Arunachal Pradesh’, by Shri Sonam Chombay, Author & Commissioner to the Chief Minister, Arunachal Pradesh on 30 July 2025 at Gulmohar Hall, India Habitat Centre. Shri Pema Khandu, Hon’ble Chief Minister, Arunachal Pradesh delivered a special address at the session and General Joginder Jaswant Singh, Former Governor of Arunachal Pradesh and Former COAS discussed the book. The session was moderated by Capt Alok Bansal, Director, India Foundation.

Shri Sonam Chombay’s book was presented as a clear and accessible exploration of Arunachal Pradesh’s rich heritage, capturing its significance as a vital part of Northeast India’s cultural and geographical landscape. As a bureaucrat, Chombay meticulously detailed the contributions of tribes, state officials, and political leaders in shaping Arunachal’s modern boundaries, tracing its historical evolution from the North East Frontier Agency (NEFA) to its current statehood. The book stood out for its insider perspective, covering pivotal events like the Anglo-Abor War of 1873 and the Indo-China War War of 1962, while positioning Arunachal as a geo-strategically significant state bordering Bhutan, China, Tibet, and Myanmar, thus serving as a valuable resource for researchers and policy analysts interested in India’s north-eastern relations. It also highlighted Arunachal’s recent infrastructural advancements, showcasing its potential as a hub for sustainable development and tourism.

Shri Pema Khandu, the Chief Minister, and Gen. JJ Singh further enriched the discussion by highlighting the book’s role in mainstreaming Arunachal’s history and diversity. Khandu emphasized the state’s transformative development since 2008, including advancements in infrastructure, tourism, and economic growth, driven by initiatives like operational airports in Itanagar, Pasighat, and Tezu, and the vision to harness Arunachal’s river basins for hydroelectric power. Gen. Singh, offering a military perspective, underscored the state’s strategic importance, particularly the McMahon Line and the Brahmaputra, while praising Chombay’s work for bringing the youngest state’s historical and ecological narrative into academic focus, advocating for its inclusion in mainstream curricula. Their insights reinforced the book’s aim to bridge India’s literary gap on the Northeast, fostering greater national awareness of Arunachal’s unique identity.

India-Japan Relations

IF-IHC Panel Discussion on ‘Iran-Israel Conflict and Its Geopolitical Implications’

India Foundation, in collaboration with India Habitat Centre, organised a panel discussion on ‘Iran-Israel Conflict and Its Geopolitical Implications’ at Gulmohar Hall, India Habitat Centre, New Delhi on 17 July 2025. The panelists for the discussion were Prof. Sanjay Bhattacharyya, Former Diplomat & Professor of Diplomatic Practice, O.P. Jindal Global University, Ms Indrani Bagchi, Chief Executive Officer, Ananta Centre & Col. Rajeev Agarwal, Senior Research Consultant, Chintan Research Foundation. The session was moderated by Capt Alok Bansal, Director, India Foundation.

The discussion on the Iran-Israel conflict gained momentum with Captain Alok Bansal, Director of the India Foundation, introducing the distinguished panel of speakers. He set the stage by describing the conflict as “a war where no land or soil force is involved, subsequently leading to countries claiming the airspace.” This highlighted the war’s deteriorating impact on the political landscape. Captain Bansal then handed the forum to Colonel Rajiv Agarwal, inviting his profound insights into the geopolitical ramifications of the conflict. Colonel Rajiv Agarwal opened his segment with a concise PowerPoint presentation, focusing on the 12-day war between Iran and Israel. He highlighted the geographical disparity, noting that Iran is eighty times larger than Israel. Colonel Agarwal provided context by critically evaluating Tulsi Gabbard’s statement on Iran’s Nuclear Program. He divided the conflict into two critical phases—April and October 2024—describing Iran and Israel as “geographically asymmetric nations with strong military capabilities.” He emphasized the importance of geographical evaluation, given the involvement of land forces.

Drawing on his expertise in military warfare, Colonel Agarwal pointed out that the UNSC’s Ballistic Missile Program was a significant issue throughout the conflict, with Israel dominating in air force capabilities and Iran excelling in ballistic missile supremacy. He concluded by labelling the war a “Nuclear Bogey” orchestrated by the United States, with Iran, Israel, and the U.S. emerging as key stakeholders, each navigating the geopolitical implications in their favour.

Ms. Indrani Bagchi offered her perspective by focusing on the regional fallout, particularly the power vacuum in Lebanon following the conflict, which weakened Hezbollah, a key military ally of Tehran. She contemplated Lebanon’s potential to rise above the war-mongering in the Middle East. Ms. Bagchi also analysed India’s stance, urging a thorough scrutiny of political regimes in West Asia, particularly in light of Assad’s regime being overthrown in Syria. She highlighted Turkey’s growing relevance and dominance in Lebanon, suggesting it could fill the regional vacuum through peace initiatives. On India’s role, Ms. Bagchi emphasized lessons to be learned from global affairs, particularly citing Turkey-Pakistan relations post-Operation Sindoor and the muted roles of China and Russia in the conflict. She urged India to remain vigilant of Chinese ambitions in its neighbourhood. Furthermore, Ms. Bagchi called for a redefinition of deterrence post-conflict, stressing the need to reassess “the way we fight through deterrence and adversaries,” drawing parallels with the Iran-Israel and Armenia-Azerbaijan conflicts. Professor Sanjay Bhattacharya addressed the panel by likening the war to a situation “where the fire is being set up but the tent is not burnt out,” underscoring the equal dominance of Iran and Israel in West Asia. He described the region as an epicentre of emerging conflicts, with Gaza’s situation remaining particularly contentious. Dr. Bhattacharya highlighted Israel’s concerns about Iran’s nuclear weapons program, which clashes with Israel’s foreign policy and deterrence strategy. He portrayed the Iran-Israel conflict as a complex, multifaceted challenge involving institutional leadership, with Gaza’s involvement amplifying West Asia’s role as a hub of armed confrontation and violence.

Look East to Act East: What Has Changed in Ten Years

The region’s geopolitical landscape has become significantly more complex, generating deeper anxieties concerning China’s aggressive rise and the escalating US-China rivalry. This situation has been further aggravated by the disruptions caused by the COVID pandemic, followed by the Ukraine-Russia war, the Gaza conflict, and most recently, by the tariff wars. The recent positions taken by the US, which are detrimental to the interests of its closest allies in the region, have compounded the security scenario. How the US will respond to future challenges in the Indo-Pacific is now questionable.

Over the past decade, China has adopted an increasingly aggressive stance in pursuing its territorial ambitions. This is evident through its militarisation of disputed islands in the South China Sea, frequent large-scale military exercises, and assertive posturing towards Taiwan. Furthermore, China has asserted expansive claims not only in the South China Sea and East China Sea but also along the India–China border, as observed in Galwan and Doklam.

In recent years, Beijing has effectively sown division among smaller regional states, drawing them into protracted, unproductive negotiations over their territorial claims in the South China Sea, while steadily advancing its regional expansion. This hegemonic impulse is also reflected in its state-sanctioned maps, which incorporate vast tracts of neighbouring nations—including India, Indonesia, Malaysia, the Philippines, Brunei, and Vietnam—into Chinese territory, despite persistent and widespread objections from all affected countries.

China’s role during Operation Sindoor, in supplying lethal weapons, aircraft, missiles, and intelligence to Pakistan, was apparent. The efficacy of their defence platforms and equipment was tested for the first time, highlighting the importance of technology. There are lessons to be learnt, not just for India, but for all others in the region, particularly the US, Japan, Taiwan, Korea, Australia, Vietnam, and the Philippines. This also merits an analysis of the reliability of our partnerships in the Indo-Pacific.

It also allows India to strengthen defence cooperation with its traditional partners, such as Vietnam, the Philippines, Malaysia, Singapore, and Indonesia, progressing beyond training and capacity building towards defence procurement, in light of the recent success of our indigenous military hardware. Some of this cooperation has already commenced and has advanced over the past decade. The role of grey zone warfare, including cyber-attacks and information warfare, presents additional important lessons for further refining our Act East Policy (AEP).

The growing economic dependence of smaller countries on China and the increasing financial burden of Chinese debt weigh heavily on those nations that have entered such unviable financing arrangements. The Belt and Road Initiative (BRI) has deleteriously affected recipient countries’ local economies and environments while serving Chinese interests. The experiences of Chinese debt in Pakistan, Sri Lanka, the Maldives, Cambodia, Laos, and Myanmar offer recent examples. Over-dependence on Chinese loans and markets, as well as its finances and supply and manufacturing chains, has hindered efforts to rein in China’s errant behaviour, as it shifts the balance of power in its favour within the region.

Against this backdrop, India’s Act East Policy (AEP) and its vision of MAHASAGAR (Mutual and Holistic Advancement of Security and Growth for All in the Region) have gained greater salience in strengthening relations with its strategic partners. India’s development cooperation programmes with the Global South in this region have also become increasingly significant through loans, grants, capacity building, and technology, encompassing new areas of collaboration in the Indo-Pacific.

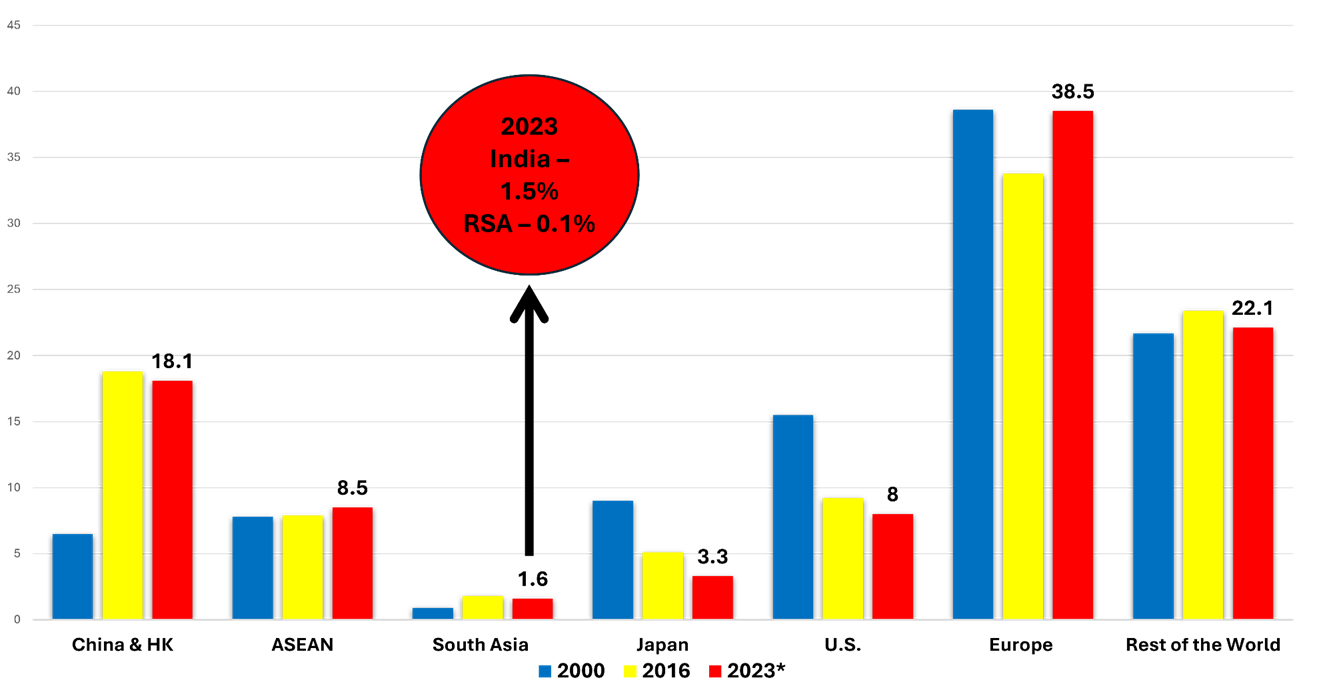

The past decade of India’s AEP has established a robust foundation. This aligns with its ambitious Sagarmala initiative to upgrade its maritime and port infrastructure, enhancing connectivity, trade, and economic activity throughout the Indian Ocean Region (IOR). Over the last ten years, India’s AEP has matured into a strategic engagement, creating a network of partnerships with ASEAN and related frameworks and with countries further east, including Japan, South Korea, Australia, Russia, the US, and the Pacific Island nations. The AEP has broadened in scope, incorporating enhanced geopolitical, geostrategic, and geoeconomic dimensions. It is action-oriented, revitalising India’s historical, cultural, and people-to-people connections with countries in the East. It has achieved the dual aims of bolstering trade and business relations while generating development opportunities for India’s northeastern states, located at the strategic junction of Bhutan, China, Bangladesh, and Myanmar. Therefore, Commerce, Culture, and Connectivity – the three Cs – are the primary pillars of India’s AEP.

At the same time, focused attention has been directed towards regional cooperation. India has actively participated in establishing new plurilateral groups and revitalising existing ones through regular summit-level meetings of the QUAD, FIPIC (Forum for India and Pacific Island Countries), BIMSTEC, IORA, and ASEAN-related frameworks such as EAS, ARF, ADMM+, and MGC. The QUAD has established a pragmatic agenda to address the region’s most urgent challenges, including health security, climate change, infrastructure, resilient supply chains, critical and emerging technology, cybersecurity, humanitarian aid and disaster relief, space, maritime security, combating disinformation, and counterterrorism. All this has been accomplished in just a few years.

Another critical emerging group in which India has partnered with other dynamic countries in the Indo-Pacific region is the Indo-Pacific Economic Framework for Prosperity (IPEF). Its other members include the United States, Australia, Brunei Darussalam, Indonesia, Japan, the Republic of Korea, Malaysia, New Zealand, the Philippines, Singapore, Thailand, and Vietnam. These countries are committed to “a free, open, fair, inclusive, interconnected, resilient, secure, and prosperous Indo-Pacific region that has the potential to achieve sustainable and inclusive economic growth.” The IPEF Statement, issued in Tokyo in May 2022, acknowledges that economic policy interests in the region are intertwined and that deepening economic engagement among partners is crucial for continued growth, peace, and prosperity. The participants have agreed to work under the pillars of trade, supply chains, clean energy, tax, and anti-corruption for cooperation.

India’s commitment to cooperation with the Pacific Island countries, along with PM Modi’s attendance at the three FIPIC Summits (the 1st FIPIC Summit in Fiji in November 2014, followed by the 2nd Summit in Jaipur in 2015 and the 3rd in Papua New Guinea in May 2023), exemplifies India’s efforts to expand its AEP remit to the small island countries in the Pacific, with which India shares strong cultural and people-to-people links. India has partnered with these nations on development cooperation, particularly in addressing the challenges of climate change. Additionally, India has initiated and participated in several other significant bilateral and trilateral project-led collaborations. These include India-Indonesia-Australia, India-Japan-Sri Lanka/Bangladesh, and collaborations with Russia, France, and other European nations, all of whom are stakeholders in peace and development in the region.

India has made significant contributions to regional maritime security by ensuring the safety of maritime traffic and enhancing the skills and logistics of countries in South and Southeast Asia. It has signed white shipping agreements with several nations. Furthermore, Indian vessels have participated in coordinated patrolling and EEZ surveillance. India is aiding its maritime neighbours in establishing their coastal surveillance systems to foster shared maritime domain awareness on behalf of its partners. The hydrographic support and capacity-building provided to India’s partners have strengthened navigational safety.

India has emerged as the preferred security provider in addressing traditional and non-traditional threats, including piracy, trafficking, illegal fishing, and smuggling. Another notable area of success for India has been cooperation in humanitarian assistance and disaster relief (HADR), encompassing risk reduction. India has been the first responder, as demonstrated once again during the region’s COVID pandemic and subsequent natural disasters. Two initiatives led by India in this context include the International Solar Alliance and the Coalition for Disaster Risk Reduction Infrastructure. Cooperation in space and cybersecurity has also emerged as a significant collaboration area.

Notwithstanding the current internal turbulence within Bangladesh, the Neighbourhood First policy since 2014 has made significant progress. In Bangladesh, Bhutan, Nepal, and Myanmar, we have witnessed the development of new roads, checkpoints, rail links, waterways, power grids, fuel pipelines, and transit facilities. Much more is in progress. Internally, India is rapidly enhancing its border infrastructure in roads, railways, ports, and waterways. The Indian Railways is undertaking several international projects, including the Jogbani-Biratnagar (Nepal), Agartala to Akhaura (Bangladesh), restoration of Haldibari (India) – Chilahati (Bangladesh), and the Rakhipur (India) to Birol (Bangladesh) 9 km line. Twenty port townships will be developed along the Brahmaputra and Barak river systems to enhance intra-regional connectivity.

With ASEAN, the relationship was further upgraded to a Comprehensive Strategic Partnership in 2022. Trade, investment, tourism, and even security have seen steady progress among all members. The recent review of the ASEAN-India Trade in Goods Agreement (AITIGA) is timely and will provide a fresh economic boost to this relationship. The importance of international trade rules, particularly rules of origin, gains significance in this context, offering India and its regional trading partners an opportunity to focus on synergies, complementarities, and mutual interests to diversify supply chains and serve as alternatives in the China plus one strategy. Opportunities in emerging areas such as AI, semiconductors, green shipping, and green hydrogen are also being actively pursued. Several ASEAN countries, including Vietnam, Malaysia, and Thailand, have liberalised visas for Indians, while other ASEAN members have also expanded air connectivity. These developments will contribute to increased trade, tourism, and people-to-people connectivity. Education and skills are further areas of cooperation that are being explored.

A crucial aspect of India’s eastward orientation has been to enhance physical, digital, and people-to-people connectivity. India has announced a $1 billion credit line to improve digital infrastructure and connectivity with ASEAN. The construction of the trilateral highway linking India with Thailand via Myanmar and its proposed expansion to Laos, Cambodia, and Vietnam is a significant undertaking. This, in turn, will align with the ASEAN Master Plan on connectivity and the ASEAN East-West Corridor. It will also serve as an important land bridge between India’s northeastern states and Southeast Asia. This will be a game changer. Unfortunately, progress is currently hindered by internal strife in Myanmar. Practical solutions will need to be devised.

The Kaladan multi-modal transport project will link Kolkata to Sittwe port in Myanmar, extending into Mizoram via river and land routes. Sea links are also vital between India’s eastern seaboard, including the ports of Ennore and Chennai, CMLV countries, and Vladivostok. There is a need to improve transhipment links with Malaysia, Singapore, Indonesia, and Thailand. Additionally, there is a proposal to connect Dawei port in Myanmar, which is being developed with Thailand, to Chennai port in India, thereby reducing shipping costs and time. For these proposals to succeed, India and ASEAN would need to explore joint ventures and related concessions. An agreement on maritime transport between India and ASEAN could encompass these essential areas. There are immense possibilities, including connecting commercial ports for cruises and enhancing tourism.

The Indian Space Research Organisation (ISRO) has supported ASEAN and its member countries in developing space technology and its applications. The peaceful exploitation of outer space will continue through the implementation of the ASEAN-India space cooperation programme, which includes the launching of satellites, their monitoring through telemetry tracking and command stations, and the utilisation of satellite image data for the sustainable exploitation of ground, sea, atmospheric, and digital resources for equitable development in the region. Two major ongoing space projects exist in Biak and Ho Chi Minh City. India is also working to enhance cooperation in digitisation, particularly regarding the financial structure and e-governance.

The Mekong Ganga Cooperation (MGC), development cooperation, Quick Impact Projects for CLMV countries, and partnership initiatives with the Indonesia-Malaysia-Thailand Growth Triangle (IMT-GT) have enhanced India’s engagement with the region. The bottom line is that Southeast Asia, with a population of almost 700 million—half of India’s—and a GDP of about USD 4.25 trillion, slightly larger than our own, represents a partner of immense significance for mutual prosperity and progress. Increased attention has also been directed towards BIMSTEC, where Act East meets Neighbourhood First.

The last summit in Bangkok in April adopted the BIMSTEC Charter in 2022, and it has a regular Secretariat operating from Dhaka. Bilateral relations with each of the BIMSTEC countries are on an upward trajectory. As the largest country in this grouping, India has offered to play a more significant role in contributing to BIMSTEC’s success. The plan to expand its activities, create more centres of excellence, strengthen youth networking, address health challenges, and increase capacity building is an important step. India is also working towards creating common regional and sub-regional power grid infrastructure within bilateral and trilateral frameworks, as well as within BBIN and BIMSTEC.

Consolidating India’s ties with this region has also encouraged more ambitious connections with the Indo-Pacific. Both Japan and South Korea have emerged as significant economic players across various sectors within India. India aims to deepen this relationship and give the collaboration a more contemporary character. India’s enhanced capabilities and talent also enable more mutually beneficial endeavours. Japan’s contribution to the Act East Forum, which prioritises development projects in the Northeast, will benefit India’s NE states. India’s engagement eastwards today extends to Australia, New Zealand, and the Pacific Islands. Australia merits particular mention as we witness the benefits of the ECTA (Economic Cooperation and Trade Agreement), alongside a sharp increase in our political and security cooperation.

Education and mobility have also been notable features of this relationship. Like Japan, QUAD membership has supported our ties. The path forward should entail the following:

- Building on the existing network of partnerships to advance our economic and strategic interests.

- Vigorous implementation of essential initiatives, both internal and external.

- Staying agile in response to changing and emerging geopolitical, geostrategic, and geoeconomic challenges.

- Enhancing economic and defence capabilities by leveraging the opportunities they present, while focusing on self-reliance and accelerated growth.

Author Brief Bio: Amb. Preeti Saran is a member of the UN’s Committee on Economic, Social and Cultural Rights. She was the former Secretary (East) at the Ministry of External Affairs. She had also served in Indian missions at Moscow, Dhaka, Geneva and was the Consul General of India at Toronto and the Indian Ambassador to Vietnam. She is a Member of the Governing Council of India Foundation.

An Interview with Shri Rajiv Kumar, Former Vice-Chairman, NITI Aayog, on “Trade and Tariffs”

Come Carpentier:

My first question relates to what is happening in the field of tariffs and free trade agreements, especially regarding President Donald Trump’s unpredictable and somewhat chaotic tariff policies. What is your view on how India should and can respond to Trump’s apparent aim of forcing an open market for American goods in India, while simultaneously imposing high tariffs on Indian exports?

Rajiv Kumar:

Unfortunately for Thomas Friedman, the world is no longer flat, which I find a pity because I believe a flat world is a good world. A flat world allows goods, services, and human beings to travel freely from one place to another, bringing the best talent and products to the world market. This enables consumers everywhere to benefit from what is available globally, creating a more interconnected and resourceful market.

A non-flat world with valleys, cliffs, and precipices essentially means the opposite: that we will divide the world. A fragmented world was what we saw before the Second World War, which is one of the reasons for the Great Depression. I fear I will see this kind of regression in the global economy. As an economist, I hope this will be temporary. Mr Trump himself, as you said, is unpredictable. We don’t know: he started with a 125% tariff for China and ended up with 30%. He also discussed banning TikTok, but it has already had three extensions. Therefore, I am unsure whether his announcement of high tariffs for Indian goods will be implemented; we will have to face it when it happens, but I am uncertain what it will be.

But all of this implies one thing regarding India’s trade policy: we must achieve global competitiveness in all sectors we want to operate. However, it’s not feasible to do so for every sector, so we need to carefully select the industries in which we aim to be competitive globally. The Production Linked Incentive (PLI) scheme, which was initiated when I was at NITI Aayog, serves as a good example. But at present, I believe it has lost focus and become too broad, so we need to refocus and choose 5-6 industries—whatever number you think can succeed—and dedicate efforts to achieving global competitiveness there. If we do that — and it is essential that we do — then any tariffs proposed or imposed by Mr Trump will not matter. Moreover, if his goods are competitive and they enter India, it will only benefit Indian consumers. So, I am not opposed to it. I hope all these issues are addressed with proper diligence in the free trade negotiations proposed with the US, and I look forward to seeing how those proceedings unfold.

Come Carpentier:

In this regard, as you know, India’s focus has been on benefiting from the desired change in supply chains. Particularly concerning high-tech goods, for example, India has been working hard to position itself as an alternative to China in manufacturing a range of industrial goods. As we have seen, Trump has adopted a very hostile stance, stating that no major American companies such as Apple should transfer their manufacturing facilities to India, for the simple reason that he wants them not only to stay in America but also to bring back those that have moved abroad, to sell rather than manufacture overseas. How do you think India should respond to this very new, I would say, mercantilist policy, which seems to imply that I shouldn’t buy from you unless I lack the product, but I should sell to you—especially high-value goods—so that I accumulate profits and you do not? In other words, the idea is that the deficit should not be mine but yours. What is your opinion on that?

Rajiv Kumar:

A mercantilist attitude or policy often appeals to the domestic constituency and is primarily pursued for that reason. It is not a genuine policy because mercantilism has limited scope; it assumes that being competitive depends on having the resources to become a producer and exporter in any chosen field. America, however, is not so abundant in skilled labour, and I believe they or Trump’s advisors recognise this. Therefore, it will be impossible for the US to become a producer across all industries and to reshore them as they wish. The best example currently is Nippon Steel. There were threats to block the US Steel merger, but yesterday, Nippon Steel completed the deal and took over US Steel.

So, you know mercantilism is a losing, a lose-lose proposition, while free trade based on your competitive advantages is a win-win. I believe this won’t last, and reality will catch up sooner rather than later. Moreover, the US has been successful in the services economy and the high-tech, network economy, including the Internet. I respect the US for its innovative capabilities and technological advancements. I think it would be better for them not to get entangled in China Plus One but instead to follow their own path and direction in providing the world with goods and services at which they excel and are innovative. I believe they will stay as vibrant an economy as ever. So, I see this as a detour that could cost the US quite a bit, and I hope it won’t continue. It is risky to turn the US into a manufacturing giant when much of its GDP now comes from services, around 60-70%.

Come Carpentier:

Yes, and I believe the primary concern in the US is that China is surpassing them in some of their key areas of excellence, which is very difficult for them to accept. That said, as you know, since 1998, the World Trade Organisation has exempted electronic goods from the usual restrictions that govern exports of goods. India has been a significant beneficiary because it is now probably the third-largest digital economy in the world. If this were to change and some tariffs and duties were imposed on the export of electronic communication goods, how should India respond to that?

Rajiv Kumar:

When we signed a treaty on electronic and hardware goods, agreeing to zero tariffs internationally, many people criticised it as impractical for India. A well-known Stanford professor, Paul Yograj, holds the best patent in this area. He pointed out that under this scheme, electronic hardware imports into India would be many times higher than oil imports because electronics hardware will be the foundation of everything, especially the digital economy and artificial intelligence driven by algorithms. He estimated imports could reach up to 500 billion. I mention this because I would prefer a tariff-based electronics hardware economy, as it would allow India, a late starter by all accounts, to develop its electronic hardware industry and make it competitive, aligning with its skills and competitiveness in the software sector.

So far, we have always been a software giant. We have taken advantage of wage arbitrage. I believe it’s time to recognise that, as you’ve seen over the past year, the government’s MeiTY department has focused significantly on enhancing our capacities in semiconductors, chips, foundries, and related areas. I believe we must continue this effort and attract major companies like TSMC and others to our country. I wouldn’t oppose the idea of tariffs if necessary. My main concern would be restrictions on technology transfer, which is a possible next step Mr. Trump might consider. Therefore, we need to seek diversified sources of technology. Fortunately, such sources exist globally. The US is a significant one, but not the sole technology provider. The electronics hardware industry, which I emphasise is essential going forward, requires us to be largely self-reliant- not entirely self-sufficient, as that wouldn’t be appropriate- but capable of absorbing innovation and developing our advancements as we proceed.

Come Carpentier:

This leads me to the topic of trade pacts and trade associations, which are both debated and embraced in this world. For example, the Regional Comprehensive Economic Partnership (RCEP) has been primarily shaped between China and ASEAN. India has so far declined to join, despite considerable pressure or at least encouragement from China and other member countries to include India, as it is seen as a very important potential partner in that association. Do you think it was right for India to remain out, or are there conditions under which India might join in the coming years?

Rajiv Kumar:

This question has persisted since the inception of RCEP. I was part of the discussions about how and why India should join. The concern India has is that RCEP could become another pathway for Chinese goods to enter the country. As you know, China accounts for over 30% of global manufacturing today. There are several industries where they hold near monopolies. Therefore, there has been a fear that if India joins, its industry could suffer greatly or even be wiped out. I am not sure if those concerns have changed yet. At that time, I advocated that India should focus on a set of industries where we can be regional and possibly global leaders, which I mentioned at the start of my interview. I believe it is not impossible, but challenging, and once we achieve the necessary scale and global competitiveness, then we should consider opening our doors to RCEP.

Otherwise, we have bilateral trade agreements with all ASEAN economies, including ASEAN itself and its member nations like Thailand, Malaysia, and others. We also continue bilateral negotiations with China, but remember that we face a significant trade deficit with China. They are our largest trading partner, yet the trade deficit is approximately 78 billion dollars out of a total trade of 120 billion dollars. It is unsustainable to maintain this gap. My current suggestion is that we should invite Chinese investment into India and open our doors across nearly all sectors, except the strategic ones. I recently visited Abu Dhabi, where we held bilateral discussions with Chinese experts, who are willing to invest. We aim to make India an export hub for their industries, similar to what Japan and Korea have achieved. Therefore, I believe it is time for us to welcome Chinese Foreign Direct Investment, encourage them to develop export-oriented capacity, and the sooner we join RCEP, the better.

Come Carpentier:

In fact, I was also speaking to someone important in China before yesterday, and they were saying the same thing. Now, we want to enter and establish ourselves in India. Clearly, there is momentum in China that India should probably seize.

Rajiv Kumar:

Absolutely.

Come Carpentier:

I have a question related to the part of the world we haven’t discussed much, apart from perhaps South America and Africa, where things are progressing at their own pace. Regarding the European Union (EU), there has been a long-standing negotiation and discussion about a free trade agreement. However, it always seems to be halted, falling short of reaching the goal. There is clearly a greater momentum from the EU’s side. One of the major issues has been retail trade, right? That’s where India has needed to protect its small and medium manufacturing industries, as well as its small shops. We know that in Europe, many small businesses have been devastated by the invasion of hypermarkets, supermarkets, and huge shopping centres. How do you think the negotiation is progressing now, and do you believe it is close to conclusion? In other words, will India soon have a free trade agreement with the EU, and what would be the main terms of that?

Rajiv Kumar:

It’s been 18 years in the making, hasn’t it? During that time, a generation has passed, and I remember when India’s main objections were to importing expensive cars, including German ones. European objections, driven mainly by the French, were centred on preventing the media industry from opening up to India. They also wanted all their wines imported here, and so on. I have always been a proponent of full liberalisation of retail trade, and I have written papers on the subject. I have even advised the government about it. When I was the Director and CEO of an organisation called ICRIER, I argued that liberalising retail trade globally would mainly bring efficiency to the market. As for the ‘mom-and-pop’ stores, the reality is that organised retail accounts for only 4%. Now, it’s 8% of India’s total retail trade. Even if this grows at whatever rate you might consider, mom-and-pop stores are unlikely to disappear.

What has happened in India, which you may not be aware of, is the growth of quick commerce, with larger companies like Amazon, Flipkart, and even Reliance now joining. This poses a threat to small, family-run stores, not the big supermarkets or hypermarkets, which were never considered a real threat. Retail trade should be liberalised immediately. It has become a factor in the real estate market, and that needs to end. I believe foreign retailers will enter, providing a healthy competitive challenge to Indian retailers, and they will create the employment we need. Therefore, this should happen. I hope that entities like Carrefour and Selfridges, and others present in India, do not become obstacles to the India-EU trade prospects. While I remain sceptical about whether this trade agreement will be completed, because what I mentioned might not be acceptable here, especially regarding France and Germany, and the UK already has a bilateral trade agreement with India—one of the main drivers for this deal is now absent. So, I am uncertain. Nonetheless, I hope it happens, as I believe it would be a very strong win-win for both sides. However, at the moment, I cannot see a definitive date for its conclusion.

Come Carpentier:

I suppose this brings us to the conclusion that, from what I observe, you are definitely an advocate of free trade as much as possible, and therefore you probably wish for many of the tariffs applicable in India to be gradually reduced in most cases, correct? Because, based on what we see now, there is both this pressure to liberalise and open the markets, and on the other hand, a fear that certain sectors of the Indian economy could suffer, which is a very sensitive issue for politicians in particular. But from what you have said, it seems to me that you do not see a significant threat from Trump’s policies, at least in the long term. You believe that India will be able to adapt and may even benefit from removing some of the hurdles to the import of various foreign goods.

Rajiv Kumar:

My own view is that foreign trade is not the primary driver of India’s economy or its progress. It is the domestic economy, given our size and all other factors, and more specifically, our private enterprise, which has been the true engine for millennia. Yes, you know. And perhaps, that’s a big if, but I firmly believe that the day our government shifts from merely regulating and supervising to actively promoting private enterprise, India will be able to compete with any country in the world. We have done so in the past. Our enterprises once stretched from Jakarta to Rome, a footprint well documented by William Dalrymple. That’s the point. The sooner we adopt this approach, the better for us. Otherwise, no matter how many free trade negotiations or agreements we enter into, they will not yield the desired results. Our bilateral agreements with Thailand, Korea, and Sri Lanka show this — they have not produced the outcomes we hoped for, and we are in deficit with these countries. In conclusion, tariffs, non-tariffs, and trade policies will come and go. India must focus intensely on achieving global competitiveness and scale within our domestic economy — and that will only happen if the government becomes a strong champion and supporter of India’s renowned private sector. We are simply waiting for that moment, and once it arrives, everything else will follow.

Come Carpentier:

This is a very apt conclusion that reminds us that despite all the efforts India has made in past years to strengthen economic ties with countries that used to be part of its sphere of co-prosperity, even in those nations, China is making increasingly significant progress, and India is struggling to catch up. This likely indicates that a change in strategy should be considered. I am very grateful to Dr Rajiv Kumar for his wise and experienced comments, and I also thank the India Foundation for facilitating this dialogue.

Rajiv Kumar:

Thank you very much.

Brief Bios:

Dr. Rajiv Kumar, former Vice Chairman of NITI Aayog, recently resumed his chairmanship of Pahle India Foundation, a not-for-profit policy think tank, established by him in 2013. He served in the government as Economic Advisor with the Department of Economic Affairs (Ministry of Finance) during 1991-1995 and took over as Vice Chairman of NITI Aayog in September 2017, with the rank of Cabinet Minister and served until April 2022. His stints with the corporate sector include serving as Chief Economist of the Confederation of Indian Industries (CII) from 2004-2006 and later as Secretary General of the Federation of Indian Chambers of Commerce and Industry (FICCI), 2011-2013. Dr. Kumar holds a Ph.D. in Economics from Lucknow University (1978) and a D.Phil. from Oxford University (1982).

Mr. Come Carpentier is a Distinguished Fellow with India Foundation.

July-August 2025: India Foundation Journal

Trump’s Return: Trade Implications for India and the Global Economy

Introduction

The return of President Trump to a second term ushered in a wave of sweeping tariff declarations, reigniting a global trade war that involved both allies and adversaries of the United States, ultimately plunging the world economy into a pronounced and far-reaching recession (Bouët, Sall & Zheng, 2024). These announcements, rolled out in successive stages, culminated in April with the imposition of reciprocal tariffs, prompting varied retaliatory responses from affected trading partners. The administration defended these unilateral tariff measures as necessary to address its persistent trade deficit with certain countries, blaming the imbalance on unfair trade practices. Central to its complaints were discriminatory tariffs, ongoing IPR infringements, and regulatory hurdles that hindered US exports and widened the trade deficit. Such tariffs may have briefly boosted customs revenues, but their broader implications cast doubt on the effectiveness of these measures. While some rationale supported the retaliatory approach adopted by the Trump 2.0 regime, the administration’s stance appeared unilateral. It contravened the spirit and rules of the multilateral trading system established in WTO agreements (Klingebiel & Baumann, 2024). The tariff increases were mainly a coercive tactic, aimed at pressuring trade partners into negotiations to rebalance trade relations and create a fairer playing field.

Through this, the US aimed to reduce its deficit by establishing bilateral or regional trade agreements. However, the core issue behind the imbalance was America’s unchecked domestic consumption. Without curbing domestic demand, its trade deficit was likely to continue. Instead of implementing structural reforms domestically, the Trump administration chose a populist strategy, shifting the burden of adjustment onto external trade policy. Additionally, the method used to set reciprocal tariffs was questionable, as these were often tied to the trade deficit levels rather than the extent of protectionism practised by partner countries. To strengthen its protectionist stance, the US employed or planned to use existing domestic laws, such as IEEPA, Sections 338, 301, 232, and 122, to restrict trade with specific partner countries, products, and regions. By June 2025, the heated rhetoric of the trade war began to ease, with negotiations resuming on various bilateral and multilateral platforms. How the international community responds to this changing tariff landscape remains an open question.

India, facing an average tariff of 26% on its exports, has not been immune to the consequences. To avoid a direct tariff clash, India has actively pursued economic agreements such as the ‘India–U.S. COMPACT’ and ‘Mission 500’ to strengthen bilateral trade relations. These initiatives cover both goods and services and seek to balance the trade relationship through mutual agreements. The US will benefit from market access in high-technology sectors, while India is given greater entry into labour-intensive segments. The long-term effects of these arrangements deserve careful examination, especially considering the unilateral imposition of a 26% reciprocal tariff by the US and India’s actions regarding US tariff policies.

Tariff Tremors: Global Response

The ‘America First Policy’ took centre stage during President Trump’s 2015 election campaign and has since remained a symbol of his political vision (Bukhari et al, 2025). It was the cornerstone of his first and second presidential terms, guiding the administration’s domestic and international stance. At its core, the policy aimed to revitalise domestic production—particularly in the manufacturing sector—to boost employment and to adopt a cautious approach towards regional integration. A key focus of the agenda was to pressure major trading partners into revising their trade frameworks to align with US efforts to narrow its growing global trade deficit. The policy’s operational focus involved strengthening the US influence over multilateral institutions such as the WTO and various UN bodies—including the WHO—alongside strategic use of tariff threats, withdrawal from the Paris Climate Accord, and a confrontational stance on immigration. However, this assertive nationalist approach has weakened the United States’ leadership in various areas of global collective action—ranging from climate change to multilateral trade—and has strained its economic relations with longstanding allies like the European Union, Canada, and Mexico, as well as strategic rivals such as China.

The initial course of action involved the sudden and comprehensive imposition of tariffs on several trading partners, aimed at reducing the growing bilateral and overall trade deficit of the United States. The US chose a unilateral approach in trade policy, trying to rebalance its bilateral trade gaps with key economic partners. These policy measures mainly aimed to protect the domestic manufacturing industry, prioritising aluminium, steel, and the automobile sectors. A significant factor contributing to the decline in US exports was widespread violations of intellectual property rights, often justified under the guise of ‘unfair trade’ practices. Other countries also saw similar practices, including forced technology transfers, non-transparent subsidies, and other structural distortions. These ongoing imbalances led President Trump to implement extraordinary policy measures designed to shift the trade balance in favour of the US and to address persistent bilateral deficits with certain nations.

Following the Executive Order issued on 20 January 2025, tariffs in various formats continued to be implemented until May of the same year. Due to their extensive scope and scale, only a few key tariff decisions are highlighted here for illustration. In January 2025, tariffs were significantly increased on imports from China, Mexico, and Canada—including steel—with Canada and Mexico facing 25% tariffs (10% on energy), and China facing 20%, justified by concerns over fentanyl trafficking and border security. In March, imports from Canada again faced a 25% tariff, with energy imports specifically taxed at 10%. A blanket tariff of 25% was also imposed on countries importing crude oil from Venezuela. Tariffs on steel and aluminium were designed to encourage the relocation of base metal manufacturing back to US territory. By April, the administration announced broad reciprocal tariffs affecting over 90 trading partners worldwide. Tariffs against China increased to 84% and 125%, before a 10% reduction was granted following the Geneva Accord. Steel and aluminium tariffs rose to 50% in May, establishing the US as the most tariff-protected economy in the industrialised world. The average tariff rate in the US rose from 2.5% in January to 27% in April, eventually decreasing to 15.6% in June after some reversals were announced.

Diverging Trade Deficit

The United States’ trade deficit with the rest of the world is a deeply rooted structural issue that cannot be solved simply by imposing trade restrictions. As a consumption-driven economy with a per capita income reaching $82,000 in 2023, the US shows a strong preference for imported goods, especially finished consumer products, which is a key reason for its growing trade deficit. The US dollar, the world’s reserve currency, remains in high demand worldwide, leading to a persistent appreciation that worsens the trade imbalance. This upward pressure on the currency makes imports more attractive while exports become less competitive, weakening the global position of American manufacturing. Recognising these structural inefficiencies, many U.S.-based companies have chosen to move their production overseas, unintentionally increasing pressure on the country’s external sector.

Additionally, global trade regimes have played a significant role in shaping the US’s external trade performance. During the second wave of the global recession, especially in 2017, the US economy saw a partial recovery, with exports and imports expanding compared to the previous global trade environment. However, this recovery was accompanied by an increase in the overall trade deficit, driven mainly by a resurgence in goods trade.

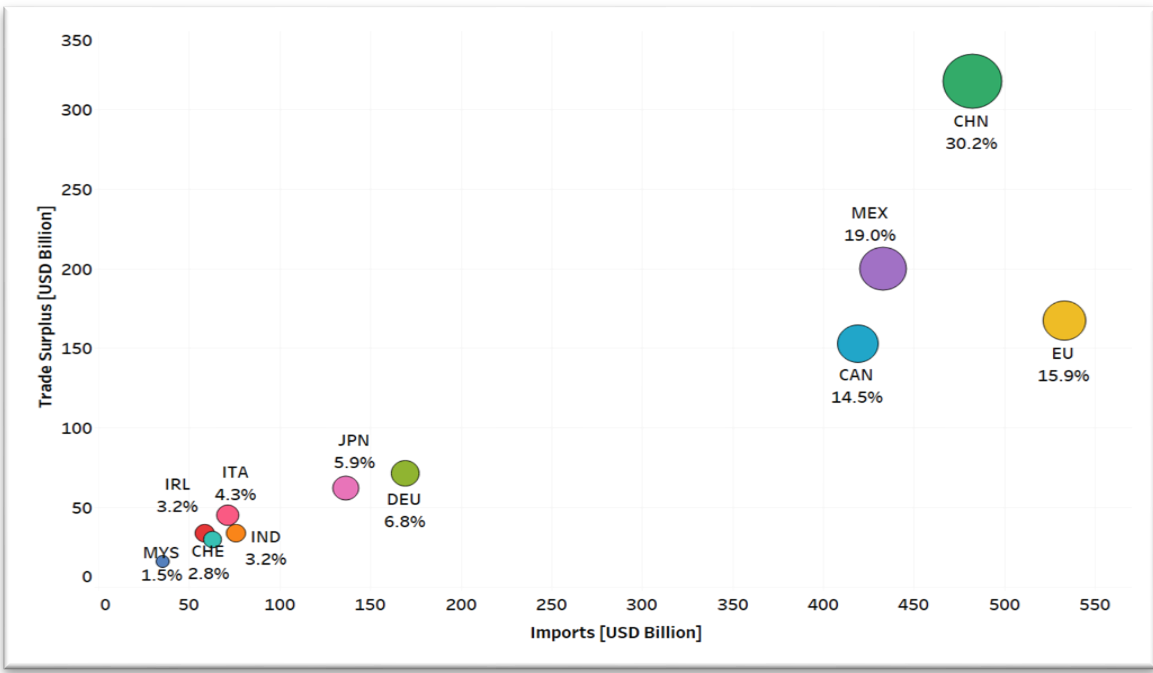

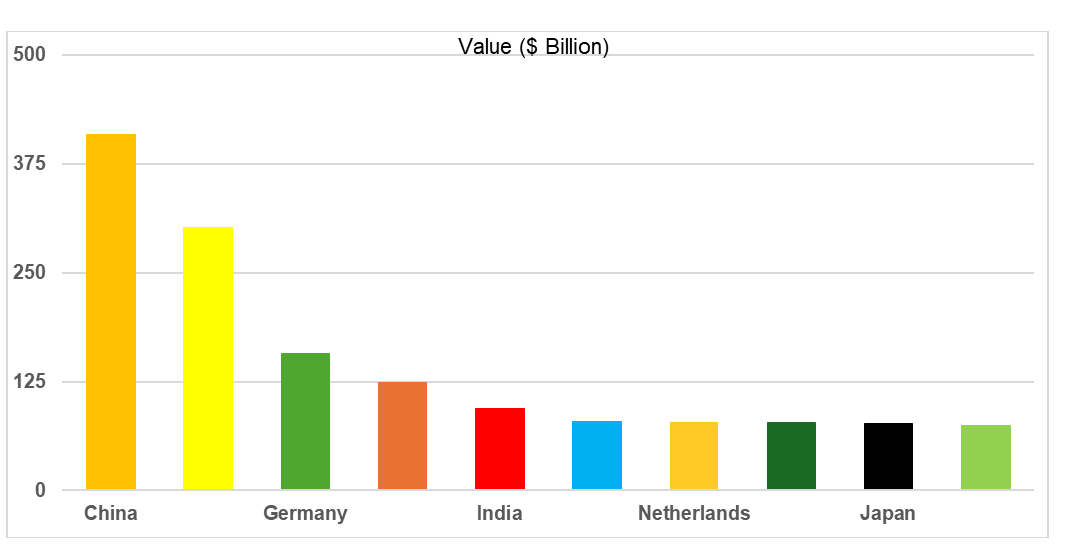

Figure 1: America’s Trade Gaps: Top Contributors by Country- Share in Overall U.S. Deficit, %

Source: RIS (2025)

The growing deficit in goods was partly offset by a favourable trade balance in the services sector, providing some relief. Nevertheless, the ongoing imbalance in goods trade negatively affected the current account and added to the gradual depletion of foreign exchange reserves. It is worth noting that the US external sector performed better in 2023 compared to 2022. In analysing the trade deficit, China emerged as the largest contributor, accounting for 30% of the total US trade gap, as shown in Figure 1, with a bilateral deficit of $317.7 billion in 2023. The US has also voiced concerns over its NAFTA partners, although bilateral trade flows—especially with Canada—have been more favourable than with other major trading partners. Bilateral trade tends to increase when the trade deficit ratio is low.

While the US showed lower bilateral trade deficit ratios as a proportion of total trade with Canada and Mexico (22.3% and 30.0%, respectively), countries such as China (49.1%), Italy (46.2%), and Ireland (40.7%) exhibited significantly higher proportions. Empirical analysis indicates that the US has struggled to sustain its global competitiveness in specific sectors, failing to maintain a consistent advantage across its major trading partners. Conversely, India recorded a relatively modest trade surplus of $33.8 billion with the US in 2023, representing 28.7% of bilateral trade. India recorded surpluses in agriculture and manufacturing while incurring deficits in minerals, along with signs of intra-industry trade in 2023 (RIS, 2025). The Indian trade surplus with the US appears to be structural, distributed across a broad range of sectors at the product level. Therefore, attempts to rectify this bilateral trade imbalance through tariff manipulation are unlikely to produce meaningful results.

Reciprocal Tariffs and Reconciliation

Reciprocal tariffs were implemented by the United States on 2 April 2025, with a comprehensive 10% tariff applied universally, alongside country-specific rates tailored to mirror the tariff structures of each trading partner. The Trump Administration targeted nearly 57 nations, notably exempting other NAFTA members from its scope. For several key partners—China, India, Japan, and others—tariff rates were determined based on various criteria, including existing tariff systems, bilateral trade imbalances, currency policies, etc. Unlike the uniform MFN tariffs approved by the WTO, these reciprocal tariffs varied significantly—China faced over 34%, Vietnam 46%, Thailand 36%, Japan 24%, and South Korea 25%. This policy also included India, with a 26% tariff levied on its exports. The impact was particularly felt in electronics, auto components, aluminium, and steel sectors, while industries like pharmaceuticals and energy exports were relatively exempt.

In response, some nations resorted to direct retaliation—China imposed 25–30% duties on soybeans, semiconductors, and automobiles, while the EU responded with tariffs of up to 25% on selected American goods such as whisky, motorcycles, jeans, and orange juice. India and others adopted more targeted strategies, penalising US exports like almonds, apples, walnuts, and pulses; Brazil notably reduced soybean shipments to China, undermining American trade interests. Others imposed non-tariff barriers—South Korea limited meat and poultry imports, while Japan introduced strict chemical compliance protocols for manufactured goods. Meanwhile, the US pursued a more conciliatory approach towards countries like Canada, Mexico, and Vietnam, opting for diplomatic negotiations and tailored bilateral agreements. By June, the Trump administration, aiming to de-escalate the growing trade conflict, stepped back from aggressive tariffs and pursued dialogue-based resolutions through bilateral deals. These agreements took various forms, involving strategic partners such as China, the EU, the UK, and South Korea. At the G7 Summit, the US and Canada committed to developing a new trade framework before July 2025—an approach India, notably, did not remain distant from.

Decoding Policy Impacts on India

Export advantage for India: A Structural Issue

India has consistently maintained a trade surplus with the United States — a crucial dynamic for a country that usually runs a persistent trade deficit with the rest of the world. With an ambitious export target of $2 trillion by 2030, India has aligned its ambitions with the Indo-US’ Mission 500′ initiative, which aims to increase bilateral trade to $500 billion by the decade’s end. This initiative fits well with India’s broader economic vision of becoming a $7 trillion economy by 2030. However, the path to this milestone is hindered by the current average tariff of 27% on Indian exports to the US. This barrier might impede India’s competitive ability to reach its export targets, especially with lower-cost exporters such as China.

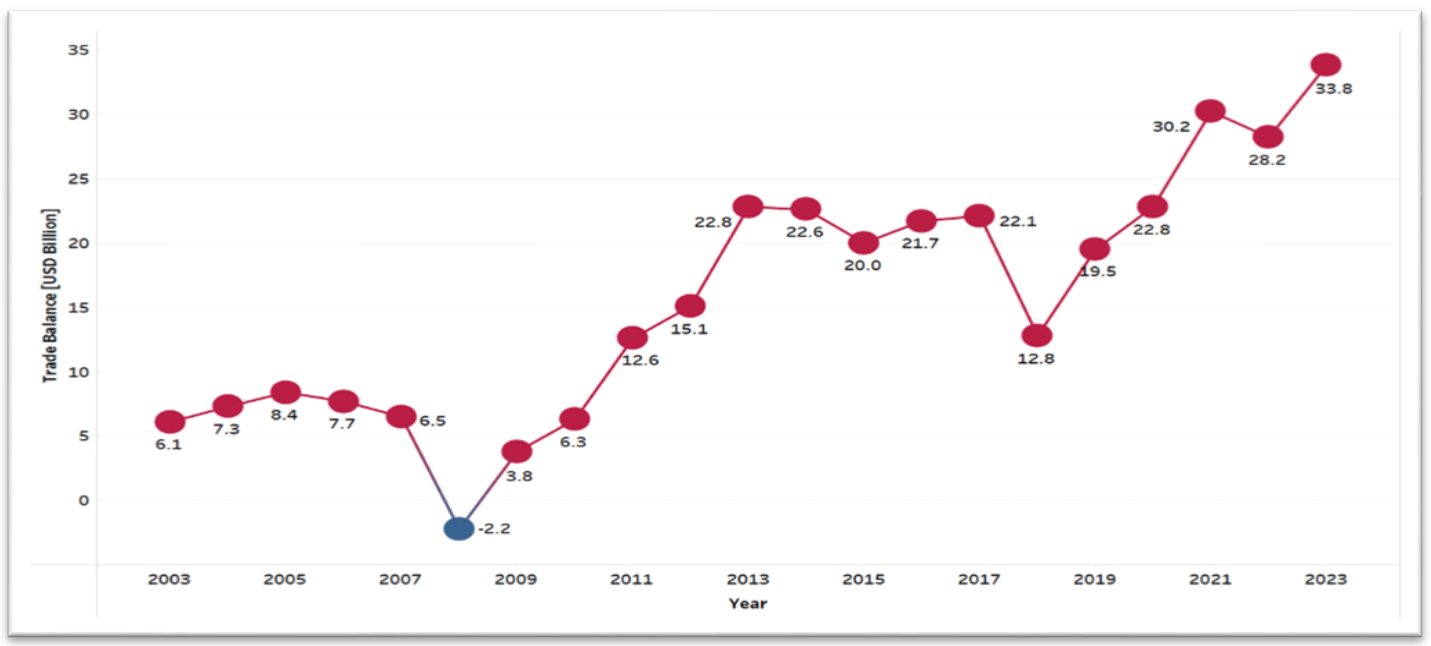

India has consistently been a competitive exporter to the United States across both primary and secondary sectors. Generally, India has maintained a trade surplus in agriculture and manufacturing, while the US has held an advantage in the mineral trade. Despite India’s significant and persistent trade deficit in hydrocarbons, its overall trade balance with the US remained favourable over the past twenty years, except for 2008, as shown in Figure 2.

Figure 2: Exporting Advantage: India’s Surplus Story with the US, $Bn

Source: RIS (2025)

This favourable balance remained steady during global economic growth, fluctuating modestly between $6.1 and $7.7 billion from 2003–07, before rising sharply from $3.8 billion in 2009 to $22.8 billion in 2013. Between 2014 and 2017, India’s trade surplus plateaued once again before experiencing a steep decline in 2018. The period from 2019 to 2023 marked another phase of rapid and consistent growth in India’s trade surplus, briefly interrupted by mild stagnation in 2022. Empirical evidence shows India’s strength in specific agricultural sub-sectors such as animal products, fruits and vegetables, and processed foods, while the US demonstrated competitiveness in oils and fats. In manufacturing, India recorded notable surpluses in chemicals (particularly pharmaceuticals), textiles and clothing, gems and jewellery, and machinery.

In 2023, India’s mineral imports amounted to $13.5 billion, yet a bilateral trade deficit of only $6.8 billion was recorded—an outcome attributed to intra-industry trade (IIT) within the same sector. Nonetheless, China remains a significant competitor for India in several product lines across the US market. Against President Trump’s 2.0 aggressive tariff regime, analysing at the product level across key target trade partners—Canada, China, Germany, Japan, South Korea, and Mexico—indicates that higher tariffs on China may spill over, indirectly impacting Indian exports. While these tariffs could restrict China’s access to the US market, India may not be able to fill the resulting gap across numerous product categories without initiating renewed negotiations under the umbrella of ‘Mission 500’.

Structural Trade Issue

The Trump administration remained convinced that India’s trade surplus in manufacturing and related sectors was a short-term anomaly, manageable through firm tariff-based strategies. The persistent bilateral trade deficit with India was not seen as a systemic economic issue and could be addressed using conventional tariffs or regulatory tools. As an emerging economy, India was often expected to export raw materials and import manufactured goods. However, this longstanding assumption does not hold in the case of Indo-US trade relations. Contrary to expectations, India does not export a significant volume of primary goods to the United States, while the US, in contrast, exports substantial amounts of such goods, especially minerals, to India. The U.S. has effectively become a net exporter of primary commodities to India. In 2023, India’s bilateral trade in intermediate goods with the US was valued at $52.6 billion, from a total bilateral trade volume of $117.8 billion. Within the intermediate goods sector, semi-processed products dominated, accounting for 68.8% of bilateral trade in this category. Although parts and components (P&C) comprised a relatively small part of this trade, India was expected to increase its dependence on the US for such imports. Nonetheless, India managed to sustain a trade surplus in semi-processed goods and the P&C sub-segments of intermediate trade.

As India progresses in its industrialisation, it is logical for its reliance to shift towards imports of final capital goods, ideally evident through increased bilateral trade volumes in this sector. However, that expected trend has not materialised. Furthermore, India’s most significant bilateral export segment remains final consumer goods, which has generated the highest trade surplus. This segment alone contributed a surplus of $23.7 billion out of the total $33.8 billion bilateral trade surplus recorded in 2023. The final consumer goods sector has thus become the primary source of India’s export earnings from the American market. It accounted for 66.7% of India’s final goods exports and 25% of the bilateral trade volume between the two nations.

Nevertheless, this heavy dependence on final consumer goods has become a strategic weakness for India. Within this category, Indian exports have shown a high concentration of a limited number of products. Specifically, just 44 products made up over 70% of India’s exportable items within the final consumer goods segment. These concentrated exports include processed foods, cotton & textiles, fish products, pharmaceuticals, footwear, carpets, and fresh produce. Such over-reliance could restrict diversification and resilience against policy shocks. Therefore, upcoming trade negotiations with the US should focus on securing stable and long-term market access for these key product lines.

Bilateral Arrangement: Mission 500

In February 2025, both nations launched ‘Mission 500’, a Multi-sector Bilateral Trade Agreement (BTA) to boost economic and technological cooperation. The BTA covers trade in goods and services, establishing a solid and future-oriented economic partnership. ‘Mission 500’ aims to double current bilateral trade flows in goods and services to reach a target of $500 billion by 2030. A core element of the agreement is a reciprocal framework, where the US seeks to improve access for its industrial products in India. At the same time, India aims for preferential terms for exporting labour-intensive goods to the U.S. India has long maintained trade surpluses in agro-based, low-technology, medium-technology, and even high-technology goods, reflecting its growing export capabilities across various sectors. Historically, the US has maintained high tariffs on low-technology goods; reducing these tariffs could help expand India’s access to the American market. The signing of ‘Mission 500’ and the India-U.S. COMPACT represents a significant development in bilateral relations. Under the BTA, India is expected to increase its imports of US goods and services, which will likely help balance the US’s persistent trade deficit with India. However, implementing high reciprocal tariffs could seriously challenge achieving the goals and cooperative spirit of ‘Mission 500’.

Conclusion

The second Trump administration’s tariff regime cast a long shadow, sowing pessimism among both allies and rivals of the United States. In its first five months, the administration unleashed a surge of bilateral and global tariffs as a bold assertion of its ‘America First’ doctrine. However, by June 2025, these tariffs were scaled back following negotiations with key trading partners. The cascade of tariff declarations from Washington prompted varied retaliation from affected nations. While major partners such as China and the European Union responded in kind with mirror tariffs as before, others employed more measured counterstrategies to navigate the pressure from the US’s unrelenting tariff offensive (Yu, 2020; Li, Balistreri, & Zhang, 2020). Adopting a more moderate stance, India chose to absorb the 27% reciprocal tariff while entering into negotiations that led to the India-U.S. COMPACT and the launch of ‘Mission 500’ in February 2025.

As such, India maintained a trade surplus of $33.8 billion with the US in 2023, supported by robust agricultural and manufacturing exports. Besides the primary sector, India has consistently recorded trade surpluses across multiple industries. Its strength particularly lies in exporting semi-processed goods and finished consumer products to the US market. Under the ‘Mission 500’ terms, both nations agreed to double their current trade volume in goods and services, aiming to reach a milestone of $500 billion by 2030. The agreement envisages reciprocal market access—India in labour-intensive goods, and the US in industrial sectors, especially high-tech products. India continues to post surpluses across low-, medium-, and high-technology sectors, even as the US imposes especially steep tariffs on low-tech imports. The American commitment under ‘Mission 500’ to reduce tariffs on labour-intensive goods could boost India’s future exports in this sector. However, the long-term success of ‘Mission 500’ depends on how effectively both sides manage future trade negotiations amid current high tariff tensions.

Author Brief Bio: Prof. S. K. Mohanty is a Professor at the Research and Information System for Developing Countries (RIS), New Delhi.

References

Bouët, A., Sall, L. M., & Zheng, Y. (2024). Trump 2.0 Tariffs: What Cost for the World Economy? Policy Brief, 49.

Bukhari, S. R. H., Jalal, S. U., Ali, M., Haq, I. U., & Irshad, A. U. R. B. (2025). America First 2.0: Assessing the Global Implications of Donald Trump’s Second Term. Qlantic Journal of Social Sciences and Humanities, 6(1), 51-63.

Klingebiel, S., & Baumann, M. O. (2024). Trump 2.0 in times of political upheaval. Implications of a possible second presidency for international politics and Europe.

Li, M., Balistreri, E. J., & Zhang, W. (2020). The US–China trade war: Tariff data and general equilibrium analysis. Journal of Asian Economics, 69, 101216.

RIS (2025), Trump’s Trade Policies Peril Global Economic Stability, Research and Information System for Developing Countries, New Delhi.

Yu, M. (2020). China-US trade war and trade talk. Berlin, Germany: Springer.

A New Case for Manufacturing and Supply Chains in India within the current geopolitical context

Introduction

The May 6, 2025, India-Pakistan conflict has raised questions about the future of South Asia’s regional economic integration. India has ceased all direct and indirect trade with Pakistan, halting a $10 billion annual exchange of goods. South Asia, as a region of aspiration, seems lost for some time. However, the geographical reality of proximity, common borders, and cultural affinity cannot be changed. India is a key destination for the shift of supply chains from China, and the region is the catchment area for these benefits. How, then, can the region play its role as the next big trade hub?

There are currently three imperatives for India to emerge as a manufacturing hub. The first is the Trump tariff effect, where India faces 26% reciprocal tariffs on exports to the US, the world’s largest high-income market. A second factor is Pakistan, whose tepid growth, low productivity, and lack of domestic reform are hindering the region, depriving it of the benefits of developing a supply chain ecosystem and ultimately prosperity. Thirdly, China and East Asia’s integration into global supply chains, which has generated jobs and unprecedented prosperity, provides valuable lessons for others, even amidst global trade policy uncertainty.

This indicates that South Asia is increasingly leaning towards trade in the new geopolitical context. Indeed, India is enhancing its trade engagement with the world, showcasing a series of free trade agreements (FTAs). Recently, Sri Lanka signed FTAS with Thailand and Singapore. Meanwhile, Bangladesh has been discussing FTAs with various Asian countries. This reflects a regional aspiration to establish the supply chain ecosystem necessary for an ambitious trade agenda.

It is none too soon. Starting in June, all of Apple’s iPhones for the U.S. market will be made in India, still cheaper despite the new U.S. tariffs. Samsung, Volvo, Siemens, and Amazon have announced they will expand their manufacturing footprint in the country. This is not a sudden shift following the imposition of U.S. tariffs. Multinational companies had already begun reducing their dependence on China before Covid-19, and its popularity as a manufacturing source was receding, particularly among Western firms.

This essay, therefore, examines the prospects for India and the rest of South Asia. It seeks to address the following questions:

- Is India rising as a global manufacturing hub?

- Is trade diplomacy in high gear at last?

- What lessons can we learn from China?

- How can India’s neighbours be lifted?

India’s Role in Global Manufacturing

The disruption of China-centric global supply chains is underway, with reports indicating that inward Foreign Direct Investment (FDI) has fallen to historic lows for both the U.S. and China (Baldwin, Freeman & Theodorakopoulos, 2023). The migration of labour-intensive supply chains from China to lower-cost locations can be attributed to rising wages, domestic supply chain bottlenecks, and investor concerns about stricter regulation of foreign companies, along with the escalating trade war between Washington and Beijing. Vietnam and Thailand have emerged as significant beneficiaries of these supply chain shifts. India is now being positioned to become a complementary Asian manufacturing hub to China (Wignaraja, 2023), regarded as a reliable alternative destination among the largest global FDI recipients, driven by its rapid economic growth, a large educated labour pool, and a vast domestic market (Economic and Social Commission for Asia and the Pacific, 2023).

An influential view, most prominently presented by Rajan and Lamba (2024), argues that India’s services sector is the primary driver of economic growth in an increasingly globalised world of services. They suggest that India should leverage its comparative advantages in labour to enhance its role in both the domestic economy and global services trade, particularly in digitally delivered services. They conclude that India ought to invest more in human capital and skills to capitalise on this strength in services. This view holds some merit, as India does possess favourable demographics with a youthful population, providing ample supplies of low-cost manpower. However, international development history indicates that relying solely on services development may be inadequate for a large economy like India to progress beyond lower middle status and create high-quality jobs.

The crucial role of manufacturing development in generating jobs and prosperity is emphasised by the East Asian miracle story. This narrative begins with the industrialisation of Japan during the inter-war period, followed by the emergence of the four East Asian dragon economies (Korea, Taiwan, Hong Kong, and Singapore) in the 1960s and 1970s, and China since the 2000s. Looking further back in history, the rise of the UK, Germany, and the US occurred alongside the industrial revolutions of the 18th and 19th centuries.