“Permit me to issue and control the money of a nation, and I care not who makes its laws” – Mayer Amschel Rothschild, 1790

What began as a 2001 prediction by Jim O’Neill from Goldman Sachs[1] and became a geoeconomic reality in 2009 when the four states listed by him held their first summit in Ekaterinburg, Russia has now reached a crucial stage of evolution. Will it remain a club of five very diverse and even sometimes diverging powers huddling together every now and then to devise cooperative ventures in development finance, science, and technology or will it expand to accommodate new members and project itself as a non-western G-10, 20 or 40, reminiscent of the Non-Aligned Movement of the seventies or of the Group of 77 of the same period?

Will it be able to hold on to the principle of unanimity in its decision-making or will it split into two or more camps under the pressure of strategic rivalries and economic disagreements? Could it even turn into an alternative or rival of sorts to the UN Security Council, still dominated by the winners of the Second World War who refuse to really make room for the new great powers?

There are differences in the strategy to be followed with regard to the two most important decisions now under consideration. While China and Russia seemed to favour the rapid admission of new members, India and Brazil made it known that they wish to grant eligible candidates partner or observer status for the time being[2].

Likewise, while Moscow and Beijing have stated their intent to launch a new common reserve and trade currency for the Group in the short term, India has reservations about that project and prefers to grow bilateral or multilateral transactions between the respective national currencies, as is now happening between India, China, Russia, and the United Arab Emirates, mainly in the energy market (e.g. India is paid for its exports to the UAE in Dirhams which are used to settle India’s oil purchases from Russia and Russia, in turn, is paid in yuan for energy deliveries to China). Whether two systems can be used side by side (currency swaps and a common BRICS basket unit) remains to be seen.

Major tests of the Organisation have been the Ukraine crisis that began in 2014 when the Western powers imposed several rigorous sanctions on Russia following the Maidan Putsch and Moscow’s annexation of Crimea and, from the February 2022 Russian ‘Special Operation’. The four other partners, while supporting a cessation of hostilities and a peaceful resolution, have kept a broadly neutral policy with regard to that enduring international confrontation although Beijing has tacitly supported Russia.

Another challenge to the viability of the BRICS system was posed by the bloody clash between the Chinese and Indian armies on the Galwan area of Ladakh around their Himalayan border in the summer of 2020. Yet, in spite of these systemic shocks and perhaps because of the very instability and unpredictability of the international situation, the partnership has survived by focusing on issues where cooperation between the members is mutually beneficial and steering clear of conflictual issues. It should be recalled that the almost seismic political transition of 2019 in Brazil between the Left-Wing government led by Lula de Silva and his hard-right opponent Jair Bolsonaro, known for his pro-US sympathies and his aversion to China and Communism did not negatively affect the BRICS. Even Bolsonaro recognised the benefits of BRICS membership. It should not be forgotten that a number of valuable academic, scientific and educational joint projects for cooperation have been launched and mostly successfully implemented between the BRICS members. The group indeed is not solely an economic and geopolitical assembly, it is also a cultural cooperation platform that helps citizens of its participant states to bypass hitherto hegemonic or at least preponderant universities, foundations, endowments and thinktanks.

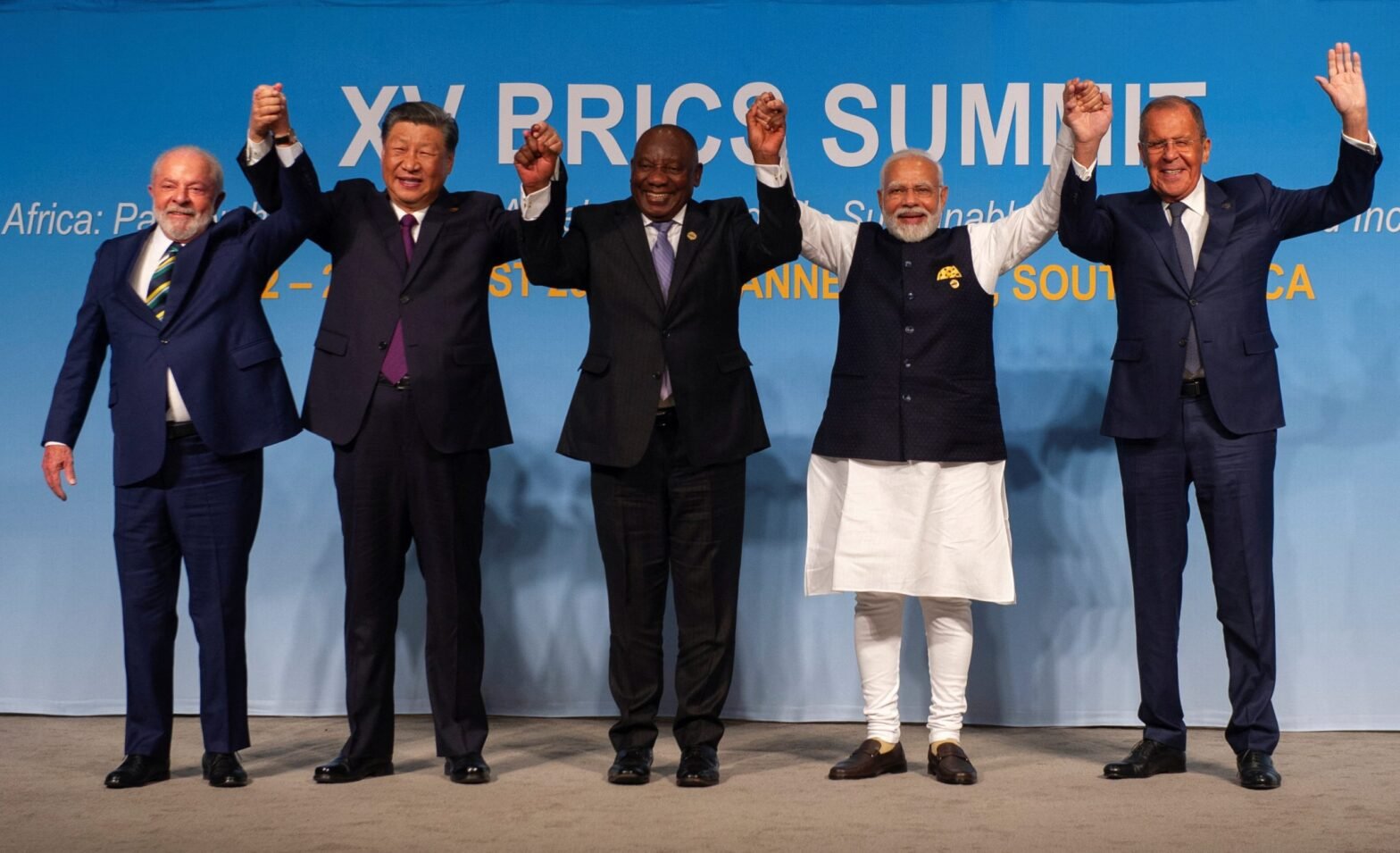

Yet, the biggest challenge since its inception was faced at the latest summit of August 2023. The BRICS had to decide whether to add new members from a fast-growing roster of applicants that exceeds forty countries, of which nineteen have formally requested admission, including several important states such as Saudi Arabia, the United Arab Emirates, Indonesia, Egypt, Nigeria, Ethiopia and Argentina. Even France’s President Macron made an unexpected attempt for his nation to join the Organisation when he sought an invitation to the Johannesburg Summit. Although China appeared open to it, whereas India probably had no objection, Russia nipped the proposal in the bud by pointing out that France is a sponsoring party to the unilateral Western sanctions against Russia and other nations and is therefore ineligible according to the BRICS Charter.

Why is this rapidly rising worldwide interest in an organisation, which was initially dismissed by the Western powers as a rather toothless league of developing or declining states scattered around the globe and having little in common apart from holding grudges against the current neoliberal order? The response is clearly to be found in the systemic crisis of the said neoliberal financial and monetary order and in the need for a solution that the BRICS may offer. While the US[3] and EU[4] economies decline as a result of untenable neoliberal policies of financialisation and industrial downsizing, their Fiat currencies (the US Dollar and the Euro) are no longer trusted as safe havens for the reserve holdings of governments and corporations, particularly those of all the other nations and alternatives backed by tangible values such as gold, strategic minerals and fossil fuels are in urgent demand.

The quest for an alternative to the US greenback has been ongoing since the beginning of the 21st century at least but it was massively accelerated by the Ukraine crisis in 2014 when the Government of the United States resorted once again to its familiar policy of economic, judicial and financial sanctions against an allegedly rogue state. However, that time the target is not another North Korea, Iraq, Syria or Iran but Russia, a nuclear superpower, controlling the largest landmass and owning the greatest reserves of natural assets on the planet. The weaponisation of the world’s main reserve and trading currency by the US Government and its subordinates against an increasing number of nations, in violation of international law and of the UN charter, was seen as a clear and present threat to all other countries, even those that had good but essentially tributary relations with the self-appointed leader of the free world.

Another triggering factor was the endemic, out-of-control money-printing by the US Treasury/Federal Reserve that has grossly abused its ‘exorbitant privilege’ as an emitter of the global currency to flood its economy and all others with ever more virtual dollars, actually IOUs whose principal is not intended to be ever repaid. The engineered COVID-19 epidemic crisis provided a new ‘force majeure’ escape for the US to keep its ailing economy afloat by distributing free money to its banks, companies and citizens. However, The inevitably resulting inflation did not immediately occur because of the remaining ut dwindling ability of the US to make the rest of the world absorb the rapidly expanding mass of Dollars which still account, together with the Euro, for 80% of all trade settlements and currency holdings.

Russia – and to some extent China, which has been designated as a systemic rival and strategic competitor by Washington – took the opportunity of the widespread alarm to promote a proposal for de-dollarisation based on the creation of a new, ‘democratically managed’ multinational ‘basket’ reserve and trading currency, backed by gold and possibly by other hard assets, such as fossil fuels and strategic minerals, that could provide security and stability for business and protect the savings of all member states from the inevitable devaluation of the fiat currency and from the actually negative (with regard to inflation) interest rates offered by US Treasury bonds.

Some early steps in that direction were taken by the D-20 Long Term Investors Club, which held a conference in Modena, Italy in 2008 with the participation of economists and bankers, Savings and Loans and pension fund managers from several countries. The founders and participants floated proposals for a return to principles of sound investments into tangible, productive assets and companies, amounting to de facto partial ‘de-financialisation’ of the economy. In November 2012, another conference on the same theme was convened in Milan under the auspices of the ‘Eurasian Razvitie (Development in Russian) Development Corridor Project’, planned on behalf of the Russian Railways Corporation, and further discussions were held during successive annual sessions of the Astana World Economic Forum in Kazakhstan[5].

Some of the ideas taken up at the Milan conferences were about in-depth reforms of the global trade regime and currency systems on the lines proposed by the late Nobel Economics Prize Laureate, Professor Maurice Allais (2009). The priority was to limit and reduce the influence of major private banks and MNCs that were seen to have taken over economic leadership from governments to impose a ‘technocratic feudal system’ to the benefit of a small, self-coopting minority of plutocratic stakeholders. Real free trade was to be defined as fair trade and great attention was paid to the IMF study authored by Jaromir Benes and Michael Kumhof “The Chicago Plan Revisited”[6] to slash private debt by 100 percent, while boosting growth and stabilizing prices.

There was also a proposal to evaluate the original Simons and Fisher’s 1936 Chicago Plan that advocated for national states to resume control of the creation of money and buy back private debt by issuing fiat currency as equity, not debt, while segregating the monetary and credit functions, in keeping with the Swiss ‘full money’ banking reform proposal. In the suggested new system, banks would be required to hold 100% reserves for loans (as proposed by Milton Friedman in 1967) and state-created credits would be invested in priority fundamental research and technological and industrial applications. It was noted that an earlier FMI-sponsored study of such a proposed reform had been predictively analysed according to the DSGE stochastic model and found feasible. It was indeed concluded that it would result in a major gain in welfare for societies implementing it.

Policies dovetailing with the proposal include the issuance of low or zero-interest public credit (special bonds, project- or industry-specific when suitable) to state-sponsored research bodies or in some cases to public-private partnerships on the basis of market evaluation and analysis of socio-environmental priorities and product/process commercial potential. Financial facilities can be provided, on the basis of such credit instruments, to attract innovating entrepreneurs.

The economic and financial roadmap advocated by the D20/LTIC and the Razvitie planning team flagged the threat posed by private equity funds, defined as cartelised corporate predators ‘churning borrowed fiat money in the short term’ for their own profit while destabilising industry and the economy in the process.

The Modena initiative was one of the sources of inspiration for the Astana World Economic Forum of 2011, which promoted President Nazarbayev’s anti-crisis plan prepared by economist S N Nugerbekov. The proposal for a radical reform of the international financial system led in the following year to the creation of the G-Global, an informal advisory platform to the G-20 Summit in Guadalajara, Mexico. G-Global also drew inspiration from the 2009 Moscow West-East Economic Forum for its Think20 Report based on the submissions of the D-20 study group and supported by some eminent economists, including Nobel Economics Prize Laureate Robert Mundell.

This preparatory work paved the way for the BRICS hard asset-based common currency project and for the creation of new cooperative financial institutions, the New Development Bank (NDB), also known as the BRICS Bank, and the Asian Investment Bank (AIB) as well as a new Gold Exchange[7] in Shanghai, that opened in 2017.

A major qualm of the emerging economies about the current financial system is shared by many in the leading capitalist countries as well. The aforementioned Nugerbekov report notes that 10 to 20% only of capital is invested in the production of material goods. {The other} 90% consist of virtual and derivative financial products used for short-term speculative transactions.’

The BRICS currency system is envisioned as a tool to correct that imbalance. An ingenious interpretation of its likely mechanisms is provided by columnist Dimitry Orlov[8] who describes it as a notional accounting unit created to rate the value of commercial transactions between currencies. An alternative method is to emit chits (short-term loans at zero interest) that can periodically be either cancelled out if the trade is balanced or renewed on identical terms. If trade imbalances cannot be corrected, gold may be provided by the debtor country in proportion to its trade volume with the other BRICS partners, only to compensate for the deficit in trade (and not to be lent or sold by the recipient) and priced in the earlier described notional accounting units.

The bad news for the American Dollar in this regime is that the participating states would have an imperative reason to sell their US Treasury holdings against gold in order to accumulate sufficient reserves of the latter. Other analysts suggest that other resources, such as gas, oil, and precious metals could also be used like bullion, if priced in the common currency chit units.

All those discussions are building up towards the decoupling that is now taking place, gradually but at high speed and not only in BRICS member states and in those that are applying to join them.

One of the most farsighted analysts of the global financial scene, Ankit Shah, has pointed out how, by replacing the old LIBOR interest-rate index, based on the estimations of London member institutions (‘Each bank estimates what it would be charged were it to borrow from other banks’), with the SOFR[9], the United States is imposing its Treasury’s data as the sole standard, depriving non-American partners of a say in interest-rate setting decisions. The response from abroad according to him will be the ‘indigenisation’ of lending rate regimes in different countries and economic blocs[10]. Thus, de-dollarisation is a predictable reaction to the increasingly autocratic management of the international economy by the US Federal Reserve and Treasury Department. Russia is in urgent need of it as it is not allowed to function normally under the current sanctions regime which is likely to be permanent, as is the case for many other such punitive measures slapped on other states several years ago. China foresees the time when it will come under similar pressures and wishes to prepare by developing a parallel, alternative system while other countries, in Asia, Africa, the Americas and even in Europe are aware of the coming currency crisis and financial-political earthquake which will make them all the victims of fateful economic decisions taken in the US and EU ruling circles. The quest for a way out is therefore an inevitable process, and only the manner and the timeframe in which it will be carried out remain topics of discussion. It will not be solely a result of the endeavour by certain ambitious rival powers to upstage and overthrow the United States from its hegemonic pedestal. Rather it is a consequence of the economic decline of the hegemon itself, no longer able to sustain the system it built when it took the place of the waning British Empire.

The spendthrift management of the American economy in the last decades and Washington’s ever more frequent use of sanctions and military aggression to keep challengers under control have eroded the trust it enjoyed in most parts of the world in the middle of the 20th century when the fear of communist revolution kept many governments and societies under the US financial and military umbrella.

Monetary and financial regimes, like civilisations and empires, go through phases of growth, acme, and decline ending in their disappearance. The bell now tolls for the fiat Dollar system. The American government knows it and is predictably trying by diverse means to prevent the BRICS from going ahead with its projects for an alternative international trading currency. Accordingly, much disinformation circulated about this year’s Johannesburg BRICS summit, aimed at convincing the world that the conclave was doomed to fail. The heads of the member governments were surreptitiously advised not to go, or to attend only virtually. South Africa was heavily pressured to comply with the arrest warrant opportunely issued by the International Criminal Court against the Russian President and, as a result, Russia was represented physically by the Foreign Minister. Rumors of dissension and mutual backstabbing within the group floated even in media that used to ignore previous such summits.

It is clear that the collective West is worried about the ongoing actions and plans of this association that it does not dominate but, as the saying goes, the horses appear to have already bolted out of the stable.

Priorities for Pilot Projects:

-Suitable for and needed in the target area (Eurasian region).

-Wide use and preferably low cost with applications in many areas.

-Bringing about major savings in energy and other natural resources and externalities, with special regard to housing, heavy industry and transportation (e.g. new materials for rail, road, air and space vehicles).

-Advances and fosters education and research.

-Promotes interdisciplinary research integration.

-Sustainability at the interaction of Environment, Economy and Society.

-Should be conducive to widespread improvement of living conditions, ecologically nurturing or at least non-toxic.

Author Brief Bio: Côme Carpentier de Gourdon is currently a Distinguished Fellow with India Foundation and is also the Convener of the Editorial Board of the WORLD AFFAIRS JOURNAL. He is an associate of the International Institute for Social and Economic Studies (IISES), Vienna, Austria. Côme Carpentier is an author of various books and several articles, essays and papers.

References:

[1] https://en.wikipedia.org/wiki/Jim_O%27Neill,_Baron_O%27Neill_of_Gatley

[2] https://www.thiesinfo.com/L-Inde-et-le-Bresil-s-opposent-a-un-elargissement-rapide-du-groupe-des-BRICS_a1042.html

[3] https://www.fitchratings.com/research/sovereigns/fitch-downgrades-united-states-long-term-ratings-to-aa-from-aaa-outlook-stable-01-08-2023

[4] https://www.cnbc.com/2023/06/08/euro-zone-enters-recession-after-germany-ireland-growth-revision.html

[5] https://www.vijayvaani.com/ArticleDisplay.aspx?aid=2334

[6] https://www.d20-ltic.org/

[7] https://en.sge.com.cn/

[8] https://reseauinternational.net/les-brics-en-or/

[9] https://www.newyorkfed.org/markets/reference-rates/sofr

[10] https://www.youtube.com/watch?v=V1M9SvX-6HQ&t=4s