The general view of the relationship between governments and industry is that the government formulates the operating framework for industries to operate on an arms- length distance from the government, except where government intervention is required for operational issues such as the issuance of a license, issuance of permits, taxation, etc. The government plays a limited role in formulating the vision for the industry or creating new industries, hence sticking to the principles of laissez-faire capitalism.

However, that is not how the world’s advanced economies have been operating, irrespective of whether they are capitalists or otherwise. Governments are deeply intertwined with the industries, and the industries’ growth has a direct impact on the government and its ability to gather taxes and spend on public goods such as infrastructure. These governments have evolved precedents and processes that are able to react to both immediate issues concerning the industries and long-term strategic issues impacting the industries and hence the economy. A key governance structural differentiator between advanced economies and the growing economies is how closely the government coordinates with the industries in the advanced economies to orchestrate growth within the economy and leadership globally.

As an example, in the Mecca of laissez-faire, the USA, PCAST (President’s Council of Advisors on Science and Technology), which is a govern- ment committee, came out with a report in 2017 that urged the government to take urgent steps for ensuring that the US industries regain their global leadership in semiconductors. Hence whatever needs to be done from a technology development perspective, global trade regime perspective, or a geopolitical perspective would be initiated by the US government.[i] The PCAST report concluded by saying: “we strongly recommend a coordinated Federal effort to influence and respond to Chinese industrial policy, strengthen the US business environment for semiconductor investment, and lead partnerships with industry and academia to advance the boundaries of semiconductor innovation. Doing this is essential to sustaining US leadership, advancing the US and global economies, and keeping the Nation secure”. The matter of leadership in semiconductors is not being left to laissez-faire, contrary to popular beliefs of how the US government operates.

The proactive steps by the US Government do not stop at only promoting its semiconductor industry. It also ensures that other nations, especially China do not overtake its companies and its technologies. In September 2017, as one of the first actions of the then newly elected US President, President Trump issued an executive order blocking Lattice Semiconductor Corporation’s proposed acquisition by Canyon Bridge Capital Partners, which was partly funded by China’s central bank[ii], under the CFIUS (Committee on Foreign Investment in the United States) framework. The US government did not want any crucial technology to be leaked to China.

If we look at the Chinese economy, given that a large number of its companies are actually believed to be driven by the People’s Liberation Army (PLA), it is in the deep interest of the government to ensure that these companies, that are both traditional[iii] and in new-age industries[iv], succeed. Moreover, this is largely because the profits from these behemoths actually find their way back into the coffers of the government and/ or the army or into those who control the government and the army.

Such close coordination between the government and the industry is not a feature of only communist countries and should not be dismissed as such. A quick look across the advanced economies in the world shows that these economies have maintained their leadership and grown because of the government’s close coordination with the industry. It is to be noted that technology has been a key driver of wealth generation of the advanced economies and that the technology leadership of the advanced economies has been aided by global trade regimes such as TRIPS (Trade-Related Aspects of Intellectual Property Rights) which helped in maintaining their lead in technology, besides several other policy driven factors[v].

Role of the US Government in creating and supporting its Technology Industries

In the 20th century, the western world and Japan were the technological leaders, and hence the global economic leaders. These nations’ governments set the direction of technology leadership that they would like to achieve and then carefully assimilated technologies from around the world and built on it rapidly to create new technologies and industries. Such orchestration of industry leaders on a global stage happened through close coordination between the government and the industry, with appropriate policies at local and global levels.

As early as in 1791, Alexander Hamilton wrote the ‘Report on Manufacture’[vi] in which he urged for an activist and mercantilist approach by the US federal government regarding its economy. This was one of the earliest articulations of the government providing a direction in the role of technology for economic development. In the same decade, the federal government played an instrumental role in developing new production techniques and technologies by turning individual entrepreneurs with innovative ideas.

The United States has become a much- admired global economic and military superpower on its technological leadership. The US government has actively and repeatedly intervened in its technology industries to develop and promote what is usually termed as “moonshot” projects. These projects are aimed at developing groundbreaking and exploratory technologies and are initiated by active and ambitious government efforts in tandem with their industry, which results in enormous benefits for the domestic US technology industry. This framework of government pushing technology development initiative with the private sector leading it has been followed by all countries since then, without exception, who have become leaders in technology. One of the earliest pushes by the US govern- ment on their strategic pursuit of dominance of technology was the push for gaining leadership in the telegraph technology. In 1842, the feasibility of Samuel Morse’s innovation of the telegraph was demonstrated with the funds appropriated by the US Congress. This initiative set the US industry players to become serious competitors in the telegraph industry and create very large number of jobs for Americans.[vii]

Similarly, the US government’s strategic intent in the second half of the 19th century to be a leader in the railway industry led to the creation of the US Railway network. The US federal government passed the Pacific Railroad Act of 1862 and the Union Pacific Act of 1864, which played an instrumental role in developing the US railway network. These acts provided substantial and significant financial incentives for the development of the US rail network[viii].

The US government has continued to pursue its policy of attaining leadership in strategic areas of technology by providing a guiding hand to its capitalistic industry, right into the 21st century, and continues to do so even today. Below are a few examples of the US federal government’s push into key technologies that led to the US gaining tremendous leadership in these areas:

- Development of dual-use industries, such as aircraft frames, engines: The National Advisory Committee for Aeronautics,[ix] formed in 1915, contributed significantly to the development of the US aircraft industry, a role it still plays, helping the US to stay as one of the global leaders in aeronautics. In fact, in 1917, the government also initiated pooling of patents to create the Manufacturers Aircraft Association, to help create a formidable domestic aircraft manufacturing industry. [x]

- Radio- By pooling patents, providing equity, and encouraging General Electric’s participation, the US Navy helped to create the Radio Corporation of America[xi]

- Computer Industry – Originated from the US government’s wartime support for a program that resulted in the creation of the ENIAC (Electronic Numerical Integrator and Computer), one of the earliest electronic digital computers, and the government’s encouragement of the industry in the postwar [xii] It was built by University of Pennsylvania and funded by the Army Ballistic Research Laboratory. It led to the US becoming the leaders in computing globally.

- Internet – Government support through the US Defense Department and the NSF played a critical role in the development of the Similarly, microelectronics, robotics, biotechnology, nanotechnologies, and the investigation of the human genome received significant support from the US government, which has turned these areas into major economic activities in the US. As Vernon W. Ruttan has observed, “Government has played an important role in technology development and transfer in almost every US industry that has become competitive on a global scale.”[xiii] Importantly, the US economy continues to be distinguished by the extent to which individual entrepreneurs and researchers take the lead in developing innovations and starting new businesses. In doing so they often harvest crops sown on fields made fertile by the government’s long-term investments in research and development.

European Government efforts for Technology Dominance

Europe and the European Union have continuously strived to gain leadership in technology through their industries. They have invested significant taxpayers’ money and governmental effort to remain ahead of the technology curve through guided innovation.

The European Union (EU) continues to stress on innovation at both the Union level as well as the regional level. For Europe 2020, the three priorities identified include smart growth, sustainable growth, and inclusive growth. The EU’s Innovation Policy places a strong emphasis on social innovation, recognising it as “an important new field which should be nurtured.” The Policy suggests creating a virtual hub of social entrepreneurs and supporting them with a European Social Fund (ESF)[xiv].

In the UK, the existing framework under the Department for Innovation, Universities & Skills (DIUS) has focused on the lifelong learning and early-stage venture capital front. The Innovation Nation White Paper[xv] outlines the future of innovation in the country, providing intellectual leadership by suggesting new policies based on new imperatives. Highlights include provisioning for ‘hidden’ innovation and demand-driven ideas and fostering collaboration between public, private and non-governmental organisations (NGOs) to transform public services. Aside from this, it stresses on reforming the Small Business Research Initiative (SBRI) and incentivising enterprises with investment and expertise to convert research into innovation. To prepare the next generation of innovators, it recommends getting educational institutions to emphasise on STEM (science, technology, engineering and mathematics) subjects.

Leadership in semiconductors has been one of the key focus areas of both the US and the European governments. The US has been leading the race through its early government initiative through the creation of the SEMATECH consortium.[xvi] In a mould similar to SEMATECH, The Interuniversity Micro-Electronics Centers (IMEC) in Flanders in Belgium, is one of the world’s largest semiconductor research partnerships and strives to be a global “centre of excellence”. The organisation, which received around half of its €285 million in revenue in 2010 from company research contracts and most of the rest from the Flemish government and the European Commission, has a staff of 1,900 and more than 500 industrial residents and guest researchers. It also has research partnerships in the Netherlands, Taiwan, and China. It has “core partnerships” with Texas Instruments, ST Microelectronics, Infineon, Micron, Samsung, Panasonic, Taiwan Semi- conductor, and Intel, and “strategic partnerships” with major equipment suppliers.

IMEC emphasises pre-competitive research that is three to 10 years ahead of industry needs, and therefore takes on risky projects that partners cannot afford to do on their own. Researchers from academia and industry work together under the same roof on areas that include chip design, processing, packaging, microsystems, and nanotechnology. In July 2005, IMEC produced its first 300 mm silicon disks with working transistors, in a new 3,200-square meter facility. A production ASML lithography system installed in 2006 offered capabilities that at the time were beyond those available even at the U.S.-based SEMATECH.

The Texas Instrument executive Allen Bowling noted that moving a new material or device into production requires seven to 12 years of pre- competitive research.[xvii] This is where IMEC has been of “great value” to its members, by reducing the cost of each company, while making Europe competitive from a cost perspective in the semiconductor space.

Also, given that electric vehicle technologies and lithium-ion batteries / other battery technologies are widely believed to be the next big industry, the European Union and many of its governments are marshalling its resources to ensure that Europe stays in the forefront of these new technologies.[xviii] In fact, EU had set a target of 8-9 million Electric vehicles (EV) on the road by 2020, to boost its strategic intent of dominating the EV industry. France had a goal of 2 million EVs on the road by 2020; Germany had 1 million by 2020; Spain had a goal of 1 million EVs by the end of 2014, The Netherlands had 200,000 EVs as its 2020 target. The targets send out a strong signal to the industry in terms of the government’s commitment and support for large-scale EV adoption.

Initiatives of the French Government

The French government has consistently taken a leadership role in ensuring that France maintains its leadership in select areas of technology such as smartcards, semiconductors etc. France had gained leadership in semiconductor research through a consortium involving ST Microelectronics, Philips, and Freescale that worked till 2007. The French government intervened in 2007 to launch a massive initiative called Nano 2012.[xix] Nano 2012 was supposed to be one of the largest industrial projects in France, that targeted to make the Grenoble region a world centre for developing 32nm and 22nm CMOS (Complementary metal oxide semiconductor) technologies. The program involved nearly €4 billion in funding from the national, state, and local governments for R&D and equipment. The consortium partners included CEA-Leti Institute for Micro and Nanotechnology Research; IBM’s Fishkill, NY, semiconductor production complex; ST Microelectronics; the University of New York at Albany; ASML Holdings of the Netherlands; and Oregon-based and ST Mentor Graphics of Wilsonville, Oregon. The initiative was housed at MINATEC, a campus in Grenoble.

In addition to providing space, MINATEC also helped bring in academic programs from four universities. MINATEC also brought in its then state-of-the-art facility for 300 mm silicon wafer centre, a 200 mm micro-electro-mechanical systems (MEMS) prototyping line for fast development of new products, and one of Europe’s best facilities for characterizing new nano-scale materials. The Nano 2012 facility houses 3,000 researchers and 600 technology transfer experts.

It is critical to note that for every five researchers, there is one technology transfer expert. MINATEC has been publishing over 1,600 research papers per year and has been filing over 350 patents per year.

MINATEC is supported by over 200 industrial partners that includes Mitsubishi, Philips, Bic, and Total. Two-thirds of its annual €300 million annual budget comes from outside contracts. The French and local governments also provide it with funding, in addition to funding from the French Atomic Energy Commission and private investors. MINATEC forms a powerful tool of the French government to keep France in the forefront of semiconductor and other high technologies.

Way back in 2009, the French government also identified Lithium-ion batteries as a focus area. The French Atomic Energy Commission and the French Strategic Investment Fund formed a joint venture with Renault and Nissan to manufacture lithium-ion batteries[xx]. The efforts led to the setting up of a €600 million plant in Flins in France that can produce up to 100,000 batteries a year. The venture also has built plants in Portugal, Great Britain, and Tennessee. The French company Saft supplies lithium-ion batteries to Mercedes, BMW, and Ford.

In 2010, The French government had set a target of having 2 million electric vehicles on the road by 2020.[xxi] Government-linked companies such as Electricité de France, SNCG, Air France, France Telecom, and La Poste have committed to buying electric vehicles. In addition, the government is investing €1.5 billion to support up to 1 million public charging stations.

Initiatives of the Japanese Government in High Technology

METI (Ministry of Economy, Trade and Industry) of the Government of Japan has been playing a pivotal role in ensuring that the Japanese industry stays as one of the leaders in the world of high technology. The government has many key initiatives that are ensuring that Japan maintains its technology lead. The METI model has been adopted in various forms by South Korea, Taiwan, and China, powering their industries into leadership in various areas.

The Japanese government realised that the Japanese industry needs to have a dominant play in semiconductors. When the Japanese semiconductor industry suffered a slump in the 1990s, policymakers looked to the past for ideas about how to revive it. Having been very pleased with the results of the Very Large-Scale Integrated Circuit (VLSI) project in facilitating the rise of Japanese semiconductor industries in the 1980s (Morris 1990), Japan launched an armada of projects that mirrored this strategy, including the Semiconductor Leading Edge Technologies, Inc. (SELET,[xxii] Association of Super-Advanced Electronics Technologies (ASET),[xxiii] Semiconductor Technology Academic Research Center (STARC), Millennium Research for Advanced Information Technology (MIRAI), Highly Agile Line Concept Advancement (HALCA), Advanced SoC Platform Corporation (ASPLA)6 (ERI-JSPMI 2002) and Extreme Ultraviolet Lithography System Development Association (EUVA).

For example, the Association of Super- Advanced Electronics Technology (ASET) that focuses on equipment and chip R & D has produced more than 100 patents and completed a number of projects with industry, including ones that developed technology for X-ray lithography and plasma physics and diagnostics. ASET had also launched the Dream Chip Project, which focused on 3-D integration technology. It had also started an initiative on next-generation information appliances.

In 1996, the Japanese government also played a key role in pushing the industry to form the Semiconductor Leading Edge Technology Corp (SELETE), a joint venture funded by 10 large Japanese semiconductor companies[xxiv]. The consortium conducts collaborative R&D for production technologies for wafer equipment, which is then used by the consortium members to exploit in a competitive environment commercially.

The Japanese government also helped create the Millennium Research for Advanced Information Technology (MIRAI) program, for alternative materials for future large-scale integrated circuits which focused on technologies such as extreme ultraviolet lithography for 50-nm device manufacturing in conjunction with 10 Japanese device and lithography equipment purchasers.[xxv] In 2010, the Japanese government also launched a number of initiatives to shore up its share of the overall global lithium-ion battery market. Japan’s New Energy and Industrial Technology Department Organisation (NEDO) have developed an ambitious roadmap that sees lithium-ion as the dominant battery technology. The Ministry of Economy, Trade, and Industry has a roadmap for the automotive industry that calls for up to 50 percent of cars to be “next-generation” electrified vehicles and up to 70 percent by 2030. The roadmap also envisions up to 2 million regular chargers and 5,000 rapid chargers deployed across the country to “pave the way for full-scale diffusion.” In fact, way back in 2010, the government’s Fiscal Year budget included ¥3 billion for collaborate R&D by the government, industry, and academia for innovative batteries.

Role of Ministry of Economy, Trade and Industry (METI)

The evolution of the Japanese technology policy shows that it is not just limited to technological advancement, but rather, there are significant economic, political and institutional implications. Thus, a comprehensive approach is needed to prevent generating any negative outcomes and to take advantage of the synergy among different policies. Concerning the investment in the innovation process, the presence of market failures and the fact that the social rate of return is superior to the private rate of return justifies the State’s intervention.

Although a clear philosophy was already expressed in a 1949 white paper (After WW II), the Japanese technology policy was often dictated by short-term visions and external pressures until a new philosophy was brought in. The new philosophy, with a particular emphasis on social contribution, fixed objectives that promote tripartite cooperation between government, industry and academia, to create a competitive environment and set an evaluation system. The system attempts to remove or reduce existing barriers to free the flow of people and ideas, set the rules of the game, and generate the dynamics of innovation.

Japan’s technology policy generally uses a top- down approach. The State acts as a social planner by making decisions based on the information it possesses in consultation with relevant stakeholders. This is the structure that has been followed by other Asian countries that subsequently became economic powers. Perhaps this is the structure that India should look at very closely to power its own growth.

Digital Breakthrough Economies

Digital breakthrough economies are those economies that became leaders in technology in the last fifty years. Concerted efforts by their governments helped these nations achieve a pole position in certain specific areas of technology. They offer significant learning for India as India attempts to become a leader in Digital technologies.

Taiwan

Public-private research programs have led Taiwan’s leadership in semiconductor design and fab since mid-1970s. One can say that Taiwan’s dominance in semiconductors started with the government-funded Industrial Technology Research Institute (ITRI) by acquiring the 7-micron chip technology from RCA to spin off UMC, a leading global semiconductor foundry.[xxvi] ITRI also helped launch TSMC, the world’s dominant foundry. ITRI continues to operate substantial semiconductor-related R&D partnerships. The institute’s Electronics and Optoelectronics Research Laboratories, for example, include programs in fields such as next-generation memories and chips for lighting and 3D imaging.

Taiwan is leveraging its advantage as a leader in both semiconductor and flat-panel display manufacturing, which uses similar production processes to make both crystalline silicon and thin- film cells rival China a photovoltaic exporter. Taiwan ranks behind only China in crystalline silicon cells, with over 230 companies across the entire supply chain. Three companies, Gintech, Motech, and Solar Power, each are building 1.2 gigawatts to 2.2 gigawatts in new production lines. Industry consortia organised through Taiwan’s Industrial Technology Research Institute are developing a range of processes for thin-film cells and printable photovoltaic cells, technologies that also are being developed by Taiwanese producers of digital displays and solid-state lighting devices. Government incentives for manufacturers include a five-year tax holiday, credits that cover 35 percent of R&D and training, accelerated depreciation for facilities, and low-interest loans. Taiwan also offers an array of subsidies to accelerate domestic deployment of solar power, targeting 10 gigawatts of capacity. The government funds 100 percent of some photovoltaic projects in remote areas, as well as several “solar city” and “solar campus” demonstration projects. Under the Renewable Energy Development Act, Taiwan implemented a feed-in tariff that would incentivise distributed production of solar energy that could then be fed into the grid.

Taiwan aims to become one of the top three lithium battery producers in the world. This goal is spearheaded by Industrial Technology Research Institute (ITRI). ITRI formed the High Safety Lithium Battery STOBA consortium of Taiwanese companies to promote the development and diffusion of STOBA-based battery technology. As of 2011, four Taiwanese companies had entered into production of STOBA lithium batteries and the local industry was projected to invest $1.7 billion in 2012.

Korea

The phenomenal post-war development of South Korea is one of the most remarkable economic stories of the twentieth century. The small Asian nation in 1960 was one of the world’s poorest countries, with a Gross Domestic Product roughly equal to that of Ghana and its per capita income being lower than that of India. In the next fifteen years, it transformed into the twelfth largest economy in the world with its per capita GDP being four times that of India. This transformation was orchestrated by Government intervention through a combination of state-directed bank financing, light and then heavy industrial export promotion, fostering of large industrial conglomerates (the fabled chaebol), and suppression of labor unions to create workplace peace.

These initiatives of the Korean government have culminated with South Korea being counted as a developed economy. As per Campbell[xxvii] underlying Korea’s strong economic development has been a consistent effort to create a robust science and technology (S&T) capacity. From the beginning of Korea’s export-oriented drive in the 1960s, this has followed two parallel tracks: creation of a state-led research and educational capacity, centred on state-run research institutes, and in-house research and development efforts by the chaebol and some medium-sized firms. Universities, which were relatively weak S&T players till the late 1990s, were strengthened through government intervention.

South Korea largely followed the METI model of Japan and worked closely with its chaebols to create technology powerhouses such as Samsung, LG, Hyundai etc.[xxviii],[xxix] In fact, five of the biggest chaebols make up more than half of the Korean Stock Market’s benchmark index.[xxx] From 1961- 1988, the Korean Government created a rudimentary research capacity, focused on creation of government-run research institutions, a technical university, and a central research park, as the private sector gradually began to muster its own applied research capacity[xxxi]. In the subsequent decade, the Korean chaebols became the leaders of R&D initiatives in Korea. The government provided significant funding for the National S&T Technology Program which became the preferred institution for catapulting the chaebols and the Korean industry into technology leaders. This program was later replaced by the 21st Century Frontier Program and specified research funds. By the turn of the century, Korea had achieved strong aggregate performance in terms of numbers of researchers and funds spent on R & D and continued to build on that advantage. The IT industry and, to a lesser extent, biotech have become the major drivers of technological and economic development. The government played a key role in growing the nascent IT sector, through a combination of privatisation of the national telephone service provider, creation of infrastructure, and dispute moderation.

As per Campbell, from the mid-1990s, Korean government has pushed for the possibilities of “Big Science,” i.e., basic or foundational science. Korea participates in various international basic science programs, and has created another big state funding effort (the 577 program) to support basic science. The government has spent much policy effort on drafting “visions” of future technological developments.

It would indeed be useful for India to look at the institutional structures adopted by Korea to transform itself so quickly, with a heavy focus on close coordination with the industries in gaining leadership in technology closely.

China

China was the next big economy after South Korea that rapidly transformed its economy from a low-income economy to an upper-middle-income economy in a short span of twenty years. China borrowed heavily from the Japanese and the Korean models to harness resources and accelerate growth in its economy. Besides the tools of using

- consortium led technology development and

- polices and regulations that are favourable to its domestic industries, it also heavily relied on a new state sanctioned policy tool for technology acquisition—illegal acquisition of technology through piracy, cyber hacks, state sanctioned IPR violations, forced surrender of IPR of western entities and other mechanisms that did not follow rule-based technology acquisition.

China has now emerged as a strong science and technology innovation player. The Organisation for Economic Co-operation and Development (OECD), along with the Ministry for Science and Technology, have been reviewing the policies for innovation in the country and have come up with gaps that we, in India, would be quite familiar with. As its medium and long-term objective, China wants its dependence on foreign technology to reduce by 30 per cent and be among the top five countries in the world in terms of domestic invention patents granted, and the number of international citations of its scientific papers.

Chinese government regards the coming up of a domestic, globally competitive semiconductor industry as an utmost priority with a stated goal of becoming self-sufficient in all areas of the semiconductor supply chain by 2030. China faced significant barriers to entry in this mature, capital- intensive, R&D-intensive industry.[xxxii] China also offered many forms of support to photovoltaic manufacturers. For example, producers could access cash grants of between ¥200,000 and ¥300,000 ($30,900 to $46,300) available to high- tech startups that are less than three years old with no more than 3,000 employees.

Large “demonstration projects” by manufacturers get grants of up to ¥1 million. The China Development Bank offered low-interest loans of several billion dollars for major production plants. The bank reportedly provided $30 billion in low-cost loans to photovoltaic manufacturers in 2010. A number of Chinese provinces offered further incentives, including refunds for interest on loans and electricity costs, 10-year tax holidays, loan guarantees, and refunds of value-added taxes. To open its production plant in China, Massachusetts-based Evergreen Solar was reported to have received $21 million in cash grants, a $15 million property tax break, a subsidised lease worth $2.7 million, and $13 million worth of infrastructure such as roads. Such subsidies have spurred massive expansion of production capacity. By the first half of 2009, some 50 Chinese companies were constructing, expanding or preparing polycrystalline silicon production lines.

The Chinese government has further set procurement rules that require products for “government investment projects” be purchased from domestic sources unless they are unavailable. Purchases of imported equipment require government approval. China requires that at least 80 percent of the equipment for its solar power plants be domestically produced.

China’s Ministry of Industry and Information Technology had plans to invest around ¥100 billion ($15.2 billion) by 2020 in subsidies and incentives over 10 years to support new-energy vehicle production. The government had set a target of selling 1 million electric vehicles a year by 2015 and aims to have 100 million by 2020. The government also offered a $9,036 subsidy to buyers of electric cars and subsidised fleet operations in 25 cities. By 2018, China was manufacturing 1.2 million electric vehicles. The National Develop- ment and Reform Commission identified lithium- ion cells and batteries as strategic industries, and several government programs subsidise China’s industry through investment and tax credits, loans, and research grants. To give its domestic industry an extra edge, the government essentially requires foreign battery companies to manufacture in China if they wish to sell there.

The Chinese government has now changed gears with bringing in tremendous focus on technologies that power the 4th Industrial revolution such as Artificial Intelligence, IOT, robotics etc.[xxxii] This focus of the government, in tandem with the industry, has placed China as one of the leaders in Artificial Intelligence, poised to gain from the economic benefits and the strategic benefits of being a leader in 4th industrial revolution technologies.

Government Supported Technology Acquisition for India

The question now is what are the institutional mechanisms that India should adopt, to make Indian economic players as leaders in various technology areas. India has been largely pursuing development of technology from scratch as the primary mechanism for technology development. In a few cases, such as the development of the Marut fighter aircraft, specialists were brought in from outside to help in the project. In the case of Marut, the renowned German aircraft designer, Kurt Tank was brought in, albeit by serendipity as Kurt Tank had chosen to live in India at that time[xxxiii],[xxxiv]. In limited other cases, joint ventures were used to catapult India to technology leadership, such as the Bramhos supersonic cruise missile project that is a joint venture between Indian and Russian state-owned defence research entities[xxxv].

However, there have been limited centralised initiatives to marshal the nation’s resources to catapult Indian industry to the heights of technology leadership. In February 2020, the Indian govern- ment constituted an empowered Technology Group (TG)[xxxvi] for providing timely policy advice on latest technologies; mapping of technology and technology products; commercialisation of dual use technologies developed in national laboratories and government R&D organisations; developing an indigenisation road map for selected key technologies; and selection of appropriate R&D programs leading to technology development. The empowered Technology Group stops short of actual acquisition of technology and the technology ecosystems that is necessary to help the Indian industry gain dominance.

For example, very few will debate the fact that India’s burgeoning aviation industry calls for India having its own single aisle passenger aircraft. It is expected that India will require 2,300 single aisle aircrafts worth USD 320 billion in the next 20 years [xxxvii]. By creating India’s own aircraft manufacturing industry, it is obvious that a large number of jobs, economic benefits and associated strategic benefits will accrue to India. However, aircraft manufacturing is extremely complex and requires hundreds, if not thousands of component manufacturers. It would take decades to build the ecosystem and the technologies to be able to have a single aisle aircraft that is state of the art and is able to compete with other aircraft manufacturers globally. Hence, it would be almost futile to pursue such a program and divert billions of dollars from other more pressing needs of the country. However, as of 2020, there are opportunities to acquire aircraft manufacturers at very low costs, with a running book, a running team and with an existing ecosystem. A prime example is the Brazilian aircraft manufacturer, the Embraer as well as possibly the Sukhoi SSJ100 regional jet. The Embraer was to be acquired by Boeing for USD 4.3 billion for 70% stake.[xxxviii] With that arrangement not coming through, Embraer could potentially be acquired by an Indian entity, backed by the Indian government.

The question is, what is the backing that is needed from the Indian government for such an acquisition? For starters, an acquisition of this kind has to be a leveraged buyout (LBO), which implies that the purchase has to be funded by the company’s future sales. Thus, the Indian government can provide support by pushing banks to be the lenders for the deal. In addition, perhaps the Indian military can purchase transport aircrafts to enable the order book to roll. For the future, policies and regulations can be adopted to provide preferential access to the Indian market as well as markets where India can expert geopolitical influence. In addition, interested Indian business houses can be selected through an open process. For sure, the Indian government would have considered the above acquisition. The larger point is, do our acquisition mechanisms provide for the agility needed to grab such opportunities? Or do we need to create a special institutional mechanism to be able to go out and acquire technology in a much more rapid manner, with a quicker response to market opportunities. Similarly, there are other mechanisms of technology acquisition that have been adopted by other nations that India needs to deploy in a concerted manner.

In summary, technology acquisition needs to be done, along with creation of entire ecosystems, in a combination of the following manners:

- Build new technologies in-house with Indian private sector through procurement

- Create consortium of Indian players to pool and build new technologies

- Buy technologies from outside India

- Hire experts from outside India who have built the technologies

- Buy companies that have the technologies

- Get the technology by other means

- Innovation in procurement

Along with the above, a CFIUS like regulation and its active implementation would also be necessary to protect the technologies acquired and developed in India [xxxix].

Conclusion

India would need to adopt an institutional structure to be able to rapidly acquire technology and technology ecosystems for its industries in order to accelerate its growth and increase per capita GDP of the nation.

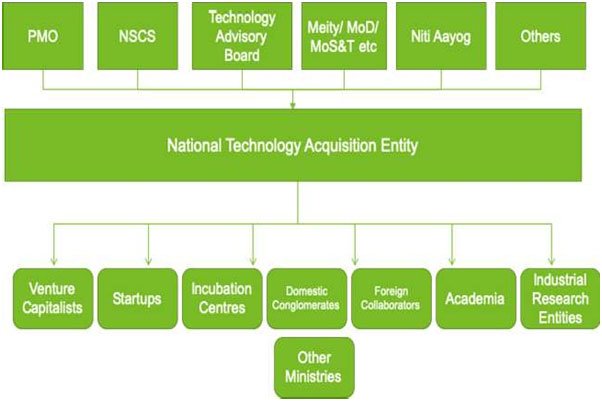

It is proposed that perhaps a National Techno- logy Acquisition entity be formed that works with the existing institutions of National Society of Collegiate Scholars (NSCS), Technology Group, Ministry of Electronics & Information Technology (Meity), MOD, MoS&T, Niti Aayog and other line ministries, while marshalling the resources from banks, venture capitalists, startups, incubation centres, domestic conglomerates, academia, industrial research entities and foreign collaborations, as shown in figure below:

Similar structures have been proposed earlier by the author[xxxx] in 2013, and in 2015[xxxxi]. Such a structure would lend towards bringing in all the mechanisms of technology acquisition across the civilian and dual- purpose industry landscape in a credible manner and help power the Indian economy towards global leadership.

*Dr Jaijit Bhattacharya is a noted expert in technology policies and technology-led societal transformation. A recipient of the prestigious APJ Abdul Kalam Award for innovation in Governance, he is currently President of Centre for Digital Economy Policy Research. He is also CEO of Zerone Microsystems Pvt Ltd, a deep-tech startup in the fintech sector.

References:

- [i]PCAST, “Report to the President – Ensuring Long-term US Leadership in Semiconductors”, January 2017, https://obamawhitehouse.archives.gov/sites/default/files/microsites/ostp/PCAST/pcast_ensuring_long- pdf

- [ii]https://jdsupra.com/legalnews/president-trump-blocks-his-first-cfius-93044/

- [iii]Jingrong Lin, Xiaoyan Lu, Junsheng Zhang, Ying Zheng, “State-owned enterprises in China: A review of 40/ years of research and practice” in China Journal of Accounting Research, Volume 13, Issue 1, March 2020, Pages 31-55

- [iv]Evan Medeiros, Roger Cliff, Keith Crane and James C. Mulvenon, Chapter “The Digital Triangle”: A New Defense-Industrial Paradigm?” in “A New Direction for China’s Defense Industry, published by RAND Corporation (https://www.jstor.org/stable/pdf/10.7249/mg334af.12.pdf)

- [v]Jaijit Bhattacharya (2010) Technology Standards: A Route to Digital Colonization, IETE Journal of Education, 51:1, 9-21, DOI: 1080/09747338.2010.10876064

- [vi]https://founders.archives.gov/documents/Hamilton/01-10-02-0001-0007

- [vii]Samuel B. Morse Papers at the Library of Congress, 1793 to 1919, at “https://www.loc.gov/collections/ samuel-morse-papers/articles-and-essays/invention-of-the-telegraph/”

- [viii]National Research Council, Policy and Global Affairs, Board on Science, Technology, and Economic Policy, Government-Industry Partnerships for the Development of New Technologies, Page 48

- [ix]The National Advisory Committee for Aeronautics, An Annotated Bibliography, https://history.nasa.gov/ pdf

- [x]David Serafino, Knowledge Ecology International, KEI Research Note 2007:6, page 16 4 June 2007 (https:/www.keionline.org/book/survey-of-patent-pools-demonstrates-variety-of-purposes-and-management- structures)

- [xi]Funding a Revolution: Government support for Computing Research, Chapter 4, pg 85-90, 1999. (https:// nap.edu/read/6323/chapter/6)

- [xii]Funding a Revolution: Government Support for Computing Research, Chapter 7, pg 85-90, 1999. (https:// nap.edu/read/6323/chapter/9)

- [xiii]https://www.nap.edu/read/10584/chapter/6#p200060ff8960051003

- [xiv]Europe 2020 Flagship Initiative Innovation Union, Communication from the commission to the European parliament, the council, the European economic and social committee and the committee of the regions, Brussels, 10.2010

- [xv]Innovation Nation Department for Innovation, Universities & Skills, presented to Parliament by the Secretary of State for Innovation, Universities & Skills, March 2008.

- [xvi]https://darpa.mil/about-us/timeline/sematech

- [xvii]Charles W Wessner and Alan Wm Wolff, Rising to the Challenge: US Innovation Policy for the Global Economy, National Research Council (US) Committee on Comparative National Innovation Policies: Best Practice for the 21st Century, National Academies Press (US); 2012, ISBN-13: 978-0-309-25551-6ISBN- 10: 0-309-25551-1

- [xviii]Natalia Lebedeva Franco Di Persio Lois Boon-Brett, “Lithium ion battery value chain and related opportunities for Europe” in JRC Science for Policy Report, 2016

- [xix]https://www.minatec.org/en/

- [xx]https://autoblog.com/2009/11/05/renault-partners-with-atomic-energy-commission-to-build-batterie/

- [xxi]Amsterdam Round Tables in Collaboration with McKinsey & Co, “Electric vehicles in Europe: Gearing up for new phase”, Pg 15, 2014

- [xxii]Shuzo Fujimura, Chapter 10, Semiconductor Consortia in Japan: Experiences and Lessons for the Future in Lessons from a Decade of Change in “21st Century Innovation Systems for Japan and the United States: Report of a Symposium”, page 126-103, 2009

- [xxiii]Lessons from a Decade of Change in “21st Century Innovation Systems for Japan and the United States: Report of a Symposium”, 2009

- [xxiv]Toshiaki Masuhara, Chapter 2, Current Japanese Partnerships: Selete and ASET in Securing the Future: Regional and National Programs to Support the Semiconductor Industry, pages 122-126, (2003)

- [xxv]Harayama Yoko, “Japanese Technology Policy: History and a New Perspective”In RIETI Discussion Paper Series 01-E-001, 2001

- [xxvi]Ying Shih, The role of public policy in the formation of a business network, Working Paper No 33 2010, Centre for East and South-East Asian Studies Lund University, Sweden

- [xxvii]Joel Campbell, Troy University, “Building an IT Economy: South Korean Science and Technology Policy”, in Issues in Technology Innovation, Number 19, September 2012

- [xxviii]Andy Hira, James Morfopoulos, Florence Chee, “Evolution of the South Korean wireless industry: from state guidance to global competition”, in International Journal of Technology and Globalisation 6(1/ 2):65 – 86, 2012

- [xxix]How South Korea Made itself into a Global Innovation Leader, https://nature.com/articles/d41586- 020-01466-7. 2020

- [xxx]Rachel Premack, “Issue: South Korea’s Conglomerates South Korea’s Conglomerates”, in SAGE BusinessResearcher, 2017

- [xxxi]Joel Campbell, Troy University, “Building an IT Economy: South Korean Science and Technology Policy”, in Issues in Technology Innovation, Number 19, September 2012

- [xxxii]Yujia He, “How China is Preparing for an AI-Powered Future,” The Wilson Center, June 20, 2017,

- [xxxiii] Chatterjee, “Hindustan Fighter HF-24 Marut; Part I: Building India’s Jet Fighter,” https://web. archive.org/; and Chris Smith, India’s Ad Hoc Arsenal: Direction or Drift in Defense Policy? (Stockholm: SIPRI, 1994) 160–62

- [xxxiv]https://britannica.com/biography/Kurt-Tank

- [xxxv]http://www.brahmos.com/content.php?id=1

- [xxxvi]https://pib.gov.in/PressReleasePage.aspx?PRID=1603642

- [xxxvii]https://economictimes.indiatimes.com/industry/transportation/airlines-/-aviation/india-will-need-2300- planes-worth-320-bn-in-20-yrs-boeing/articleshow/67159161.cms?from=mdr

- [xxxviii]https://in.reuters.com/article/embraer-m-a-suitors/embraer-seeks-business-partners-but-not-a-repeat-of-the- boeing-deal-idINKBN239141

- [xxxix]Jaijit Bhattacharya, “TikTok’s Shifting Of Headquarters Out Of China Will Make It No Less Predatory”, in Outlook, July 2020 (https://www.outlookindia.com/website/story/opinion-tiktoks-shifting-of-headquarters- out-of-china-will-make-it-no-less-predatory/356841)

- [xxxx]Jaijit Bhattacharya, “Strategic Implications of Internet Governance”, in CLAWS Journal, Winter 2013

- [xxxxi]Jaijit Bhattacharya, “Imperatives For Technological Sovereignty For A Credible Indian Defence Ecosystem”, in SALUTE, October 2015