It is a well-known factthat leadingeconomies such as theUnited States, Europe and Japan,have established their dominance on a liberal economic model. They haveproved that governments cannot micromanage national resources and promote economic growth1. These economieshad adopted free-market systems, which translates to less regulation. On the other hand, we have the world’s fastest growing economies including China, where State-owned Enterprises (SOEs) play a significant role in economic growth . The Indian concept of State-owned Enterprises or Central Public Sector Enterprises (CPSEs) follow a hybrid model which fall between the Chinese model and the United States model.

Despite the trend toward privatisation over the past few decades, the role of State capitalism can no longer be ignored. It has been observed globally that State-owned Enterprises play a critical role in sectors such as natural resources, banking & finance, and utilities. In many countries, Governments have established SOEs in competitive industries, large scale manufacturing and service sector. Globally, State-owned Enterprises account for up to 40 percent of economic output, 5 percent of employment and 20 percent of investment in some economies2 .

Importance of State-owned Enterprises (SOEs) in BRIC economies

Source: OECD (2016), State-Owned Enterprises as Global Competitors: A Challenge or an Opportunity?

When we think of emerging economies, including the so-called BRIC countries i.e. Brazil, Russia, India and China, SOEs are playing a proactive role in the global market place.There is a growing importance of State-owned enterprises in the BRIC economies, which could be confirmed in relation to the world’s largest companies. Analysis of the Fortune –Global 2000 list indicates that the number of state-owned enterprises during the period 2005-2014, almost doubled. Data for South Africa was not available.

In 2014, out of 326 world’s largest SOEs, approximately 128 were headquartered in China and 13 in Hong Kong. A further observation is that 34 Indian SOEs, 7 Russian SOEs and 7 BrazilianSOEs, were also part of the list. This indicates that Federal Governments are now effectively managing an estimated 16 percent of the Fortune- Global 2000 companies. Many of these operate in mainstream sectors of economic importance such as banking & finance, manufacturing, oil & gas, metal & mining, public utilities etc., which play a vital role in international supply chains3 . The figures aboveindicate that among BRIC economies, after China, India has a large number of world’s biggest SOEs. However, their market size is smaller than comparable private Indian companies.

Role of State-owned Enterprises (SOEs) in India4

Since Independence, Public Sector enterprises have provided the much-needed momentum to India’s growth story. Indian Government at the time of the First Five Year Plan, established five Central Public Sector Enterprises (CPSEs) with a total investment of Rs 29 crore. They were established with the objective to meet broad economic objectives as well as meeting certain socio-economic obligations. Today there are approximately 339 CPSEs in the country with a total investment of Rs 13,73,412crore as on March 31, 2018.

Contribution to GDP

Source: Authors own calculation using data fromEconomic Survey of India 2018-19& Public Sector Enterprises Surveys

The above analysis indicates that there is an increase in the contribution of private sector in GDP and the share of CPSEs have fallen in the post reform period.The reduction in contribution may be probably because many business activities, which were earlier reserved for public sector, are now open for private sector. However, as per the Public Enterprises Survey 2017-18, CPSEs contribute to the Central Exchequer by way of dividends, interest on loans, and, payment of taxes and duties. An increase in the total contribution of CPSEs to the Central Exchequer from Rs. 275,840 crore in 2015-16 to Rs. 350,052 crorein 2017-18 was observed.

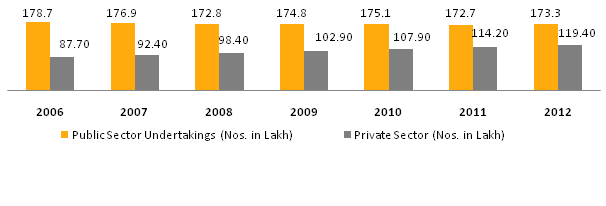

Employment Generation

Source: Economic Survey of India 2018-19

Although the latest data is not published by the Government, however, it is worth mentioning that the share of employment in Indian PSUs is higher than other indicators both at the beginning and the end of the analysed period. However, in 2012 the strength of women working in public sector stood at 18 percent as a comparison to private sector i.e. 24 percent.

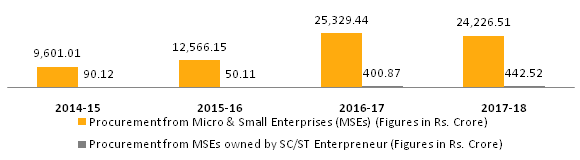

Procurement from Micro & Small Enterprises (MSEs)

Source: Public Enterprises Survey 2017-18

From 2015 onwards, the Indian Government has mandated CPSEs to procure minimum 20 percent from Micro & Small Enterprises (MSEs) and has also earmarked a sub target of annual procurement of 4 percent from MSEs owned by scheduled casts and scheduled tribe enterprises. The trend is encouraging and as per the available data, in 2017-18, approximately 168 CPSEs made procurement of Rs161,652.98 crore from the private sector. Out of which Rs 24,226.51 crore was procured from the MSEs.

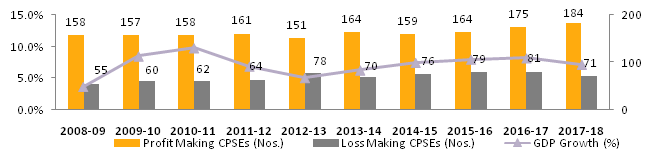

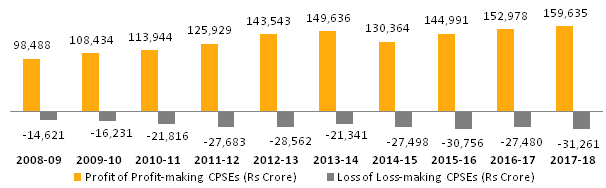

Financial Scorecard of CPSEs

Source: Economic Survey of India 2018-19

As per the available data, approximately one-third of CPSEs are making losses today. During 2017-18, BSNL, Air India and MTNL were the highest loss making CPSEs. During this period, the top ten-loss making CPSEs claimed 84.71 percent of the total losses incurred by total of 71 loss-making CPSEs. At the same time, IOCL, ONGC and NTPC were ranked the top profit making CPSEs. Out of 184 profit-making CPSEs, the share of top ten profit making CPSEs claimed 61.83 percent of the total profitable CPSEs.

Source: Economic Survey of India 2018-19

On analysing the profitability of CPSEs during 2008-2018, it was observed that the Average Annual Growth Rate (AAGR)of losses of Loss-making CPSEs was 10.4 percent. However, the AAGR of profitsof Profit-making CPSEs was only 5.8 percent. During the same period the Compounded Annual Growth Rate (CAGR) of losses of Loss-making CPSEs was recorded at 7.9 percent against the CAGR of 4.95 percent of profits of Profit-making CPSEs5.

Way Forward

India had established Public Sector Undertakings with a variety of public policy and social goals in mind. While many CPSEs are playing an important role in India’s development, still many CPSEs did not evolve with liberalisation and with the opening of Indian economy, lost ground very quickly to private sector. The reasons for the losses vary from enterprise-to-enterprise, which include micro level issues such no emphasis on modernisation, lack of business strategy, dependence on Government orders, high input cost etc.

It is true that profit margins of almost one-third of the CPSEs are under immense pressure in comparison to their private sector counterparts, which have become global businesses. Government of India’s concern for this issue is very much visible in the recent 2019-20 Union Budget speech of the Hon’ble Finance Minister of India where she mentioned that the government will undertake strategic disinvestment of select Public Sector Undertakings on priority. It was also announced that in view of the current macro-economic scenario, India will not only re-initiate the process of strategic disinvestment of the national carrier – Air India, but also, modify present policy of retaining 51 percent government stake in Indian State-owned Enterprises.

Against this backdrop,a strong view exists that Public Sector Enterprises serve broad macro-economic and social objectives, and hence should not be compared with corporate sector. Undoubtedly, they are generating employment more than private sector and creating necessary infrastructure for other stakeholders including big corporates, micro small enterprises and start-ups. The Government could consider divesting or closure of the loss making enterprises, which are not strategic in nature. At the same time, the government could establish more enterprises if they could fulfill the needs and aspirations of Indian citizens.

Although the scope of this article is limited to CPSEs, the following suggestions may also apply to departmental enterprises (railways and post), State-owned financial institutions (PSU banks and insurance companies) and State-owned Enterprises at State level.

Assessing the Need for Pubic Sector Enterprises

• In today’s world, which is governed by the principals of globalisation and rapidly changing technology, the Government may consider assessing the need for loss-making public-sector enterprises in every 3-year period. If they are not strategic in nature, then the decision to divest or closure could be taken at the earliest.

• At the same time, the Government could set-up new Public Sector enterprises if it fulfills the needs and aspirations of the Indian citizens.

• The board of a Public Sector Enterprise must be empowered to take various strategic decisions just like a board of a private sector company. In very limited cases, the matter should reach to the Ministry of Heavy Industries and Public Enterprises for approvals etc. This could support the CEO of the enterprise to undertake adequate business risk.

Distinguishing Strategic & Non-strategic Public Sector Enterprises

• NITI Aayogopined that CPSEs, which are serving national security purposes, sovereign or quasi-sovereign functions, could be categorized as ‘strategic’ and must be retained by the Indian Government.

• When we apply the aforesaid point of view on loss making CPSEs namely BSNL & MTNL, it is found that they address security needs in areas prone to insurgencies & conflict and at the same time help in connecting the rural areas with the mainland via its various projects and programmes such as BharatNet, Digital India programme, USOF etc.

• In Pharmaceutical sector, it will make sense for the government to consider closing or disinvesting loss making CPSEs, as indigenous private pharmaceutical companies are fully capable and competitive to serve the societal and Government needs.

Enhancing Autonomy for Efficient Functioning of Public Sector Enterprises

• The Government has given some operational freedom to various categories of profitable Public Sector Enterprises such as Ratnas, Maharatnas, Navratna and Mini-Ratna.

• Unless the Public Sector Enterprises are given the desired level of authority or independence in decision making especially in the matters of recruitment, procurement, or even in devising marketing strategy, they will not be able to compete in the current business environment.

Require Cautious Approach Towards Consolidation or Merger of Loss-making Public-Sector Sector Enterprises

• The Government’s efforts in past to merge two loss making entities –‘Indian Airlines’ and ‘Air India’ miserably failed6 . Furthermore, Government’s effort to merge a loss-makingentity i.e. Instrumentation Ltd. with a profit making BHEL did not materialize7 . However, the takeover of HSCL by NBCC is yielding some positive results8 .

• The policy makers are required to follow a cautious approach before taking any decision to merge Public Sector Enterprises, especially loss-making PSEs. It is very important to analyze all internal and external factors affecting the performance of the enterprises.

Fast Track Approvals and Support Required by Public-Sector Sector Enterprises from the Government

• It is a known fact that monetary support is required by the enterprises from the Government and any further delay in decision making from the Government of India could further deteriorate their performance.

• Government could consider developing standard operating procedures for various category of support required by the enterprises, such as technology up gradation, monetising assets, restructuring etc. This could fast track the process and help the enterprises to efficiently undertake business activities in a highly competitive business environment.

Technology Up gradation

• The Government could consider empanelment of technology experts or advisory firms, which could regularly undertake study of required technology up gradation in various Public Sector Enterprises, so that timely decision with respect to technology up gradation could be taken.

Human Resource Management

• Adequate steps to be taken by the Enterprises to make their human resource policies more market-based. This will motivate employees and drive profit and innovation at work.

• Furthermore, to motivate PSU employees, the Government could institute‘Best Practices Awards’ as well as regularly developing‘Compendium of Best Practices in PSUs’. In addition, efforts could be undertaken to replicate the best practices in various PSUs.

Diversification of Business Activities

• There are very limited case studies available to prove that diversification of business activities could support Public Sector Enterprises to become profitable. A loss-making PSU i.e. ‘Mecon Ltd’ turned profitable in 2017-18 as it diversified into infrastructure and energy sector. Earlier it was dealing in Metals only 9.

• Loss making CPSE such as Air India could consider diversifying into dedicated cargo & courier logistics, and digital aviation business to hedge the company from the risks of being in a pure aviation business. Its counterpart Spicejet is also exploring this option10 .

Monetising Assets of Loss-making Enterprises

• Currently, loss making enterprises cannot monetise their assets especially land & buildings at the premium location of the country and become profitable.

• A chronically loss-making Public Sector Enterprise will not gain much from sale of such assets being used for revival if its losses have mounted to very high levels and its products are technologically obsolete.

• In this scenario, the Government could create a ‘national fund’ and transfer the amount obtained through monetisation of assets of loss-making enterprises.

In conclusion, improving the performance of Public Sector Enterprises could be a complex task given the fact that many stakeholders are involved in their oversight and management. Many commissions and expert groups11 which were set-up by the Government have studied this issue in-depth and made various recommendations. In short, there is no dearth of information: the steps to be taken to revive the CPSEs are well known.

The challenge going forward is what could be done differently to implement the aforesaid suggestions or already known recommendations made by various experts. To deal with this challenge we could study the best practices existing among Indian public sector enterprises as well as State-owned Enterprises in BRICS and Commonwealth countries. The good practices could be replicated among CPSEs to improve their profitability and design new age public sector enterprises.

References:

1Bremmer, Ian. State Capitalism and the Crisis. Report. Mckinsey. 2009.

2Corporate Governance of State-Owned Enterprises: A Toolkit. Report. The World Bank. 2014.

3State-Owned Enterprises as Global Competitors: A Challenge or an Opportunity?.Report. Organisation for Economic Co-operation and Development (OECD). 2016.

4Public Enterprises Survey 2017-18. Publication. Department of Public Enterprises (DPE), Govt. of India. Vol. I.

Economic Survey of India 2018-19. Publication. Ministry of Finance, Govt. of India.

5Author’s own analysis using data from Economic Survey of India 2018-19

6Shukla, Geetanjali. “Anatomy of a Failed Merger.” Business Today, June 2012.

7Shaji, K. A. “Instrumentation Ltd. Not to Be Merged with BHEL.” The Hindu, April 24, 2015.

8Hindustan Steelworks Construction Ltd. (A subsidiary of NBCC) Annual Report 2017-18

9Mecon Ltd. Annual Report 2017-18

10 Raj, Yashwant. “SpiceJet Plans to Diversify beyond “pure Aviation” to Offset Fuel Price-related Risks.” Hindustan Times (Washington), July 13, 2018.

11Review of Loss Making CPSUs. Report. Parliamentary Standing Committee on Public Undertakings, LokSabha. December 2018.