3rd NLIU-India Foundation Constitutional Law Symposium

India Foundation organized the 3rd NLIU-India Foundation Constitutional Law Symposium on April 29-30, 2023, at National Law Institute University (NLIU), Bhopal, in collaboration with NLIU Law Review. Over a span of two days, the symposium witnessed multiple sessions of thought-provoking presentations and panel discussions on contemporary issues of relevance. Seven student paper presentations under the overarching theme of “Individual Rights vis-à-vis the Constitutional Order” were conducted on the first day of the symposium.

As a part of the symposium, a seminar on anti-blasphemy laws was organized on April 30, 2023. The seminar witnessed the participation of important stakeholders including senior academic scholars, domain experts and religious and social thought leaders from different religious communities of India. Through an active engagement of the panelists and interactions with the student community and law professors of NLIU Bhopal, fruitful discussions on the contemporary issue of having anti-blasphemy legislations and an assessment of their socio-political impact was conducted during the seminar. The seminar was split into two consecutive sessions, in order to better focus on the various aspects of anti-blasphemy laws.

The first session of the seminar was themed “Blasphemy: A Theological and Legal Perspective”. The session was chaired by Prof. (Dr.) Faizan Mustafa, Former Vice Chancellor, NALSAR University of Law. It witnessed a panel consisting of Mr. Shaykh Hodri Ariev, Chairman, Nahdlatul Ulama Pesantren Association, Indonesia; Archbishop Felix Anthony Machado, Diocese of Vasai; and Shri Vikramjit Banerjee, Senior Advocate and Additional Solicitor General of India. Although the panelists offered contrasting views on the theological significance of blasphemy, and the legal recognition of blasphemy as an offence, however they emphasized on the need for toning down the stringency of such legislations, setting up reasonable constitutional parameters for the operability of the offence, and an equal implementation of penalization across the board.

The second session of the seminar was conducted on the theme of “Political and Socio-Cultural Implications of Blasphemy”. The panelists for the session were Prof. (Dr.) Eqbal Hussain, Dean, Faculty of Law, Jamia Millia Islamia University; Shri Abhijit Iyer-Mitra, Senior Fellow, Institute of Peace and Conflict Studies; Smt. Aayushi Ketkar, Assistant Professor, Jawaharlal Nehru University; and Dr. Guru Prakash Paswan, Assistant Professor of Law, Patna University and Visiting Fellow, India Foundation. The session was chaired by Prof. (Dr.) Ghayur Alam, Dean, UG Studies, NLIU Bhopal and Faculty Advisor, NLIU Law Review. The panelists provided differing thoughts on the socio-cultural and political implications which anti-blasphemy legal provisions have had on the Indian society at large. A couple of the panelists argued in favor of the retention of such penal provisions, and reasoned that such provisions are a legitimate recognition of the offence, while also highlighting the need for such provisions as a matter of expediency for the maintenance of communal harmony. On the other hand, other panelists clearly argued for the abolition of anti-blasphemy legislations which serve the purposes of religious radicalization and create an impediment on the free expression of individuals.

Jammu and Kashmir Security Tracker: January – December 2022

Event Report: 4th ASEAN-India Youth Summit, 12-16 February 2023, Hyderabad, India

The 4th ASEAN-India Youth Summit was organised by India Foundation on 12-16 February 2023, in Hyderabad, Telangana, India. The Youth Summit, organised in collaboration with Ministry of External Affairs, Government of India and the ASEAN Foundation, was themed on “Strengthening ASEAN-India Partnership in the Indo-Pacific”.

India and ASEAN have emerged as rising Asian powers in the new millennium with fast-growing economies. Their formidable demographic dividend and a population commanding a considerably high purchasing power have given to this region an immense potential for growth-centric mutual cooperation. With this in mind, the Youth Summit plays a significant role in bringing together the potential future leaders in various fields from India and the ASEAN countries, to discuss and deliberate upon policies and contemporary issues, and to develop higher levels of understanding of each other’s culture, politics, societies, traditions and concerns. This initiative of getting together youth leaders from ASEAN and India on a common platform started in August 2017 when the First ASEAN-India Youth Summit was in Bhopal, Madhya Pradesh. This was followed up in February 2019 in Guwahati, Assam, where the Second edition of the Youth Summit was held. The 3rd edition of Youth Summit was organised virtually in June 2020 during pandemic time.

The ASEAN-India Youth Summit, being a confluence of youth leaders from India and the ten ASEAN countries – Brunei, Cambodia, Indonesia, Lao PDR, Malaysia, Myanmar, Philippines, Singapore, Thailand, and Vietnam – leads to a shared understanding of the challenges we face and the actions that we need to take to restore and nourish connectivity in all dimensions within the region. In the 4th ASEAN-India Youth Summit, 75 promising young leaders from India and 100 young leaders from ASEAN got an opportunity to participate in brainstorming sessions over the course of four days. The participants represented some of the largest institutions in their respective countries including political parties, think-tanks, media and cultural organisations. The discussions in various sessions at the Youth Summit highlighted the importance of strengthening ASEAN-India connectivity partnership in the Indo-Pacific and finding ways to further enhancing physical and digital connectivity cooperation in the Indo-Pacific region.

The Organising Committee of the 4th ASEAN-India Youth Summit was Chaired by Dr. Rajkumar Ranjan Singh, Hon’ble Minister of State for External Affairs and Education, Govt of India. The Inaugural Session of Youth Summit was addressed by Shri G. Kishan Reddy, Hon’ble Minister of Culture, Govt of India and Dr Kao Kim Hourn, Secretary General, ASEAN (Virtual Address). Shri G. Kishan Reddy also hosted a dinner for all the delegates on the inaugural day. This was preceded by a cultural performance by the Tetseo Sisters from Nagaland.

Panel Discussions in the Youth Summit covered various issues like Connectivity, Digital Partnership, Good Governance & Regional Development and Shared Cultural Ethos & Promotion of People to People to ties. The delegates in the Youth Summit were divided into small groups for focussed group discussion on topics like Governance & Polity, Cultural & Historical linkages and Entrepreneurship & Skill Development. As part of the experiential learning, Young Delegates were taken to places like Charminar, Shilparamam, T-Hub in Hi-Tech City, Buddha Statue etc.

The valedictory session of the 4th ASEAN-India Youth Summit, held on February 14, 2023, was graced by Smt. Tamilisai Soundararajan, Hon’ble Governor of Telangana & Lt. Governor of Puducherry, and by Shri Rajkumar Ranjan Singh, Hon’ble Union Minister of State, Ministry of External Affairs & Education, Government of India. Mr. Alvin Tan, Hon’ble Minister of State, Ministry of Culture, Community and Youth & Ministry of Trade and Industry, Singapore joined the session virtually. The Welcome Remarks were delivered by Shri Alok Bansal, Director, India Foundation.

Mr. Alvin Tan highlighted how the future of the world rests in the hands of young people and it is thus essential that we continue to work together to support and empower them. He mentioned that innovation and entrepreneurship is a way to forge a better future for the progress of Indo-Pacific region. He urged young people to lead social initiatives to address regional challenges such as climate change and sustainable development. Opportunities such as these would help the future generation to gain new perspectives, broaden their horizons and improve understanding of culture beyond the borders of their countries.

In his address, Shri Rajkumar Ranjan Singh stated that ASEAN-India relations form the central pillar of India’s Act East Policy. He noted that both India and ASEAN shared a similar vision of the Indo-Pacific. Emphasising on the need for connectivity, he observed that connectivity in its broadest sense, whether physical or digital, was one of the most important aspects of India-ASEAN development. India and ASEAN have a robust digital relationship and are already working towards a shared digital transformation. The youth of both the countries are eager to contribute to the development of the entire region.

Addressing all the dignitaries and delegates present, the Hon’ble Governor stated that summits like the 4th ASEAN-India Youth Summit played an important role in enhancing the relationships across the region. She described ASEAN as “Ambitious, Sincere, Effective & Efficient, Aspirational New Generation”. India and ASEAN could work on common areas such as political security, economics and cultural and social relationships. Mentioning the difficulties of the period of Covid pandemic, she stated that the period showed how digitisation could become a lifeline of communication. Through the combined efforts of various groups, we could successfully overcome the pandemic. Addressing the youth delegates, she also observed that youngsters are the pillars of the future and the nation, and advised them not to compromise their happiness for anything as it is only by being happy that challenges can be overcome. She hoped that such summits would pave the way for an ASEAN-India Youth Network to help strengthen the entire region and bring all the nations together to face challenges. This would ensure a safer, secure, peaceful and prosperous world for the future generations.

Event Report: 7th International Dharma Dhamma Conference

The 7th International Dharma Dhamma Conference was organised by India Foundation in collaboration with Sanchi University of Buddhist and Indic Studies on 3-5 March 2023 at Kushabhau Thakre Hall, Bhopal. The conference was attended by approximately 300 scholars from 15 countries and was themed on “Eastern Humanism in the New Era”. 41 distinguished speakers addressed the conference while 105 scholars presented their research papers on various sub-themes of the conference.

The Hon’ble President of India, Smt. Draupadi Murmu, was the Chief Guest for the Conference. The Conference was also graced by Shri Mangubhai Patel, Hon’ble Governor of Madhya Pradesh, India and Shri Shivraj Singh Chauhan, Hon’ble Chief Minister, Madhya Pradesh, India.

Inaugural Session

Dr. Neerja Gupta Director, Vice-Chancellor, Sanchi University of Buddhist and Indic Studies, welcomed the Hon’ble President of India and all the guests, eminent scholars, academics and students to the Conference. In her remarks, she stated, “It’s our duty with our academic fraternity to bring out the truth with genuine research”.

Swami Govinda Dev Giri Maharaj, spoke on the concept of ‘Vasudhaiva Kutumbakam’ which has its roots in India and the value that is given to knowledge, learning and wisdom in this great land. He said, “This is the land which always embraced the whole world as one family…this is the land which has been a centre of attraction for the whole world…this is the land of learning; the land of wisdom”

Shri Shivraj Singh Chauhan, Hon’ble Chief Minister of Madhya Pradesh, focused on moral values. “Not only in congregations of scholars, but in every village of India, even today, in every facet of moral duty, each child follows the mantra i.e., let there be victory of Dharma, defeat of adharma, a sense of good faith amongst all living beings and universal wellbeing,” he said.

Shri Mangubhai Patel, Hon’ble Governor of Madhya Pradesh, spoke of India’s ancient wisdom in solving contemporary problems. “In the social sphere, Buddhist thought is important for the well-being of humankind. To tackle global issues and protect humanity from problems such as extremism, imperialism and the negative effects of climate change, it is only Indian knowledge and the philosophy of Rishis which can provide pathways to solutions for these problems in contemporary times,” he said.

In her address, H.E. Draupadi Murmu, Hon’ble President of India, said that “Progress of individuals and society with the spirit of friendship, compassion and non-violence as well as free from attachment and hatred, has been the main message of eastern humanism. Personal conduct and social order based on morality is the practical form of eastern humanism. It has been considered the duty of every person to preserve and strengthen such a system based on morality”.

Ministers Session

The Ministers Session was chaired by Shri Ram Madhav, Member, Governing Council, India Foundation. Ministers from four different countries including India were the speakers for this session. These were: H.E. Ugyen Dorji, Hon’ble Minister of Home and Cultural Affairs, Royal Government of Bhutan, Hon. Vidura Wickramanayaka, Hon’ble Minister of Buddhasasana Religious and Cultural Affairs, Government of Sri Lanka, Hon. Prof. Dr. Ir. Tjokorda Oka Artha Ardana Sukawati, Msi., Vice-Governor of Bali, Indonesia and Smt. Usha Thakur, Minister of Culture, Government of Madhya Pradesh, India.

Shri Ram Madhav initiated the session highlighting the unique nature of the humanism that was born within the Indic Civilisation. He said that, “Over this long history, in this journey of civilisations, we have also come up with the idea of humanism which is not human centric but humanity centric. Whatever is there, is divinity; everything is divine, sarvam khalvidam brahman. This idea that everything is divine is at the core of the humanist discourse in eastern religions and eastern traditions.

Hon. Ugyen Dorji in his address spoke of the importance of applying eastern humanistic thought in our worldview moving forward. He said that, “As the world moves into the new-era, a post COVID-19 chapter, it is imperative that we examine our values and beliefs to ensure that we move forward with compassion, wisdom and empathy”.

Hon. Vidura Wickramanayaka highlighted the urgent need for action from this generation. He said that, “All these isms (socialism, capitalism etc.) have negated the very essence of humanism and we have forgotten about the real “ism”. That is why we are in an economic collapse, political mayhem, cultural degradation, environmental collapse. We have to rectify this. If not us, there won’t be anybody”.

Prof. Dr. Ir. Tjokorda Oka Artha Ardana Sukawati, Msi. spoke about the lessons to be learnt from the disharmony of recent times. He said, “Balinese humanism emphasises the responsibility that falls in our hand which dictates both harmony and disharmony in life. Hence, the recent disharmony should be treated as a moment for humans to contemplate our roles in the realms of religiosity, humanism and ecology”.

Smt. Usha Thakur spoke about the inherent value of nature and its resources in their purest forms. She said that, “The amount we take from earth, it is a matter of ethics and humanism that at the very least we must return that amount back to earth. Any knowledge, till it doesn’t become wisdom and lead to behavioural change, will remain meaningless”.

Keynote Session

The keynote session in the Dharma Dhamma Conference was chaired by Mr. Come Carpentier, Distinguished Fellow, India Foundation. The speakers of the session were, Swami Govinda Dev Giri Maharaj, Treasurer, Shri Ram Janmabhoomi Teerth Kshetra Trust, India, Ven Kotapitiye Rahula Anunayaka Thera, Professor and Head of Department, Department of Pali and Buddhist Studies University of Peradeniya, Sri Lanka and Mahamahopadhyay Sri Sadhu Bhadresh Das, Akshardham New Delhi, India.

Mr. Come Carpentier, initiated the session with a brief overview of the similarities between the intent of the concept of humanism in the west and the humanistic philosophies of the east. He said that originally, humanism was really intended as a new form of learning which would take into account many forgotten texts from antiquity. He spoke of western antiquity which means essentially Greek and Roman schools of thought, that would challenge the realm of theological supremacy. It would no longer be about man’s relationship to God but it would be a matter of man’s own many fold pursuits and abilities.

Swami Govinda Dev Giri Maharaj, in his address, said that, “Really speaking the difference (between Dharma and Dhamma) is only, according to me, verbal. The words are different but the essence is the same. This is the mischief of so many colonial scholars, that they have tried to take Pali away from Sanskrit, that they have tried to give more emphasis to the difference, in spite of the similarities that both ideas have. Therefore, let us first look at the similarities”.

Ven Kotapitiye Rahula Anunayaka Thera, noted that, “Building trust in each other helps us to live without fear and doubt. Morality is crucial for a just and law-abiding society. One should be generous, to respect the opinions of others without thinking that only one’s own opinion is correct.”

In his address, Mahamahopadhyay Sri Sadhu Bhadresh Das stated, “As we enter this new era of rapid change and challenges, it is essential that we come together to explore solutions that are rooted in humanism…to chart a course forward that is grounded in deep respect towards interconnectedness of all life”.

Plenary and Parallel Sessions

There were five plenary sessions in the conference where 41 distinguished speakers from various countries participated. They addressed the conference on the theme, Eastern Humanism in the New Era. There were also 15 parallel sessions in the conference where scholars presented their papers on sub-themes of the conference. Thus, the 7th edition of Dharma-Dhamma Conference explored the role of eastern humanistic thought in guiding the world out of the turbulent times and charting a course of peace and harmony moving forward.

Conclusion

The conference was successful in putting forward the similarities between the dharmic and dhammic philosophies. It highlighted the united will of both traditions to heal the spiritual, social, mental and economic fabric of society by sharing their vast wealth of wisdom, thereby contributing to the creation of a new a world order more resistant to future adversities and challenges.

Event Report – India Foundation Dialogue – 88

India Foundation hosted the 88th India Foundation Dialogue on March 22, 2023 at India Foundation office, New Delhi. The Dialogue was addressed by Ms. Cleo Paskal, Non-Resident Senior Fellow, Foundation for Defense of Democracies (FDD). The session was chaired by Capt. Alok Bansal (Retd.), Director, India Foundation. The session was themed ‘China, Taiwan and the Pacific Islands’ and was attended by eminent dignitaries based in the National Capital Region. The speaker, in her lecture, shed light on the geopolitical significance of the Pacific Islands to the Indian Ocean and larger Indo-Pacific region. She highlighted China’s increasing hold and influence on the Pacific Island countries and the former’s attempts to extend its hegemony over the region. She also highlighted how India was uniquely positioned and better suited to counter Chinese influence in the region as compared to the Western world.

India Foundation Journal: March-April 2023

A Vision for Bharat

The Union Budget 2023-24 has been characterised as the first budget for “Amrit Kaal”— A vision to see a transformed Bharat by the time the nation celebrates its Independence centenary on 15 August 2047. For the first time, we have a long-term road map of what Bharat should be in terms of its human and developmental index, with clear markers for reaching the desired end state over the course of the next quarter century.

This, by itself is a quantum leap forward from the incremental development policies followed for the most part since 1947. There was a hesitancy in envisioning a great and prosperous Bharat, which perhaps was a result of a socialist mind-set, mired in a philosophy that pedalled poverty as virtue and derided wealth as being sinful and corrupting. For decades since independence, the state set about controlling the means of production and telling the people what, how and how much they could produce and at what cost. The bureaucracy became all powerful as the arbiters of the nation’s destiny and this soon morphed into a political-bureaucratic-criminal nexus.

This was a recipe for disaster and by 1990, the nation was on the verge of bankruptcy. Then came the era of reforms, which since the last decade, have taken on a more focussed approach with major initiatives like the rolling out of the GST and the JAM trinity (Jan Dhan Yojana which has provided access to India’s poor to the banking sector, Aadhar—a unique biometric identifier and the Mobile penetration). This has enabled targeted provision of benefits to millions below the poverty line with near zero pilferage and brought about a sense of inclusivity to an unparalleled extent. Rural housing, electricity access, toilets for all, are but a few of the myriad schemes which has seen wide penetration across the length and breadth of Bharat in a truly transformative manner.

Budget 2023-24 builds on the India story which saw a rejuvenation in 2014 after a decade of stalled economic reforms. There is renewed focus on digitisation, indigenous defence manufacture, green energy, transparency in government, skilling of the work force, education sector reforms and the like. A host of initiatives have been announced to unleash the full potential of all citizens. In this new Bharat, there is little doubt that every citizen will stand up to be counted. But a slew of challenges remain.

It would be naive to think that the major powers will look on benignly as India moves ahead. A strong and economically powerful Bharat poses a threat to the economic interests of other powers. An Atmanirbhar Bharat would be an economic challenger, and with defence indigenisation taking place at a rapid rate, a rival to the worlds military industrial complex as an arms exporter. So, there will be attempts made by both India’s enemies as well as those with whom India has friendly relations, but who may view India as a serious competitor in future, to sabotage the Bharat growth story. An inkling of what the coming year holds can be seen in attempts being made to create rift in society by inciting the public. The ham-handed manner in which the BBC tried to inflame passions by making a documentary on the post-Godhra riots of 2002, is a case in point. Another is the hit job done by a US based short-seller on the Adani business group. We are now seeing fringe Khalistani elements raising their ugly heads in a clear bid at destabilising the country. We are likely to see radical Muslim elements within the country creating discord over inane issues. There will be others with perceived grievances, who will be funded by external actors like the George Soros Open Society Foundation, the Ford Foundation and the Rockefeller Foundation, all of whom, through a network of NGOs, will attempt to spread a divisive agenda. And in all this they will receive support from both China and Pakistan, who have their own axe to grind. Unfortunately, there will be elements of certain political parties who have their own agenda, who will also lend political support to such groups.

But these challenges are an intrinsic part of trying to create a strong and vibrant Bharat. But while the Government can provide the vision and the policy support, it is also up to each and every citizen to rise to the occasion, to achieve the objectives of Atmanirbharta. The nations public and private sectors too will have to play their role. The same goes for the nation’s bureaucracy. Can they measure up to the Prime Minister’s vision and play an enabling and supportive role? Therein lies the challenge.

Positioning India for The Future: The Amrit Kaal Budget

On February 1, the Hon’ble Finance Minister Srimati Nirmala Sitharaman, presented her FY 2024 Budget to Parliament. The Hon’ble Prime Minister termed this the Amrit Kaal Budget—the budget for a golden age for India. It proved to be so. Unlike most other budgets, which are almost always criticised on multiple counts, this budget has been hailed by all stakeholders. The people of India appreciated the continued support for key welfare programs and infrastructure investment. Taxpayers loved the judicious tax cuts. Businesspeople expressed their happiness for policies supporting green growth and robust job creation. The capital markets praised the stability and continuity in policymaking. And economists were gratified to see that all the key macroeconomic parameters ranging from growth to the fiscal deficit to open market borrowings were deftly managed.

The Amrit Kaal budget was prepared under daunting circumstances. The last three years have drastically disrupted the world. The global economy has suffered from high inflationary pressures and interest rates, low investments and, more recently, a wave of layoffs in technology-based companies. Through the economic slowdown of the last three years, India has emerged as the shining star of the global economy. According to a United Nations study[1], growth prospects in the developed world have taken a sharp downturn – with the United States and the European Union growing by a low 0.4% and 0.1% in 2023, respectively. On the other hand, India is expected to grow at close to 6% in 2023, while the average growth rate in South Asia is projected to remain at 4.4%.

From being a Fragile Five country in 2013-14, India is now among the Top Five economies in the world! The Indian government’s strong and stable fiscal policies have allowed the country’s economy to not only emerge relatively unscathed from the pandemic, but also aid the developing world. To put the Union Budget of 2023-24 in context, it is important to understand how the major events of the past three years have impacted the world economy.

- Covid-19 Pandemic: Following the once-in-a-century pandemic, the World Bank projected the growth of the developing world, much like Covid-19 vaccine accessibility, to be quite uneven. As a result, Low-Income Countries (LICs) have fallen into extreme poverty due to rising food and energy insecurity. As per the Bank’s projections[2], LICs with extreme poverty over 50% will rise to a positive figure by 2024, as opposed to the pre-pandemic expectation of poverty reduction. The strict, yet poorly managed, lockdowns in China have also impacted supply chains and global trade even as the world starts to recover from the pandemic.

- Russia-Ukraine War: The conflict has had significant spill over effects on both the South Asian and global economy due to disrupted supply chains and increased food and energy prices. The impact was further magnified due to increased energy requirements, owing to climate change and disrupted energy supply following the war. As median inflation[3] reached a new high of 9% in the second half of 2022, central banks around the world tightened monetary policy, reducing inflation but temporarily slowing down growth as well.

- Climate Change and Natural Disasters: Even as the world was reeling from the post-Covid impact on local, regional, and global economies, it was further shaken up by grave climate change-induced disasters in the form of hurricanes, cyclones and floods. The ‘State of the Global Climate 2021’[4], published by the World Meteorological Organization, reported loss and damages worth USD 100 billion in 2021. In 2022, the floods in neighbouring Pakistan devastated the country’s economy[5] – with total damages at USD 15 billion, total economic losses at USD 15.2 billion, and the cost of rehabilitation and reconstruction at USD 16.3 billion, Over 33 million people were affected and almost 9 million were pushed below the poverty line. India also witnessed more frequent extreme weather events, as storms and flooding alone cost the country over USD 7.5 billion in 2021. Once the loss and damage from weather events in agriculture and other sectors are quantified, the figure will be much larger.

This year’s budget is historic for two major reasons: first, it seeks to lay the foundation for the next 25 years to ensure continuity and stability in development decisions and, second, it divides policy priorities into seven interdependent, yet holistic ‘saptarishis’ (seven sages). Together, they make the budget people- and development-friendly. They are:

- Inclusive Development:

Equal benefit to all sections of society through investments in agriculture and farmers’ welfare, as well as medical infrastructure.

- Agriculture (BE 2023-24 = Rs 1,25,036 crore or a 5% increase over last FY RE): The proposed additions under the Budget will cater to the entire agricultural supply chain. Enhanced agriculture credit to the tune of Rs 20 lakh crore for animal husbandry, dairy, and fisheries aims to improve the quality and care of farm resources. The proposed Digital Public Infrastructure will revolutionise agricultural practices in India by providing open-source access to solutions, inputs, credit, and insurance to farmers. Decentralised storage capacity for farmers will help them realise competitive prices, and additional cooperative dairy and fishery societies will further organise the sector and bring in more formal agricultural employment. Finally, in line with the Atma Nirbhar Bharat vision of the Hon’ble Prime Minister, the Agriculture Accelerator Fund will reach young entrepreneurs in rural areas and give them an opportunity to innovate and revolutionise agricultural practices.

- Health (BE 2023-24 = Rs 89,155 crore or a 12% increase over last FY RE): Post the Covid-19 pandemic, the focus of the health sector has shifted to infrastructure development. The Budget speech announced the establishment of 157 new nursing colleges, introducing multidisciplinary courses at medical colleges on technology, allowing private players to access the Indian Council for Medical Research (ICMR) facilities, and pushing R&D in the pharmaceutical sector. In addition, health infrastructure via the old and new All India Institute for Medical Sciences (AIIMS) has received an increased outlay, and additional expenditure under Ayushman Bharat shall further the mission of achieving universal healthcare.

- Reaching the Last Mile:

To ensure inclusivity of tribal groups, the Budget lays special emphasis on schemes for their benefit, specifically through the new Pradhan Mantri PVTG (particularly vulnerable tribal groups) Development Mission, and by increasing the number of teachers in the Eklavya Residential Model Schools for tribal children in remote areas. Education has received a significant boost this year of 8.3% as compared to last year.

- Unleashing the Potential:

Micro, Small and Medium Enterprises (MSMEs) form a core part of the Indian economy. India has over 63 million MSMEs, contributing 30% to its GDP, 40% to its manufacturing output, and 48% to its exports. One of the biggest challenges of the sector has been the provision of safe credit opportunities. The Standing Committee on Finance[6], in our ‘Strengthening Credit Flows to the MSME Sector’, had noted that more than 60% of the MSMEs currently avail credit from informal sources, depending on costly and unreliable credit. The Budget provides additional support to MSMEs through the infusion of Rs 9000 crore under the revamped Credit Guarantee Scheme. This will potentially lower the cost of capital and allow MSMEs to avail collateral-free credit guarantee of Rs 2 lakh crore. Access to reliable credit will significantly boost their output, accelerate formalisation, and increase creditworthiness.

Additionally, the Standing Committee also recommended bringing MSMEs into the digital ecosystem both for credit access and formalisation, especially given India’s UPI success story. The Government further establishes an enterprise DigiLocker for MSMEs, other businesses and trusts as a one-stop solution for foundational identification and digital safe-keeping of documents.

- Youth Power:

With a strong belief in the power of the youth and their ability to take our nation forward through the Amrit Kaal, the Budget aims to enhance the layout for skilling. The PM Kaushal Vikas Yojana 4.0 (PMKVY 4.0) will focus on technical skills like robotics, artificial intelligence, and coding to provide a stimulus to India’s already booming start-up industry. Previous editions of PMKVY have provided over 10 million certifications, out of which a quarter have materialised into meaningful employment. The increased outlay for school and higher education, coupled with the National Education Policy, will provide an impetus to infrastructure-oriented, multidisciplinary, and skill-based education. The power of India’s youth will be unleashed by providing them with high-quality modern education with a special focus on skill development and entrepreneurship.

- Green Growth:

The Hon’ble Prime Minister’s commitment to net zero by 2070 at COP26 laid the foundation for India’s green growth. With the announcement of the target, India also committed to utilising renewable power for 50% of its energy requirements, reaching 500 GW of non-fossil energy capacity by 2030, reducing the total projected carbon emissions by one billion tonnes by 2030, and reducing the carbon intensity of the economy by 45% by 2030. The announcement came at a crucial juncture for the world, as the United Nations Environment Programme[7] projects a 2.8 degrees Celsius rise in temperature by the end of the century, as opposed to the target of capping it at 2.0 degrees Celsius by 2100. It is estimated that by 2070, over 75% of greenhouse gas (GHG) emissions will come from countries from the Global South (developing countries).

India is one of the few Global South countries that has declared a net zero target for itself. The 2023-24 Budget takes this vision forward with Rs 35,000 crore allocated for capital investments into the green transition and net zero. Additionally, support shall be provided to set up battery storage systems with a capacity of 4000 MWh. The Green Credit Programme, along with the additional outlay to the National Green Hydrogen Mission, will provide further momentum to the green transition in India. The Government is also planning to introduce an Emissions Trading System unique to India, based on buying and selling of credits earned from reducing emissions intensity, as opposed to absolute emissions reductions.

At COP26, the Hon. Prime Minister announced a requirement of $1 trillion from developed countries for climate finance.[8] India’s Budget proves that it is on track to achieve its Nationally Determined Contribution (NDCs) and achieve net zero, which shall also require mobilisation of finance from the developed world, in line with the principle of common but differentiated responsibilities (CBDR).

- Infrastructure Investment:

The last nine years have been extremely positive for India’s infrastructure story. For example, the Government doubled the number of airports to 146, added close to 43,000 kilometres to the national highways, and tripled the capital expenditure on higher education institutions like AIIMS and IITs. The budget streamlines the investment pipeline for the country across sectors. Firstly, it simplifies the administrative structure for investments. It creates an Infrastructure Finance Secretariat for more private investment in public-dominated sectors like urban infrastructure, power, and others. It creates a ‘Harmonised Master List of Infrastructure’, with recommendations from experts on classification and financing requirements for the Amrit Kaal.

Secondly, the Budget lays great emphasis on city and urban planning through the ‘Sustainable Cities of Tomorrow’ mission, focusing on resource efficiency and enhanced availability and affordability. It creates the foundation for significant investment opportunities in urban infrastructure through the introduction of municipal bonds. Urban investments also get a renewed push through the Urban Infrastructure Development Fund worth Rs 10,000 crores.

Lastly, regional connectivity, railways, and logistics have been given a boost via enhanced allocation of Rs 2.4 lakh crore to the railways.

- Financial Sector:

To reduce the cost of compliance, regulators shall be expected to review regulations through public and private consultation. Further, in order to enhance the governance of public sector banks, the Government shall propose amendments to the Banking Regulation Act, the Reserve Bank of India Act, and the Banking Companies Act. Additionally, the focus will be on setting up better digital infrastructure for payment security by using PAN as the common identifier on platforms and providing subsidies to banks on UPI payments.

Conclusion

In summary, the Amrit Kaal Budget is a visionary, well-balanced budget as it provides fresh stimulus through two key measures. Firstly, enhanced capital expenditure (capex) to boost employment, help crowd in private investments, and improve operational efficiency. This year, capex has been increased to Rs 10 lakh crore (3.3% of GDP), and effective capital expenditure, inclusive of grants-in-aid to states, to Rs 13.7 lakh crore (4.5% of GDP). Secondly, a significant middle-class tax cut to put money in the hands of consumers, generate demand, as well as increase spending and consumption. Together, both sources of stimuli will stabilise macroeconomic parameters, increase growth rate to 6-7%, and make India a shining star in the global economy by driving digitisation and decarbonisation.

Author Brief Bio: Jayant Sinha is the Chairman of the Standing Committee on Finance in Parliament and a Lok Sabha MP from Hazaribagh, Jharkhand. Views are personal.

Reference:

[1] https://www.un.org/development/desa/dpad/publication/world-economic-situation-and-prospects-february-2023-briefing-no-169/#:~:text=Average%20GDP%20growth%20is%20projected,weigh%20on%20investment%20and%20exports.

[2]https://openknowledge.worldbank.org/bitstream/handle/10986/38030/GEP-January-2023.pdf?sequence=34&isAllowed=ypage 25

[3]https://openknowledge.worldbank.org/bitstream/handle/10986/38030/GEP-January-2023.pdf?sequence=34&isAllowed=ypage 11

[4]https://library.wmo.int/doc_num.php?explnum_id=11178

[5]https://www.worldbank.org/en/news/press-release/2022/10/28/pakistan-flood-damages-and-economic-losses-over-usd-30-billion-and-reconstruction-needs-over-usd-16-billion-new-assessme

[6] https://eparlib.nic.in/bitstream/123456789/994373/1/17_Finance_46.pdf

[7] https://www.unep.org/resources/emissions-gap-report-2022

[8] https://pib.gov.in/PressReleasePage.aspx?PRID=1768712

Navigating the Precarious Balancing Act: A Critical Analysis of the Union Budget

Introduction

The Union Budget, which is an annual report on the government’s revenue and expenditure, is often perceived as a platform for major policy announcements. However, it actually accounts for a decreasing share of public expenditure, with much more spending happening at the state level. As a result, State Budgets deserve more attention and scrutiny. The hype around the Union Budget stems from a bygone era when taxes changed frequently, and people were eager to know how prices would be affected. However, stability and predictability are essential for tax reform. While there may be a need to simplify the GST and reduce the number of tax rates, this is the responsibility of the GST Council, not the Union Budget.

The current budget is a stark contrast to N.D. Tiwari’s “sindoor budget” of 1988-89 made headlines for its symbolic tax exemptions on items like sindoor and kajal. Instead, this budget is all about empowering women, youth and progress. The government is gearing up for the ‘Amritkaal’, charting a path towards a developed India by 2047. It’s a budget focused on real change and investment in the future, leaving the quaint symbols of the past behind. This is a budget for a new India, ready to embrace its destiny and unleash its full potential.

The Finance Minister encountered a nuanced predicament in navigating the current economic terrain. Mindful of the importance of upholding macroeconomic stability, the budget strikes a delicate equilibrium between tackling inflationary constraints and promoting economic growth hindered by external factors. This conundrum entailed a precarious balancing act, which necessitated the Finance Minister to display unwavering composure.

The art of budgeting is a crucial component in fulfilling the commitment to proficient and impactful governance. Substantial deviations in the projection of revenue and expenses can impede the execution of government initiatives and policies, ultimately jeopardising social welfare results. Against this background, we highlight four areas where the budget has done exceptionally well.

Fiscal Discipline

Democratic political systems often face choices between present and future welfare. According to Nordhaus’ influential work published in 1975 on the political business cycle, a democracy that evaluates political parties solely based on their past performance is likely to make decisions that are unfair to future generations. This is because politicians may prioritise short-term gains over long-term benefits in order to secure immediate political success. Nordhaus (1975) further goes on to say, “within an incumbent’s term in office, there is a predictable pattern of policy, starting with relative austerity in early years and ending with the potlatch right before elections” (pp.187)[1].

Hence, the political business cycle theories posit that incumbent political parties engage in opportunistic behaviour, manipulating economic instruments before elections to enhance their chances of being re-elected. In other words, Governments are known to employ a strategic approach by exploiting the short-term Phillips curve to further their objectives[2]. In addition, governments may also take advantage of the limited knowledge and simplistic expectations of voters in order to attain their goals. This reveals a complex interplay between political manipulation and the economic implications of short-term policies.

At the same time, the work of Rogoff (1990) and Rogoff and Sibert (1988) suggests that in situations where information about the competence of an incumbent is limited, expansionary policy measures implemented prior to an election are often viewed as an indicator of high competence[3]&[4]. As per their analysis, a potential outcome of the political business cycle could be an increase in the budget deficit, as well as an increase in the money supply via the monetisation of the deficit. In addition, there may also be an increase in inflation during the electoral period, as politicians prioritise short-term economic gains in order to increase their chances of re-election. In the case of India, too, some studies have found clear evidence of an increase in revenue deficit in the years leading to an election[5].

However, under the incumbent government in India, things have changed. What Narendra Modi’s government is doing is completely opposite to the basic tenets of the political business cycle theories. The Prime Minister has proved Nordhaus and other PBC theorists wrong.

With the upcoming elections, many expected the government to unleash a spree of spending, showering voters with loan waivers and other financial goodies. But the Finance Minister and the government have taken a different approach, choosing to prioritise long-term stability over short-term gains. By resisting the temptation to indulge in vote-winning measures, the government has demonstrated a commitment to responsible financial management, even in the face of political pressure. This budget stands as a testament to the government’s determination to put the country’s future first.

The government has demonstrated exceptional fiscal discipline in recent years, consistently meeting or exceeding its deficit target. India’s fiscal deficit shot up to a record 9.3% in 2020/21, from 4.6% the previous year due to pandemic-related spending. This year, despite formidable fiscal challenges owing to the ongoing Russia-Ukraine conflict and global economic uncertainties, the government deserves accolades for reinforcing its resolve to stick to the fiscal deficit target of 6.4%.

For the next year, the government has committed to bringing down the fiscal deficit to 5.9%. This reduction is in line with the government’s earlier commitment towards the fiscal deficit target of 4.5% of GDP by the end of 2025/26. Obviously, this doesn’t have to be linear. Even if the reduction is by 0.5% next, there may be more opportunities for substantial consolidation and growth as the global recession and headwinds would be behind us in the first year of the next government. Thus, there will be more room for fiscal consolidation in the next two years.

The endeavour to simultaneously achieve rapid economic growth and social welfare improvement while maintaining responsible fiscal management is a multifaceted challenge. Nevertheless, recent studies indicate that the fundamental means of accomplishing these goals is not merely through the reduction of fiscal deficits but rather by diminishing expenditures of inferior quality. This necessitates abstaining from the temptation to artificially generate capital account surpluses that come at the cost of enlarging gross fiscal deficits.

Capital Expenditure

In the midst of the Great Depression in 1933, economist John Maynard Keynes penned a passionate letter[6] to President Roosevelt urging him to take bold actions to jumpstart the economy. Keynes argued that the government should borrow money and use it to increase spending rather than raise taxes, as a way to boost national purchasing power and ignite growth. While it’s unclear if Roosevelt actually read the letter, he did ultimately turn to government spending to revitalise the economy through his New Deal.

A lot has already been written about the union government setting aside ₹ 10 lakh crore (~3.3% of the country’s GDP) for Capital Expenditure in this budget, a 37.4% increase from last year’s Revised Estimates. Economists talk about the multiplier effect. The multiplier effect is a concept that highlights the exponential impact of changes in government spending on a nation’s output. When the fiscal multiplier is greater than one, an increase in government spending leads to a corresponding increase in output that is greater than the original investment. In simpler terms, a single rupee increase in government spending could result in a return that is worth much more than one rupee.

The economic survey may have shed light on the resurgence of private investment, but with global challenges and monetary constraints, it alone may not be enough to drive growth. This is where the government steps in, with their unwavering commitment to revive the economy demonstrated by allocating a record-high ₹ 10 trillion for long-term capital expenditure in 2023-2024, surpassing the previous year’s budget of ₹ 7.5 trillion, thus providing a cushion from global headwinds. A 33% increase year-on-year shows that the government is putting their money where its mouth is and that growth is within reach. This, in turn, will also help in crowding in private investments.

But what is the extent of the fiscal multiplier in the case of capital expenditure in India? There is a dearth of studies on the subject. However, the most influential study out of these is that by Bose & Bhanumurthy, which first came out as a NIPFP Working Paper in 2013 and later got published in the Journal of Applied Economic Research[7]. According to their calculations, the multipliers for capital expenditures, transfer payments, and other revenue expenditures are 2.45, 0.98, and 0.99, respectively. However, the multipliers for taxes are approximately -1. Goyal & Sharma (2018) find that capital expenditure exhibits the greatest cumulative multiplier, with a size ranging from 2.4 to 6.5 times that of revenue expenditure.

Furthermore, capital expenditure has a more pronounced impact on long-term inflation reduction. Nonetheless, capital expenditure is susceptible to greater volatility due to its vulnerability to discretionary spending cuts[8]. However, the multipliers of public capital expenditure would not be as high as they used to be in 2013. The explanation for this phenomenon is straightforward. During the past nine years, the government has made significant expenditures on infrastructure development, including roads, railways and logistics. Infrastructure no longer poses as significant an obstacle for private capital influx as it did during the UPA era. Thus, the government is not just focusing on capital expenditure but also on addressing institutional weaknesses.

At the same time, the capital expenditure multipliers of the states are much higher the that of the union government’s capital expenditure. Thus, it is crucial to encourage states to prioritise capital expenditure as a means to revitalise the economy, especially after the shocks[9].

Incentivising States for Capital Expenditure

In pursuit of fostering cooperative fiscal federalism, the Union Government has extended a program of financial assistance program for capital expenditure for the upcoming fiscal year of 2023-24. This initiative has received a significant boost in allocation, with an increased budget of 1.30 lakh crore, representing a 30% escalation from the previous year. In terms of the current fiscal year, this amounts to approximately 0.4% of the nation’s GDP. The importance of empowering the states to undertake capital projects cannot be overstated, and this expanded allocation represents a progressive step forward.

The FM has decided to continue a 50-year interest-free loan to the state governments for one year. The states have been given autonomy to spend this at their discretion, with a catch – a portion of it is contingent upon increasing their actual capital expenditure. But what will they spend it on? The Union Government has tied parts of the outlay to either reforms or allocation to priority areas. This includes urban planning reforms, financing reforms in ULBs to make them creditworthy, the State share of capital expenditure of central schemes etc. Thus, there will be an inherent incentive for the state governments to also ensure the quality of public expenditure.

However, states should focus on the quality of the capital expenditure. There is a significant variation in capital expenditure by different states. Delving into the granular details, the states of Uttar Pradesh, Maharashtra, Madhya Pradesh, Karnataka, and Tamil Nadu collectively contribute over 40% towards the consolidated capital outlay carried out by all states. In a particularly fascinating trend, states such as Uttar Pradesh, Odisha, Assam and Jharkhand exhibit a relatively larger proportion of capital outlays in relation to the size of their respective economies.[10]

Similarly, the RBI’s State Finances report has also pointed out that fiscal marksmanship relating to capital outlay also varies across the state. During 2017-18 to 2019-20, states & union territories like Andhra Pradesh, Delhi, Jammu & Kashmir, Goa, Tripura and Punjab have cut their budgeted capital expenditure by more than 40%. Himachal Pradesh, Haryana, and Nagaland were the sole outliers in exceeding their budgeted targets for capital expenditure.

The RBI report has also flagged the issue of a residual approach to spending. Over the past five years, a substantial portion, amounting to one-fourth, of total expenditures occurred solely during the month of March. This presents a grave matter as the primary objective of spending by the year’s end results in a compromise in the quality of expenditures. The Union budget can only nudge the states to improve their quality of public expenditure. But under a federal structure, states will have to do more if they want to ensure higher growth rates for a prolonged period.

Transparency

In the past two budgets, the government has taken bold steps to bring off-budget borrowings, like those of the Food Corporation of India (FCI) previously, in its own light. By doing so, they aim to offer a clear picture of the government’s financial obligations, enabling informed decisions and assessments. Previous finance ministers acknowledged the issue with off-budget borrowings and made hollow announcements which were never fructified. P. Chidambaram, in his budget speech (2008-09), stated – “I acknowledge that significant liabilities of the government on account of oil, food and fertilizer bonds are currently below the line. This accounting arrangement is consistent with past practice. Nevertheless, our fiscal and revenue deficits are understated to that extent. There is a need to bring these liabilities into our fiscal accounting.” However, it was Nirmala Sitharaman who made it a reality. The finance minister has continued with this tradition again this year.

Social Sector

Some have argued that the union government’s outlay on the social sector, as a percentage of its overall expenditure, has displayed a persistent stasis. In FY 2009-10, the government allocated 21% of its total expenditure towards social sector expenditures, which subsequently saw a slight decrease to 20% by FY 2019-20. Over the past fourteen years, the average proportion of social sector spending by the government, amounting to nearly one-third (30%), was dedicated to the provision of subsidised food to the country’s poorest two-thirds. However, the percentage of such spending exceeded 50% in FY 2020-21 amidst the global health crisis caused by the COVID-19 pandemic.

While the percentage of overall expenditure on the social sector would have remained same in the last few years, there is an incremental improvement on quality of expenditure in the social sector. Notably, today, intended beneficiaries get 100% of funds which they are supposed to get. During a visit to the drought-stricken Kalahandi district in Odisha in 1985, Rajiv Gandhi made a statement indicating that only 15 paise out of every rupee spent by the government actually reached the intended recipient. One should quote Justice A. K. Sikri’s majority opinion on the constitutionality of the Aadhar Act: “Resultantly, lots of ghosts and duplicate beneficiaries are able to take undue and impermissible benefits… It cannot be doubted that with UID/Aadhaar much of the malaise in this field can be taken care of.”[11]

The digital public infrastructure has not only enhanced accessibility of public services to the most disadvantaged and susceptible sections of the nation, but it has also facilitated the detection and elimination of fraudulent beneficiaries from various government schemes. The system has effectively curbed leaks caused by non-existent and duplicate beneficiaries who use fake identities to obtain benefits. While one should acknowledge that there are some exclusion errors, but the government is ensuring that there are enough safeguards against exclusion in the cases of authentication failure. The digital public infrastructure and Aadhaar based biometric authentication (ABBA) also makes it easier to ensure portability of benefits.

More importantly, use of Aadhaar to identify and authenticate beneficiaries in government scheme has led to considerable fiscal savings. Thus, even if the social sector spending has remained stagnant, the use of DPI and ABBA, has ensured that more people, especially the one who are marginalised and vulnerable are able to get intended benefits.

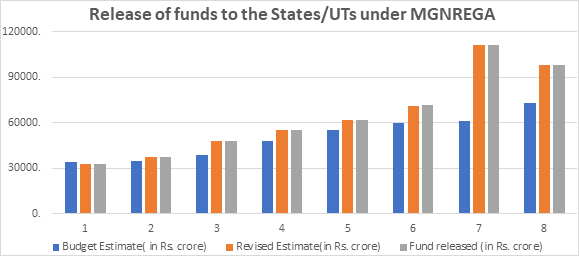

Moreover, criticism has been raised regarding the allocation of funds for the Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA) scheme in the 2023-24 budget. The budget for MGNREGA in 2023 is 18% lower than the budget estimates of Rs. 73,000 crore for the current year of 2022-23, and approximately 33% lower than the revised estimates of Rs. 89,000 crore for the current year.

MGNREGA operates on a demand-driven model where households seeking employment are entitled to a minimum of 100 days of unskilled manual labor during a given financial year. In the ongoing fiscal year of 2022-23, nearly all rural households, or 99.81%, have been offered wage employment according to their demand. If a job seeker does not receive employment within 15 days of application, they are eligible for a daily unemployment allowance as per the provisions of the Scheme.

As there is reduced demand of MGNREGA, the number of person days generated by MGNREGA has also been going down. While the person days generated under MGNREGA was 389.09 crore in FY20-21 due to the migration to rural areas owing to pandemic, it has been going down subsequently.

| FY2022-2023 | FY 2021-22 | FY2020-21 | FY 2019-20 | |

| Person days generated (in crores) | 248.08 | 363.33 | 389.09 | 265.35 |

Source: Ministry of Rural Development[12]

It should also be highlighted that the budget estimates are revised once there is more demand for work under MGNREGA. Over the past seven years, actual funds released to states under MGNREGA have consistently exceeded budget estimates. For example, in the fiscal year 2019-20, the budget estimate for MGNREGA was Rs.60,000 crore, but due to increased demand, it was revised to Rs.71,001 crore. Similarly, the COVID-19 pandemic and the sudden influx of population into rural areas led to a revised estimate of Rs.1,11,500 crore in 2020-21, compared to the original budget estimate of Rs.61,500 crore. In the fiscal year 2021-22, the budget estimate of Rs.73,000 crore was revised to Rs.98,000 crore. These figures demonstrate that the government is willing to allocate additional funds to MGNREGA in response to demand.

Source: Ministry of Rural Development

Conclusion

The Union Budget is no longer the sole platform for major policy announcements, as much more spending happens at the state level. The hype surrounding the budget is a remnant of a bygone era, and stability and predictability are essential for tax reform. The current budget is focused on empowering women, youth, and progress, leaving symbolic tax exemptions of the past behind. The Finance Minister has done an exceptional job of balancing tackling inflationary constraints and promoting economic growth. The government’s commitment to responsible financial management is commendable, even in the face of political pressure, and this budget stands as a testament to putting the country’s future first. The government has demonstrated exceptional fiscal discipline in recent years and deserves accolades for reinforcing its resolve to stick to the fiscal deficit target of 6.4%. The endeavour to simultaneously achieve rapid economic growth and social welfare improvement while maintaining responsible fiscal management is a long-term goal that requires prudent budgeting, and this budget is a step in the right direction.

Author Brief Bio: Bibek Debroy is the Chairman, Economic Advisory Council to the Prime Minister & Aditya Sinha is Additional Private Secretary (Policy & Research), Economic Advisory Council to the Prime Minister.

References:

[1] Nordhaus, W. D. (1975). The Political Business Cycle. The Review of Economic Studies, 42(2), 169-190.

[2] Dubois, E. (2016). Political Business Cycles 40 Years after Nordhaus. Public Choice, 166(1-2), 235-259.

[3] Rogoff, K. (1990). Equilibrium Political Budget Cycles. The American Economic Review, 80(1), 21-36.

[4] Rogoff, K., & Sibert, A. (1988). Elections and Macroeconomic Policy Cycles. The Review of Economic Studies,, 55(1), 1-16.

[5] Sen, K., & Vaidya, R. R. (1996). Political Budget Cycles in India. Economic and Political Weekly, 31(30), 2023-2027.

[6] Keynes, J. M. (1933). An Open Letter to President Roosevelt. Retrieved from University of Texas: https://bit.ly/3ScJVa2

[7] Bose, S., & Bhanumurthy, N. R. (2015). Fiscal Multipliers for India. The Journal of Applied Economic Research, 9(4), 379–401.

[8] Goyal, A., & Sharma, B. (2018). Government Expenditure in India: Composition and Multipliers. Journal of Quantitative Economics volume, 16, 47-85.

[9] Swaroop, E. (2022). Estimation of Expenditure Multiplier for India. Retrieved from IES: https://bit.ly/3YSly44

[10] RBI. (2023). State Finances: A Study of Budgets of 2022-23. Mumbai: Reserve Bank of India.

[11] Justice K S Puttaswamy (Retd.) and Another versus Union of India and others, 494 of 2012 (Supreme Court of India September 26, 2018). https://bit.ly/3XNTsph

[12] Ministry of Rural Development. (2023, February 3). Clarifications of Union Rural Development Ministry on budget cut to MGNREGA. Retrieved from Press Information Bureau: https://bit.ly/3SdCmzP

Foreign Direct Investment, Trade and the Union Budget: Understanding the Issues

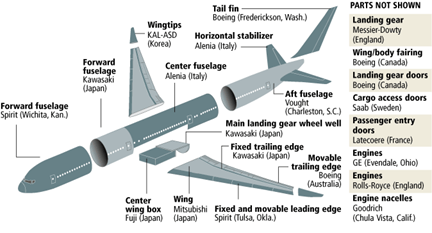

The global economy has been experiencing severe economic downturns since 2008. Much before the sub-prime crisis triggered the collapse of global trade, the world economy started experiencing recessionary trends. The European debt crises, the US-China war, the Covid-19 pandemic, and the Russian-Ukraine war, among others, have significantly influenced the world economic outlook in the last decade. Amid such a crises prone period, even though the growth of trade has also been sluggish, the world trading platform has experienced a structural transformation creating several new opportunities for emerging and developing market economies. More than ever, international trade and commerce are now considered as critical weapons to ensure world peace and harmony, as these escalate the cost of future conflicts. This ideology though is not new. Mill (1848) also emphasised how international trade renders inter-country wars obsolete by enhancing their interdependences. However, today, the definition of trade has changed drastically. Unlike the traditional concept where production processes used to happen domestically and countries were engaged in the export and import of only final goods and services, in today’s world, there is no product which is made in a single country. The new trade reality is now demonstrated by the so-called Global Value Chains [or, GVCs], which are guided by fragmented production structures spread across different countries in the world. For example, as explained in a recent study by Xing and Huang (2021), a smartphone finally assembled in China contains components from several countries, such as visual design and power management module from the USA, computer codes from France, printed circuit board from Taiwan, silicon chips from Singapore, memory chips from Korea, and precious metals from Bolivia.[1] Another example is that of a Boeing 787 Dreamliner (originally an American product), the fragmented value chain of which, is shown in Figure 1 below.

Figure 1: GVC of a Boeing 787 Dreamliner Aircraft

Source: Adapted from <https://modernairliners.com/>

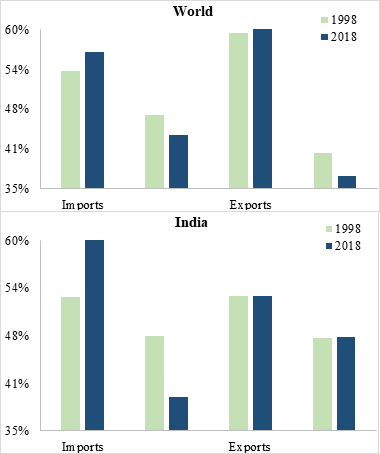

Thus, Figure 1 clearly demonstrates how in the new world of highly complex international production chains, goods cross several borders multiple times before reaching their end customers. To put it another way, this suggests that what we see happening in the world today isn’t really trade in final goods or services, but rather trade in intermediate inputs, materials, components, activities, or tasks. Rapid technological development, a steady decline in tariffs, lower costs for shipping and logistics, organisational innovations, etc. are just a few of the factors that remarkably decreased the cost of coordination between nations and enabled this process of global production sharing. The upper panel of Figure 2, based on OECD’S TIVA database, shows how, in the past few decades, this type of trade has dominated global exports and imports, and today, contributes to more than 60 per cent of the world trade.

Figure 2: Gross Trade in (Final and Intermediate) Goods and Services, 1998 – 2018

Source: OECD TIVA (2021 Ed.); Authors’ Calculations.

In addition, it is crucial to understand that the network of trade is expanding not between countries or industries but rather between businesses/firms, the majority of which are overseas affiliates or subsidiaries of various multinational corporations (i.e., the carriers of Foreign Direct Investment).[2] This is what is referred to as intra-firm trade in the literature, which is distinct from international trade carried out between unrelated parties. In a recent interaction with Financial Express, Pant and Bimal (2020) noted that

“Estimates suggest that about a third of global trade occurs in the form of intra-firm trade among MNEs;[3] the remaining two-thirds occur either as exports by MNEs to non-affiliates or trade among non-MNE national firms.”

In fact, the value of these intra-firm trade flows has increased as a result of MNCs’ expanding operations and rapidly emerging GVCs in the past decade or so. Based on the OECD’s database on Activities of Multinational Enterprises [AMNE], it has been estimated that these companies contribute to approximately 36 per cent of the global output, which accounts for about two-thirds of the world exports and more than 50 per cent of world imports. The UNCTAD [United Nations Conference on Trade and Development] estimates also suggest that around 80 per cent of global trade takes place under the purview of MNCs. However, this type of trade occurs only when MNs make investments abroad, referred to as Foreign Direct Investment [or, FDI]. Thus, in today’s GVC-driven era, FDI is serving as a conduit for the growth of trade flows. The main argument is that, in the present-day world, it is impossible to examine trade policy in isolation or to disentangle it from FDI policies.

To discuss the linkages between international trade and FDI, let us first understand the definition of Foreign Direct Investment, and how it differs from Foreign Portfolio Investments (FPI) or what we call Foreign Institutional Investors (FII) in India.

Until about the early 1960s, FDI, like other forms of international investment used to be considered as a part of international capital theory. It was actually seen as a response to interest rate differentials between countries around the globe. Thus, it was recognised that, similar to trade in goods, a capital-scarce country (the one which offers higher return) imports capital and this continues up to the point where the return to capital gets equalised internationally. This explanation is analogous to the predictions of the standard Heckscher-Ohlin (H-O) theory of trade.[4] Hence, it was thought that trade in goods could substitute for the international movement of factors of production, including FDI. But, with the failure of this capital theory in explaining most of the rise in international production (in contrast to just capital movement) during the late 1950s, efforts were made to analyse them from the trade theorist’s point of view. Only then, it was realised that trade and FDI are actually two different sides of the same coin (Pant and Srivastava 2015) and hence, they cannot be studied or analysed in isolation.

It was John Dunning who, in his 1980 seminal work, defined foreign direct investment based on what is popularly referred to as the ‘OLI’ paradigm, where O stands for Ownership, L for Location, and I stands for Internalisation. According to him, these three are potential sources of advantage that underlie a firm’s decision to become a multinational corporation. The first component ‘O’ addresses the question that why some firms go abroad, and suggests that a successful MNC has some firm-specific advantages, which allow it to overcome the costs of operating in a foreign country. Location advantages, on the other hand, deal with the question of where an MNC chooses to locate and suggest why it sometimes becomes profitable for a firm to locate itself in different countries, rather than producing and exporting from its parent country. Lastly, internalisation advantages influence how a firm chooses to operate in a foreign country, trading off the savings in transactions, hold-up and monitoring costs of a wholly-owned subsidiary, against the advantages of other entry modes such as exports, licensing, or joint venture. This implies that Foreign Direct Investment, as distinct from FPI or FII, does not just include the transfer of foreign capital from an enterprise in the source to another related entity in the host country, but also the transfer of know-how in the form of advanced technology, managerial expertise, or any other firm-specific factor.[5] Put differently, FDI combines three elements, viz. trade in commodities, services (for example, managerial services) and international technology flows. Secondly, most direct tax treaties between nations provide favourable treatment in the withholding tax rates applied on dividends/royalty payments among related enterprises, acknowledging the relationship between FDI flows and the production capacities of firms (Pant 2014).

In fact, as explained in Pant and Srivastava (2015), an investor in the parent country decides to switch to domestic production in the other country (i.e., it opts for FDI), when either entry barriers like tariffs make its exports uncompetitive, the other location gives it access to critical inputs at comparatively lower costs (vis-à-vis, the parent country), or when such a move becomes necessary to internalise the firm-specific advantages. With the establishment of the World Trade Organisation [WTO], the world has already experienced a gradual decline in tariff rates imposed by different countries. Hence, as argued in Huria and Pant (op. cit.), it is the latter reason that presently explains the expansion in the flows of FDI. This is because even if trade is free but FDI flows are restricted, it will be difficult for an economy to deepen its integration with the world market via GVCs. For one, restrictions on FDI inhibit the flow of technology and hence, the country’s technology-based trade. Secondly, no or lower levels of integration with global value chains (due to restrictions on intra-firm trade) may limit trade in intermediate inputs, which, in turn, could render a nation less competitive in the manufacture of a good (or goods) in which it had previously enjoyed a comparative advantage. Nevertheless, it is equally important to recognise that this association between FDI and trade could be complex and vary across countries, industries, production stages, and types of investment, etc. For example, while liberalised trade and FDI policies may foster a favourable correlation between the two, higher regulatory interventions in an industry in the form of tariff or non-tariff barriers, tax-based subsidies, etc. could potentially offer substantial incentives to the MNC to replace trade with FDI.

Tables 1 and 2 encapsulate Pearson’s pairwise correlation coefficients (measuring the strength and direction of the linear relationship) between different FDI and trade indicators (at the aggregate and sectoral level) for the world economy.

Table 1: Pearson’s Pairwise Correlation Coefficients – Trade and FDI, World (1970-2021)

| Percentage Shares in GDP | Total Exports | Total Imports | Total Trade |

| Net FDI Inflows | 0.714* | 0.731* | 0.821* |

| Net FDI Outflows | 0.654* | 0.676* | 0.780* |

| Total FDI Flows | 0.701* | 0.719* | 0.817* |

Source: World Bank’s World Development Indicators (WDI) Database; Authors’ calculations. Note: * represents significance at 1 per cent level, Total trade represents the total of goods and services trade, Green highlights represent the top three correlations. Interestingly, all the correlations are above 50 per cent, and the majority of the correlations are above 70 per cent (i.e., closer to perfect correlation).

Table 2: Pearson’s Pairwise Correlation Coefficients – Goods, Services Trade and FDI, World (1970-2021)

| Percentage Shares in GDP | Goods Exports | Goods Imports | Goods Trade | Services Exports | Services Imports | Services Trade |

| Net FDI Inflows | 0.717* | 0.745* | 0.721* | 0.729* | 0.662* | 0.704* |

| Net FDI Outflows | 0.665* | 0.699* | 0.669* | 0.660* | 0.581* | 0.635* |

| Total FDI Flows | 0.707* | 0.736* | 0.711* | 0.711* | 0.638* | 0.686* |

Source: WDI; Authors’ calculations. Note: * represents significance at 1 per cent level, Green highlights represent the top three correlations.

At the aggregate level for the world economy, Table 1 shows that trade and FDI are significantly and positively correlated with each other – be it the association between inward FDI and exports/imports, or the outward FDI or total FDI with exports/imports. Further, Table 2 replicates the analysis by incorporating information separately, on goods and services trade. Once again, we find that there exists a direct positive association between the two, indicating their complementarity. Though our analysis is indicative, it clearly makes a strong case for examining trade and FDI policies in a comprehensive and coherent framework.[6]

But, is this link well established in India’s trade and FDI-related policies? – Below we discuss some of the evidence in this regard, and suggest a possible way forward.

The Case of India

The lower panel of Figure 2 and Tables A.1, A.2 in the appendix to this article, show that India’s trade composition and the trade-FDI link are in line with our observations for the global economy. In fact, the correlation coefficients, on average, are higher in the case of India, than in the world, indicating the strength of the positive association between international trade and foreign direct investment. The last decade has witnessed several initiatives on the part of the country’s government to improve the ease of doing business, and make the country one of the most attractive FDI destinations in the world. In 2011, the Department for Promotion of Industry and Internal Trade (erstwhile Department of Industrial Policy and Promotion [DIPP]) introduced the National Manufacturing Policy [NMP] to increase the share of the manufacturing sector in India’s GDP. National Investment and Manufacturing Zones have been established as an instrument to implement NMP, with an overall objective to facilitate the access to a requisite ecosystem for promoting world-class manufacturing activity (Press Information Bureau [PIB] 2018).

In September 2014, the government launched the Make In India [MII] programme with an endeavour to create and encourage domestic and multinational firms to develop, design, manufacture, and assemble products in India (PIB 2022b). As an initiative to simplify the process of approvals of inward FDI flows under government approval, the Union Cabinet abolished the Foreign Investment Promotion Board [FIPB] in May 2017. Henceforth, all the FDI proposals are required to be submitted through the DPIIT-managed Foreign Investment Facilitation [FIF] Portal, and respective applications are then screened by the concerned administrative ministries/department (PIB 2022a). Further, the government has also opened up several sectors for which FDI up to 100 per cent is permitted through the automatic route. A few examples are – ports and shipping, railway infrastructure, renewable energy, agriculture and animal husbandry, automobiles and auto components, single-brand product retail trading, and insurance intermediaries, among others.

While several other policy initiatives have also been undertaken to position India as the most attractive location for investment and conducting businesses (such as the Production Linked Incentive Schemes, PM Gati Shakti, India Industrial Landbank, the National Logistics Policy, Remission of Duties and Taxes on Exported Products, and the National Single Window System), however, at the same time, the country’s trade policy has been found to be highly restrictive in nature in the past one decade. Figure 3, based on the Global Trade Alert Database, shows the share of harmful trade interventions defined as those that restrict trade practices, as a percentage of total trade interventions for India for the period 2009-2022.

Figure 3: Harmful Interventions (% of total trade interventions), India (2009-2022)

Source: Global Trade Alert Database; Authors’ Calculations.

Except for the year 2011, as shown in Figure 3, the number of harmful trade interventions has always exceeded the number of liberalised trade interventions by the country. In fact, very recently, India was also flagged as highly restrictive in its trade practices by the industry associations of the United States of America, who pointed out that “although Prime Minister Narendra Modi has taken steps aimed at improving India’s business environment, India’s high tariff rates and restrictive border measures continue to limit manufacturers’ ability to invest in and export to India.”[7] This is a concern in itself as trade and FDI go hand in hand, and the rapidly expanding international production networks have only strengthened their association in the recent past.

The recent Budget announcements, however, seem to take a positive step in this direction. While the country’s long-due Foreign Trade Policy is still in the making, in this year’s Union Budget 2023-24, the country’s finance minister has reduced custom duties on a selected set of intermediate inputs to enhance domestic value addition, promote export competitiveness, and correct duty inversion. This is in contrast to the Union Budget 2021-22, where duties on imports of inputs were raised to ensure higher value addition within the country (even though the majority of India’s imports are of the intermediate category (see Figure 2, Lower panel)). Examples include some components used in TV manufacturing, electric heat coils, capital equipment for electrically operated vehicles and lithium battery production, parts of mobile phones, denatured ethyl alcohol for manufacturing of industrial chemicals, lab-grown diamonds, etc. Certain tariffs have been raised though for competing imports that may impact the local industry, such as rubber, toys and parts of toys.[8] Other initiatives include skill training programmes, the development of data processing centres, etc.