ப ொருபென்னும் ப ொய்யொ விெக்கம் இருெறுக்கும் எண்ணிய தேயத்துச் பென்று

Wealth, the lamp unfailing, speeds to every land, Dispersing darkness at its lord’s command.” – Thirukural, Chapter 76, verse 753

For a country like Bharat, inclusive economic growth has been a significant part of its conscious. It is an indispensable part of the value system as enunciated in the four purushaarth – dharm, arth, kaam and moksh. Arth is the driver of all activities in the country, and when informed to all sections of the society, has the ability to transform the developmental outlook for it as well. This value system enabled Bharat to attain the second largest share (over 25%) in the global GDP for over 2,000 years1.

Post-independence, however, this agenda of robust and inclusive economic growth with central importance of arth, remained inconsistent. During the first two decades of independence, there have been wide variations in India’s growth rate with high frequency of negative growth rates2. This trend reflected in India’s poverty rates as well as the percentage of people in poverty increased from 47% in 1951 to 56% in 19743. Further, in 1969, major banks were nationalised with the objective to organise and improve efficiency of the banking system. While it helped in the expansion of banking services, lack of professionalism, high SLR and CRR rates combined with increasing Non-Performing Assets affected the banking health of the country.

The reforms of 1991 followed by structural changes to improve the economic health of country have been characterised with high economic growth rate, poverty reduction and significant improvement in the banking health. These structural changes helped India sail through the challenges posed by the Global Financial Crisis of 2008. However, the 2004-2014 era was characterised by high inflation rates, low fiscal discipline and increased revenue expenditures.

Starting 2014, a series of structural reforms have aided the country towards achieving its goal of economic prosperity for all. These reforms have been aligned with the broader objectives clearly articulated by the Govt. of India. It includes establishing $5 trillion economy by 2025 and a $7 trillion economy by 2030. The recently announced Viksit Bharat Sankalp by 2047 is an aim to present a holistic vision towards economic growth. The current review analyses the major economic reforms undertaken by the Govt. of India during the past decade under three broad themes, namely Macroeconomic Reforms, Banking Reforms and reforms towards Ease of Doing Business.

Macroeconomic Reforms

In 2014, the newly formed Modi government worked towards a stable macroeconomic policy. The purpose was to make the Indian economy resilient to external shocks post the Global Financial Crisis in 2008. This required effort towards reducing inflation, addressing jobless growth, enabling fiscal discipline and increasing forex reserves. One of the most prominent reforms is the make in India program.

Make in India

The policy is aimed to transform India into a global manufacturing hub. The purpose was to boost investment, foster innovation, enhance skill development, promote employment generation and build a manufacturing ecosystem in the country.

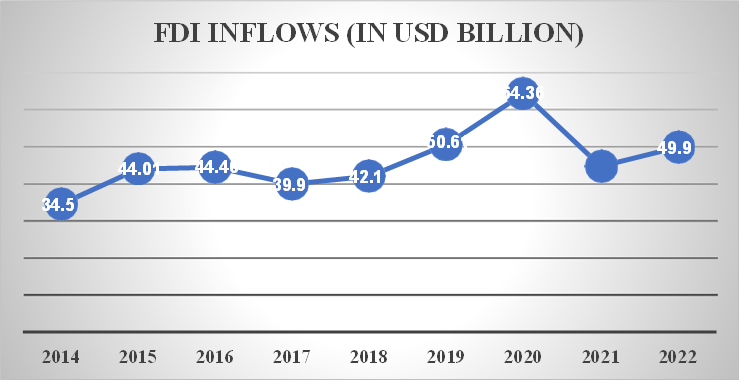

The Make in India initiative has led to a consistent increase in the net Foreign Direct Investment (FDI) inflows. This is evident in the graph 1 given below.

Graph 1:FDI in India (2014-2022) Source: World Bank

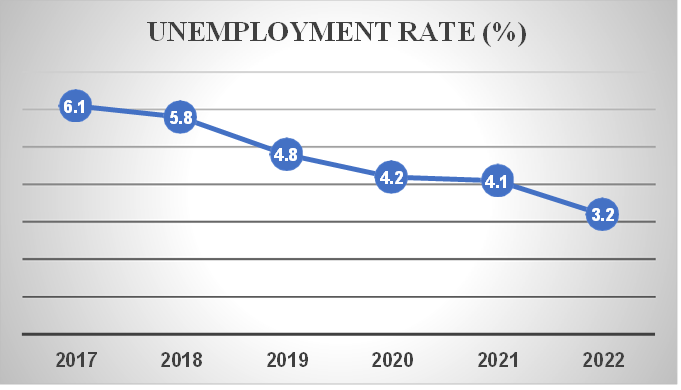

Make in India also has boosted employment generation. The Periodic Labour Force Survey (PLFS), published by the National Sample Survey Organisation (NSSO), has recorded a consistent decline in the unemployment rate of India since 2017 as evident in graph 2.

Graph 2: Unemployment Rate (%)

Source: Periodic Labour Force Survey Annual Report 2022-23

Make in India has acted as a catalyst to boost employment-oriented economic growth with a priority to produce many wealth creators. Make in India’s real success will come when share of manufacturing in the Indian economy increases from the present 17 percent to 35 percent, as envisioned. Make in India initiative got a further filip with the AtmaNirbhar Bharat Abhiyaan in 2020, that focused on developing a holistic strategy for future-proofing the economy from external shocks and external dependence. Focus was oriented towards providing liquidity to the MSMEs, incentivise agripreneurship and creating viable sources of income for the underprivileged4.

Fiscal Prudence

One of the most crucial aspects of the Modi government’s economic agenda has been a stable and prudent fiscal policy.

To maintain fiscal discipline and regulate government spending, Parliament of India enacted the Fiscal Responsibility and Budget Management (FRBM) Act, 2003. The Act mandated the government to maintain a fiscal deficit of less than 3%. Towards this end, the Govt. of India aims to limit public debt, borrowings and thereby, interest payments. India’s Gross Fiscal Deficit since 2013 has been demonstrated in graph 4. Here, it is visible that even though in the pandemic the fiscal deficit of the country tripled of the desired level, the country is enroute to reduce the deficit, indicating that the government is prudent in its spending.

Graph 3: Gross Fiscal Deficit (2013-2023) Source: RBI

Goods and Services Tax (GST)

One of the single biggest reforms undertaken by the Modi Government is the constitutional amendment that led to the adoption of the GST. Towards improving tax collection and enabling ease of tax payment, the GoI introduced the Goods and Services Tax (GST), a major structural change in the economy. The objective was to replace the prevailing complex and fragmented tax structure with a unified system that would simplify compliance, reduce tax cascading, and promote economic integration. It replaced the previous regime of multiplicity of taxes including VAT and service tax that were imposed on manufacturers.

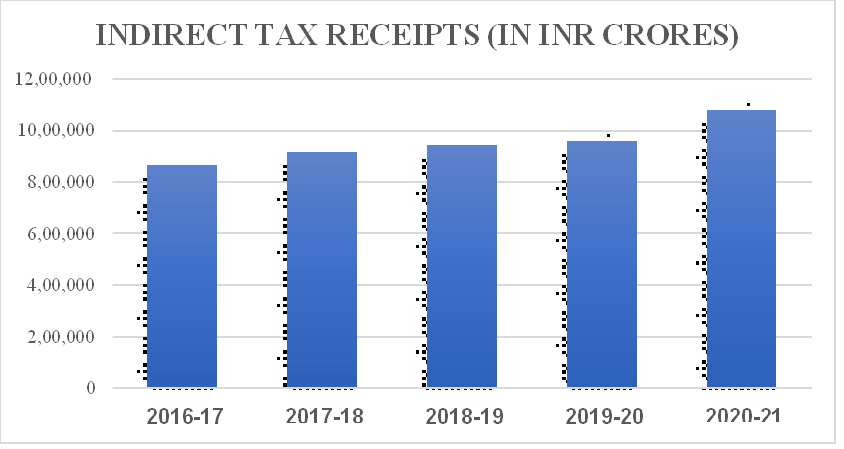

Since its introduction in 2016 and after the initial hiccups, GST has now streamlined tax collection and has greatly improved tax compliance and collection.

Since its introduction, GST has enabled a decent increase in the indirect tax collection, surpassing more than INR 10,00,000 crores in 2020-21 (see graph 7).

Graph 4: Indirect Tax Receipts (2016-2020) Source: Union Finance Accounts

As monthly GST collections top 1.78 lakh crore, for the fiscal year 2023-24, total GST collection topped 20 lakh crore and has witnessed double digit growth rates. This indicates a growing economy and a robust tax mechanism, enabling the government to plan its long term spending and capital expenditure.

Banking Reforms

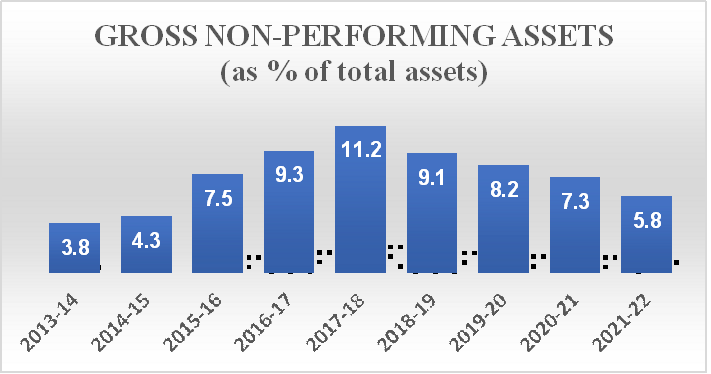

In 2014, the banks of the country were grieving from an unprecedented and undisclosed crisis. With the collapse of the Leeman Brothers in 2008, a set of emergency measures were introduced to provide banks a leeway to prevent spillover of the global crisis. As a result, regulatory forbearance was introduced wherein restructured assets were no longer required to be classified as Non-Performing Assets (NPAs) and therefore did not require the levels of provisioning that NPAs attract. It provided a temporary relief for both the borrowers and the lenders, but its prolonged implementation resulted in piling up of undisclosed NPAs5.

Regulatory forbearance was coupled with the fact that banks were involved in increased risky lending since mid-2000s6. These borrowers when started to default were not displayed on the balance sheet of the banks owing to regulatory forbearance. Once the forbearance was lifted in 2014, the NPAs started to reflect on the balance of all banks. This fact is reflected in graph 8 that depicts the Gross NPAs of the SCBs. Its clear that GNPAs have increased till 2017-18 after which they witnessed a progressive decline, indicating dispersal of good loans by SCBs.

Graph 5: Gross Non-Performing Assets (GNPA) % of total assets of SCBs

Source: RBI

Government’s biggest reform push has been towards a clean up of the banking industry and concerted measures to reduce the GNPA.

Mission Indradhanush is one of the most comprehensive efforts to improve the health of Public Sector Banks (PSB). It covers all aspects of banking functions from appointment to a path towards addressing bad assets. It is meant to bring in transparency, professionalism and build robust balance sheets for banks. The several components of Mission Indradhanush include:

- Appointments – The separation of the post of CEO and MD to check excess concentration of

power and bring greater transparency in decision making.

- Creation of Banks Board Bureau – it has replaced the appointments board of PSBs and advises banks on fund raising; besides holding bad assets for the banks.

- Capitalisation – PSBs that were earlier struggling with bad assets and inadequate capital have now been well capitalised.

- De-stressing – Address pending issues in the infrastructure sector, which in turn reduces the problem of stressed assets for banks.

- Empowerment – providing greater autonomy for banks and more flexibility for hiring manpower that can allow PSBs to become competitive and efficient.

- Framework of accountability – key performance indicators for banks like NPA management, financial inclusion, diversification and growth, improve asset quality are all matrix that are now carefully monitored.

- Governance Reforms

Improved Legal Framework for Loan Recovery for Banks :

By enacting laws that allow banks to recover bad debts, the Government has aimed to address one of the thorniest issues for banks. amending laws like the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 (SARFAESI) have provided banks greater visibility in terms of acting against defaulters and bad loans. Such reform measures also go a long way in building investor confidence.

Revised Prompt Corrective Action Framework-

In 2017, with the idea to implement the Basel III norms, the RBI revised the Prompt

Economic Action Framework for Banks8. Capital, asset quality and profitability were the key areas for monitoring. The instruments of monitoring included CRAR, Net NPA Ratio, profitability and Return on Assets. It mandated banks to prepare a recovery plan in cases of emergency, manage credit and market risks. PCA framework is applicable to all the banks operating in the country including small banks and foreign banks. Inability to maintain the standards enunciated by the RBI, banks will be brought under the purview of PCA. The banking regulator can impose a host of restrictions on banks, ranging from restrictions related to the expansion of a branch, dividend and director’s remuneration and so on.

Asset Quality Review

While self-regulation is crucial, RBI has been actively engaging in the process of Asset Quality Review (AQR) initiated in 2015. RBI’s detailed assessment of the bank’s overall lending helps it to analyse the vulnerability of a bank to risky lending. It was through AQR, under which RBI has been continuously monitoring banks, that the rising level of NPAs were addressed. Besides the AQR, the RBI’s Strategic Debt Restructuring scheme have allowed banks to convert their loans to corporates and entities into major equity in the company. This is an innovative strategy that has protected banks from potential defaulters and added a new revenue stream.

Merger of Banks

Since 1991, fewer but stronger PSBs have been envisaged to create an efficient banking system capable to address the needs of a developing economy. These stronger PSBs were envisioned to act as catalysts of growth for the banking sector and provide a robust framework capable to withstand the headwinds of international economy. Merger of PSBs was reiterated by the Narasimhan Committee in 1998 and again the Leeladhar Committee in 2008. Beginning 2017, government has initiated a set of reforms for merger of banks in the country. Since then, the number of PSBs has been reduced to 12. Post these mergers, profitability of banks has consistently risen as presented in figure 1. Profitability figures are also a result of reduced NPAs, lower cost of operation, better geographical coverage and higher economies of scale.

National Asset Reconstruction Company Limited

To enable asset reconstruction, budget 2021-22 announced the formation of an ARC-AMC structure, comprising of two entities for aggregation and resolution of NPAs in the Banking Industry. It has been set up with a strategic initiative to clean up the legacy stressed assets with an exposure of Rs 500 crore and above in the Indian Banking system. It will provide assistance in consolidation of debt, currently fragmented across various lenders, thus leading to faster, single point decision making including through IBC processes, where applicable. It will incentivize quicker action on resolving stressed assets thereby helping in better value realization.

Indian banks, which are the backbone of the economy and are vital for stimulating a virtuous cycle of economic growth, have been witnessing reforms under the government’s 4R strategy, namely Recognition, Resolution, Recapitalisation and Reform.

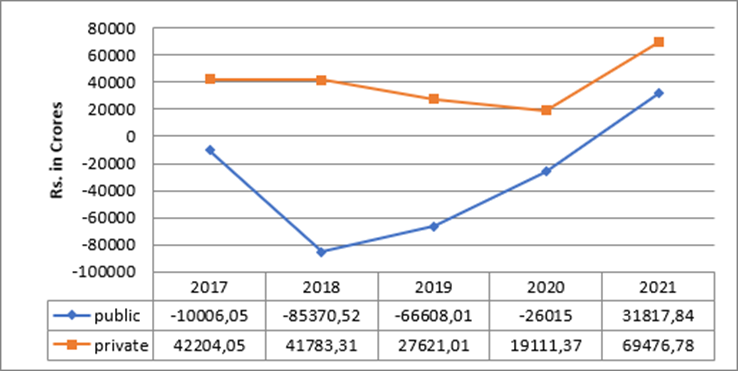

Fig. 1.: Net Profits of public and private sector banks in India Source: ResearchGate

Ease of Doing Business

For a country like India, setting up a business, operating it and maintaining it were considered to be a meticulous task. The fear of failure of a startup was persistent and continued to plague the development of wealth creators. To give the much-needed boost to entrepreneurship, creation of an investor-friendly ecosystem is crucial. This requirement was felt by the Modi government which worked towards improving ease of doing business. Improvement of India’s ranking in World Bank’s Ease of Doing Business became a priority.

GoI launched the PM MUDRA Yojana wherein loans of upto 10 lakh are provided to income generating micro enterprises engaged in manufacturing, trading and services sectors. More than 37.76 crore loans amounting to over Rs. 20.43 lakh crore have been disbursed since inception of the Scheme in April 2015. It has helped in generating 1.12 crore net additional employment during a period of nearly 3 years 9. India ranked 25 in terms of getting credit with the successful implementation of this scheme.

Real Estate (Regulation and Development) Act, 2016

For setting up any business easily, the process of getting construction permits needs to be streamlined. Recognising this gap, Parliament enacted the Real Estate (Regulation and Development) Act, 2016 that significantly helped reduce corruption in acquiring land, building construction and enabling physical operations of the business. Post this major reform, India’s rank improved significantly in this parameter to 27. RERA made it mandatory for builders to register their projects before the start of the project. It also seeks to address other issues like pricing, quality of construction, and other charges. While this has greatly improved ease of doing business, RERA has had a larger impact on improving the real estate sector by providing much-needed transparency.

The third key parameter associated with improving ease of doing business is continued access to electricity. Power reforms related to distribution and transmission have improved the health of state-owned Discoms, thereby ensuring electricity for businesses.

Implementation of the Deen Dayal Updhyay Gram Jyoti Yojana (DDUGJY) and SAUBHAGYA has allowed 100% electrification of rural households enabling them access to electricity and providing better opportunities.

Insolvency and Bankruptcy Code, 2016

Another key aspect of improving the business climate in the country to make it attractive for global investors was allowing easier exits to investors in case of unsuccessful ventures. The Insolvency and Bankruptcy Code (IBC) was enacted in 2016. It provides time-bound processes for insolvency resolution of companies and individuals by licensed Insolvency Professionals (IPs). The Code specifies similar insolvency resolution processes for companies and individuals, which will have to be completed within 180 days. The resolution process will involve negotiations between the debtor and creditors to draft a resolution plan, paving the way for a process-driven exit in a time-bound manner. IBC has significantly helped improve India’s ranking as it ranked 52 in Resolving Insolvency parameter.

IBS allows visibility to investors in case of unsuccessful business ventures. Easier exits give comfort to global investors to evaluate alternate investment opportunities.

Author Brief Bio: Gaurie Dwivedi is a senior journalist and author.

References:

- Economic Survey 2019-20, Chap 1: Wealth Creation – The Invisible Hand Supported by the Hand of Trust.

- https://data.worldbank.org/indicator/NY.GDP.MKTP.KD.ZG?end=1986&locations=IN&start=1961

- https://pdf.usaid.gov/pdf_docs/PNACR801.pdf

- https://prsindia.org/files/policy/policy_committee_reports/Aatma%20Nirbhar%20Scheme.pdf

- Economic Survey 2020-21. Chap 7: Regulatory Forbearance – An Emergency Medicine, Not Staple Diet!

- Economic Survey 2019-20, Chap 1: Wealth Creation – The Invisible Hand Supported by the Hand of Trust.

- https://www.rbi.org.in/commonperson/english/scripts/Notification.aspx?Id=2523

- https://pib.gov.in/PressReleaseIframePage.aspx?PRID=1882885

- https://www.ventureintelligence.com/Indian-Unicorn-Tracker.php